Dear Subscribers,

Bitcoin's price has only undergone slight consolidation, suggesting that the recent decline might be a corrective movement triggered by profit realization. It’s plausible that once the correction stage concludes, the price will likely initiate a fresh, impulsive surge.

In this Uncharted:

We analyze why BTC had a highly negative start to May that culminated last Wednesday with a price dump to a two-month low of $56.5k.

We expand how the U.S. central bank last week kept its policy rate in the 5.25%-5.50% range, and the likeness of interest rates to stay where they are for longer than previously thought.

We go over the broader recovery in crypto market as ETH, SOL, XRP, DOGE, SHIB and other altcoin rebound.

Let’s dive in!

Markets

🇨🇭 Join our Swissblock Telegram Group! Get daily updates, in-house content, and technical analysis on crypto & macroeconomics. Tap into a hub of knowledge and insights. Stay ahead with Swissblock. Sign up now! 🚀

State of the System

Picking up from the last Uncharted, the situation doesn’t differ much to the current one:

“The market has experienced a significant decline during the week, indicating ongoing volatility. However, amidst this volatility, the $60k level appears to be offering significant support. This presents a potential buying opportunity for players.

If the market were to break below the $60k level, it could signal a further decline towards the $52k level. The recent parabolic rise, fueled by increased interest from ETFs, has slowed down, resulting in a more stable market environment. While this may differ from the rapid gains seen in previous months, it ultimately fosters a healthier market.”

BTC has experienced fluctuations throughout the week, with the $60k level serving as a key support area. This level is one that many traders are closely monitoring, but overall, the market continues to maintain a bullish outlook, albeit with work to be done.

Looking ahead, there appears to be potential for the market to target the $73k level. Last week's price action formed a hammer candlestick, a bullish technical sign. Additionally, the recent influx of capital into the BTC market via the ETF has contributed to the positive sentiment. There has been a shift from the bearish quadrant to the neutral in the past weeks as price recovers.

BTC is currently testing resistance as the weekend approaches, and you should watch for a breakout with substantial volume to support continuation. There's potential for BTC to break out of the current liquidity area and then retrace. The current price action suggests this is not a strong downtrend, as the volume is decreasing alongside the price. The combination of price decline with a drop in volume is technically a bullish sign, indicating that the selling pressure may be easing.

Overall, it appears that BTC is undergoing a corrective phase rather than a significant downward movement. This period of correction is expected as the market stabilizes after previous gains. Monitor key levels and volume closely for signs of a potential breakout and subsequent continuation of the bullish trend.

If BTC manages to break above the $73k level, it could pave the way for a move towards $75k and eventually $80k. However, if the price breaks below the bottom of last week's hammer candlestick, it may open up a potential decline towards $52k, and possibly even as low as the 50-week EMA around the $46k level.

While a significant decline seems unlikely, short-term choppy and sideways trading is expected over the next few weeks. This period of consolidation would allow the market to digest the recent 92% run-up over six weeks. Once this consolidation phase is complete, the market is likely to continue its upward trend.

