Key Takeaways

BTC is holding above $27k in a quiet session with the US on Holidays.

Charged week ahead with some short-term macro headwinds and the announcement of the debt ceiling deal.

Bitcoin’s trends turned bullish, yet momentum needs to pick up to see higher prices.

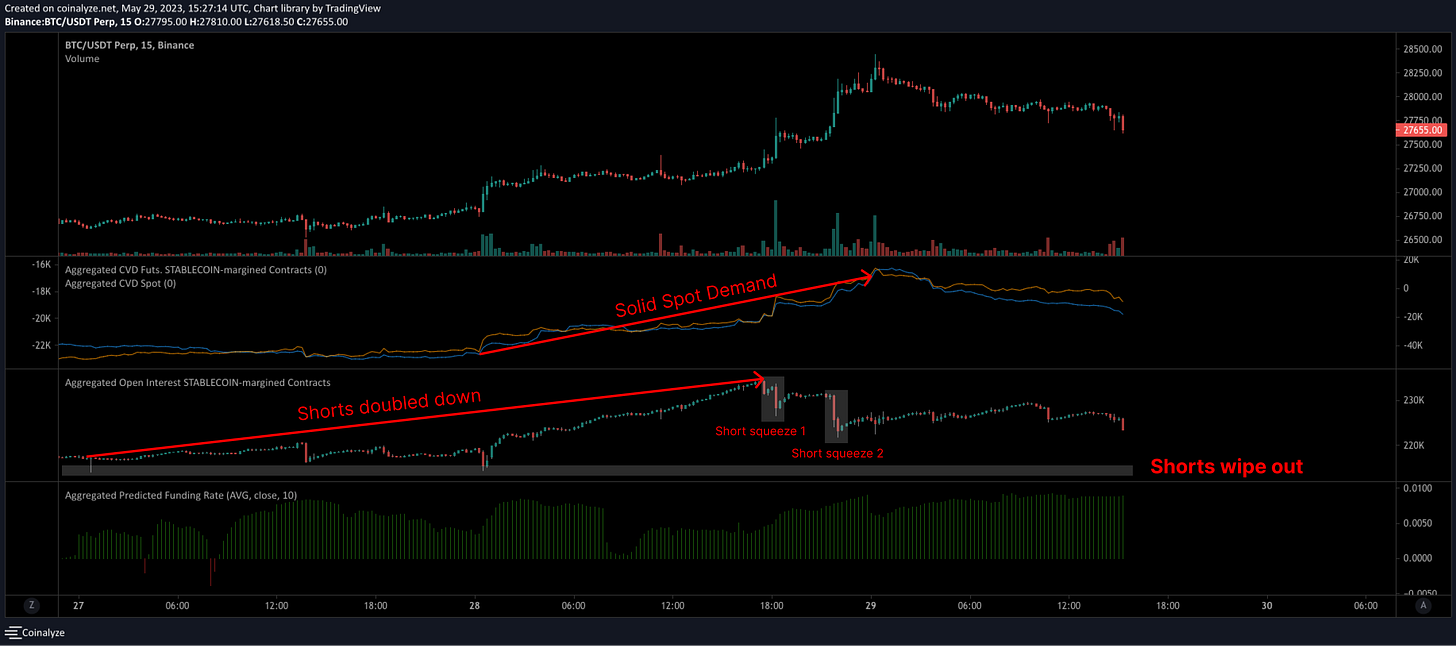

Shorts are getting squeezed, we need diamond hands longs to shake the rest of them out.

Holding the $27.8k area is key (Compass 19 pivot point). Last time we broke higher and retested the $28k range, the price consolidated and held the pivot point before dashing for $30k.

Was the debt ceiling resolution the catalyst we were waiting for? The risk of a pronounced drop is easing, fundamentals are strengthening, and momentum is picking up. When $30k?

Spot demand finally kicked in while perps chased and pushed BTC over $28k. More demand is needed for a follow-through; we expect BTC to consolidate between $27.3 and $27.8k until then. ** Some weak longs came in late into the move, so we could see some retraces as they are squeezed out.

Remember the short overcrowded market? Over $33mn in short positions were liquidated on Sunday... Still some room to go to flush them out, which means we could see another short squeeze-driven move.

So, what’s the next step? All of the trends turned bullish, yet when looking at this year’s significant moves, we can observe that we’re missing one key element: momentum.

The RSI is still below the overbought area; it must cross 70 and hold for the price to rally. For now, this move is still a bounce (relief). Call in more spot demand.

We’ve been talking about the beginning of the end. The macro outlook is improving (DXY closer to our forecasted top), and the cross-asset structure is bullish. However, caution is advised in the short-term, especially in alts (mid-term: is time to go all in).

We continue to favor BTC under these conditions. ETH showed some strength, but looking at its momentum against bitcoin, we can see it was more beta than anything.