How Bitcoin fell right along with traditional assets.

Traditional markets collapsed on Monday, leaving a trail of massive liquidations and dragging all assets down with them; the S&P 500 and Nasdaq closed the session with losses of 3%, erasing $1.4 trillion in market value, with Nvidia experiencing the largest drop among the "Magnificent Seven." The S&P 500 recorded its worst drop in two years, and the Nasdaq 100, at its worst intraday point, was down by 6% before rebounding and mitigating some of the losses. The Nikkei 225 index in Japan experienced its worst two-day streak in history, dropping 19%, which puts the major Asian index firmly into bear market territory.

The VIX, the stock market's volatility index, rose to levels not seen since the March 2020 black swan event during the Covid crash, reflecting the fear that has spread among investors. The uncertainty escalated to the point that rumors began to circulate that the Fed might convene an emergency meeting to agree on an interest rate cut, with a 50 bps reduction already anticipated. However, this measure has been dismissed as it would exacerbate the effects of the yen carry trade deleveraging.

The effects on Bitcoin and the broader crypto ecosystem have been devastating, with realized losses exceeding $850 million in just over 24 hours. Bitcoin spiked down to $49k, breaching the Weekly 50 EMA and leaving a wick that reached above $53k before the daily close. On the altcoin front, the selloff has been brutal, with not only tokens hitting new annual lows but some, like ATOM, even matching their 2020 lows and others, like MATIC, recording their lowest levels since 2022.

Currently, the Nikkei 225 index has recovered more than 12%; meanwhile, the S&P 500 has maintained a level that is 2% above the lows recorded on Monday. Bitcoin and the crypto market have recovered as they typically do after capitulation moves, with ETH climbing up to 20% and Solana rebounding almost 30% from its lowest point, right now retracing 8% from its highest point.

The questions on investors' minds are: Is it possible that we've already witnessed the worst effects of Black Monday, and that the fear will dissipate as the days pass and the market cools down? Will the bloodbath continue for much longer? Does this invalidate the long-term projections?

Risk levels have surged, and the price momentum has turned more bearish than last week, although the fundamentals remain solid despite a slight setback; let's delve into the details.

The risk spike.

During the first week of August, risk levels escalated to similar extents as those observed after the halving in late April, when Bitcoin's price corrected down to $56.5k. During that period, the initial spike in risk intensified and led to a bullish trend for much of May, culminating in a gradual recovery that pushed Bitcoin’s price up to $72k.

Then in the next weeks, risk levels began to increase once the price formed a double top and started to decline in the latter half of June and early July. During this period, Bitcoin registered new lows, with a last drop to $53k. The recovery in July eased the risk despite the negative catalysts experienced at that time until external events ultimately drove the risk to current levels.

The question now is whether the risk will continue to increase as the price consolidates and approaches the highs of early July, amid the FUD caused by the German government's sales and the Mt. Gox repayments. On the positive side, if we follow a similar pattern, we’re aware of the potential risk increasing. However, we anticipate that risk could continue to rise if the current price development turns into a pullback that subsequently drives us to revisit the lows between $49k and $52k.

Healthy fundamentals remain.

The Bitcoin Fundamental Index (BFI) has experienced a slight decline due to the loss of support levels and a drop in price, indicating a loss of momentum in the short term. However, it has not fallen below 60, which still signals strength in the short term. At current prices, and considering the bullish cycle we are in, we would like to see the BFI strengthen and maintain its upward trend, so that fundamentals can support us as accumulation occurs at these levels. There are positive signs, such as accumulation by long-term holders. However, we still need to closely monitor the BFI in the coming days to assess its impact on market dynamics and investor sentiment.

Long-term holders: The backbone of the Bitcoin market.