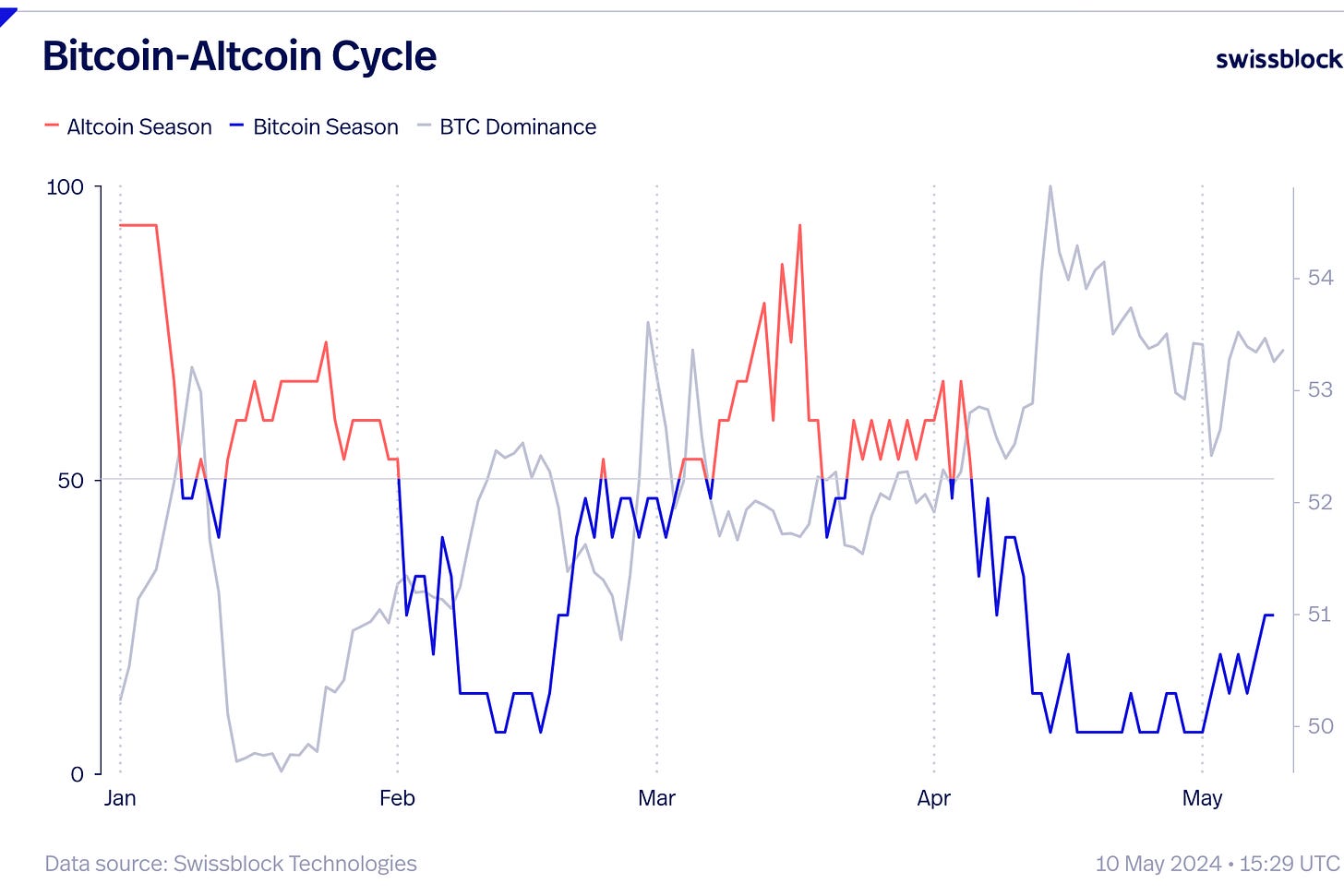

Since December, most altcoins have been in a period of consolidation while BTC has taken center stage. With BTC now ranging, altcoins have not shown significant movement due to the influence of Bitcoin dominance.

A breakdown in BTC dominance is necessary to trigger potential gains in altcoins. The ETH/BTC trading pair printing its second bearish engulfing pattern on the daily chart within a week suggests that breaking through the 55% grand resistance on the BTC dominance chart could be imminent.

If BTC dominance continues to rise beyond 59% and the Altcoin Signal remains deep in BTC season, it indicates that an altcoin season is not likely in the near future. As a result, patience is advised as the market may need more time to shift focus away from BTC and toward altcoins.

BTC has recently experienced a modest bullish rebound from the substantial $59k support level, but encountered selling pressure that led to a retracement back to the critical 100-day moving average at $61k. Upon examining the daily chart, it is evident that BTC has been in an extended phase of sideways consolidation near the crucial $60k price range.

Price saw a decline after its recent bullish rebound from the $59k threshold, moving back toward a critical support region. BTC sellers have been challenged to breach this significant support area, which includes the 100-day moving average and the 0.618 ($59.395k) Fibonacci level, for several weeks.

A sudden decline below the critical $59k level could spark another notable downward movement toward the $56k threshold. However, this crucial juncture could also act as a turning point, providing mid-term support and potentially halting further downward pressures. The price action around this level will be key in anticipating BTC’s future movements, as it will either establish a base for a potential upward trajectory or signal further declines. Investors should monitor these levels closely to gauge the next phase of BTC’s price action.

The Macro Environment

The U.S. government reported that real GDP grew at an annualized rate of 1.6% in the first quarter of 2024, slower than anticipated and marking the slowest rate of expansion since the second quarter of 2022. The relatively weak growth was primarily due to a decline in business inventories, reduced Federal government purchases, and a sharp increase in imports that led to a negative net contribution from trade. Other components of GDP, such as household spending, showed positive performance. However, attention was mainly focused on inflation data.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.