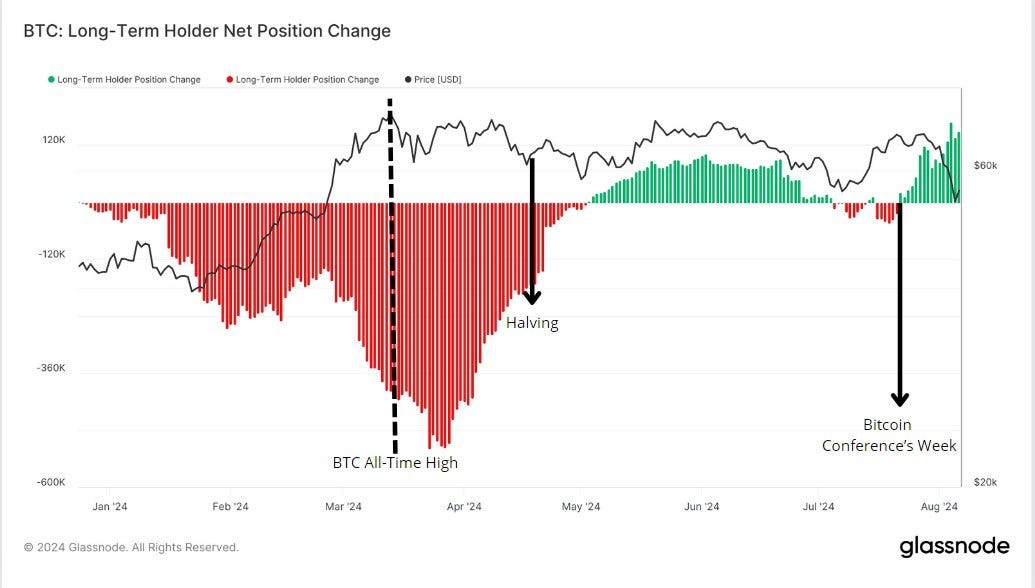

Long-term holders of Bitcoin have increased their BTC holdings significantly, reaching a year-high and continuing the accumulation trend that began after the last halving. At the beginning of the year, long-term holders began reducing their positions as Bitcoin approached its historical highs, with this trend persisting through March as the long-term price range was established. In April, the month of the Bitcoin halving, this trend started to weaken, but by May, the accumulation process by these holders had resumed.

In early July, the positions of long-term Bitcoin holders slightly decreased as BTC retraced to $53k, and this continued as the price recovered to $65k. Additionally, starting from the week of the Bitcoin Conference, there was an increase in BTC accumulation, a trend that strengthened even in the face of the drop to $49k. Long-term holders are a crucial line of defense for Bitcoin, representing those who have confidence in its fundamental and long-term value, even in the face of market fluctuations.

A window closes, but a door may be opening.

In our weekend update, we mentioned that if Bitcoin remained above $60k, the chances of a rebound toward $63.5k would be key to maintaining a short-term uptrend. Nevertheless, this did not occur, leading to pullbacks that trapped long positions and triggered liquidations. The point of interest for investors was revisiting the $53k level, now above that price at $55k.

In the short term, we've observed that Bitcoin has bounced back from $49k to $57k, boosting the entire crypto market with it. The next area of resistance is at $59.5k, where the Daily 200 EMA is located. This level had previously served as a reference point after Bitcoin had dropped to $53k in early July. Part of this rebound is due to a shift in sentiment in the traditional market, and although the original problem still looms, what is becoming evident is that Black Monday was also a reaction to the uncertainty surrounding a potential recession and that all markets are susceptible to both news developments and macroeconomic data.

Given the corrective phase we are currently in and considering the external factors that have exerted bearish pressure on Bitcoin's price, there's potential for the price to fill the liquidity wick left by the daily candle from $49k to $54k. This corrective price pattern is normal within the accumulation process, so it's possible that in the short term, there may be bull traps—where a false move serves to catch traders off-guard and trigger their liquidation. Similarly, bear traps could ensnare bears with a false breakdown, fueling an upward movement.

In the short term, we anticipate the formation of a pullback that seeks liquidity between $49k and $54k, a zone where there is significant interest from whales and institutional portfolios looking to satisfy the appetite of ETFs. Could there be better buying opportunities at levels below $49k? This question involves many uncertainties. We know that external factors will continue to influence Bitcoin, so if the markets run for cover in case fear reignites, we cannot discount the possibility that the sentiment will spread. However, we can also consider that many of these factors might already be priced in, which could lead to corrections that are not as deep as those seen over the weekend and on Black Monday.

Key Takeaways.

The S&P 500 and Nasdaq closed with losses of 3%, erasing $1.4 trillion in market value, with tech giant Nvidia leading the drop among the major companies.

The Nikkei 225 index saw its worst two-day performance in history, dropping by 19% and entering a bear market.

The VIX, which measures market volatility, reached levels reminiscent of the March 2020 downturn, indicating a high degree of investor fear and uncertainty.

The crypto market was hit hard, with Bitcoin and altcoins seeing substantial losses. Bitcoin dropped sharply to $49k and momentarily dipped below the weekly 50 EMA.

Despite the initial drop, markets like the Nikkei 225 and the S&P 500 showed some recovery signs later in the week, with Bitcoin and major altcoins like ETH and Solana rebounding significantly, indicating resilient market segments.

Risk levels have increased dramatically, turning price momentum more bearish than the previous week. However, the fundamentals have held up relatively well despite some setbacks.

Long-term Bitcoin holders have increased their stakes, reaching a yearly high and continuing the post-halving accumulation trend. This group’s behavior provides a cushion against market volatility, reflecting confidence in Bitcoin's long-term value.

Bitcoin is currently in a corrective phase, influenced heavily by external bearish pressures. The market might fill the liquidity gap left from $49k to $54k, indicative of the ongoing accumulation process and market attempts to stabilize.

The current market condition could set the stage for bull and bear traps. Bull traps might lure traders into premature buying positions, while bearish traps could falsely signal further declines, potentially leading to unexpected rebounds.

Short-term trends suggest a pullback to the $49k to $54k range, attracting interest from large-scale investors and whales, and possibly setting up favorable conditions for ETFs and institutional buying.

love life live lufe 1 life 2 live