Dear Subscribers,

In this Uncharted:

We describe this crucial moment in crypto markets: bitcoin's price is at a critical juncture around $25k, a significant support/resistance level, while a regulatory attack is unleashed on the space.

We analyze the increasingly bullish macro backdrop, with tech stocks boosting the Nasdaq and S&P 500, even as the Federal Reserve plans for two more increases in 2023 despite lower-than-expected inflation.

We explore how narratives and breakout coins are getting attention; if you want to diversify your portfolio it may be the opportunity to look at these ones.

Let’s dig in!

Please vote below on your content preferences for our Substack publications, and you will be eligible for a 35% discount on your Substack subscription.

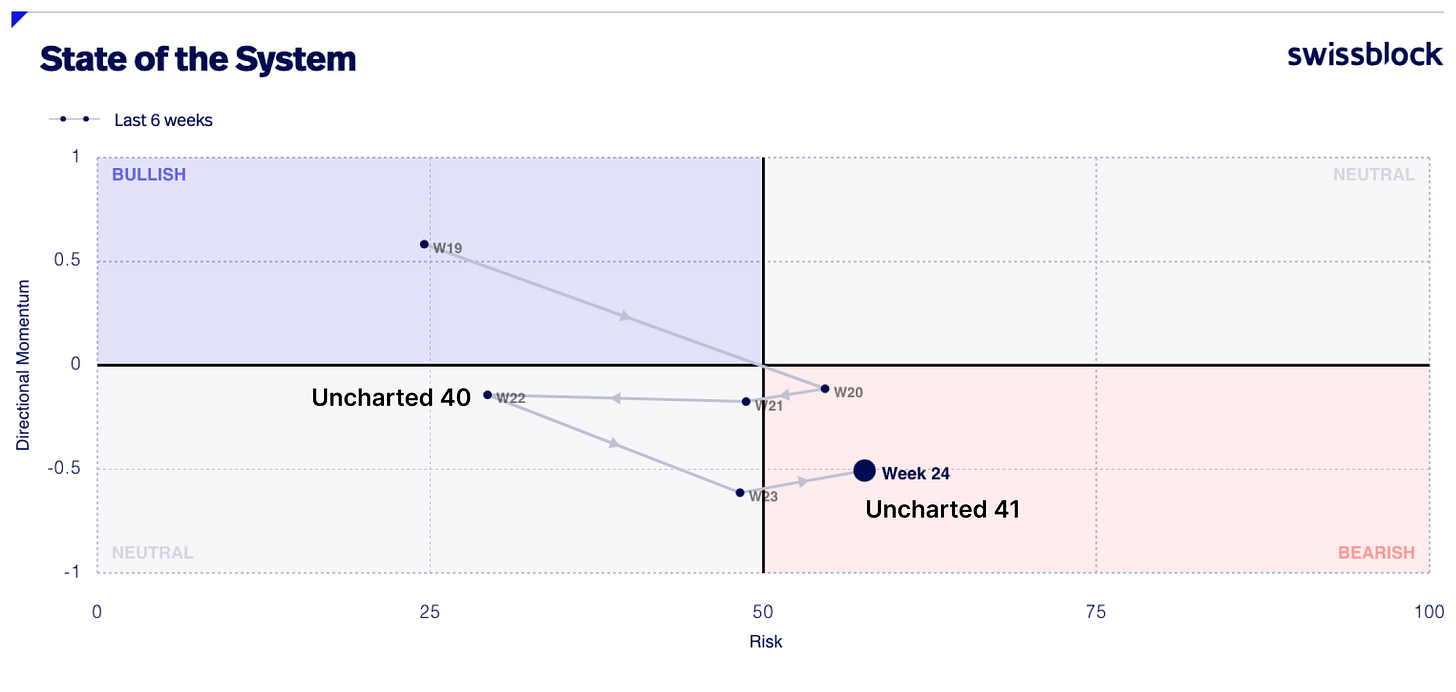

State of the System

It's been a tumultuous two weeks since the last Uncharted. In the preceding post, we celebrated bitcoin's resilience during the debt ceiling debate; however, we've now returned to the bearish quadrant (figure 1) after the price retested the $25k level, quickly slipping to $24.9k. The spotlight on the SEC lawsuit against Binance and Coinbase has left the market unable to recover from the shock, with Binance.US market depth dropping 76% in June. The Bitcoin Risk Signal suggests significant risk, and the momentum is worsening as low volatility remains. However, we’re at the beginning of the end.

Bitcoin's price is at a crucial point, hovering around the $25k mark. This level is important because it previously acted as a support and resistance area. The price may dip to around $24.2k to attract more buyers and confuse those who expect it to keep falling. We must not forget the missing factor we have mentioned before, the key for bitcoin’s next leg up: The need for new participants and the subsequent momentum.

Currently, the mid-term support aligns with the weekly timeframe

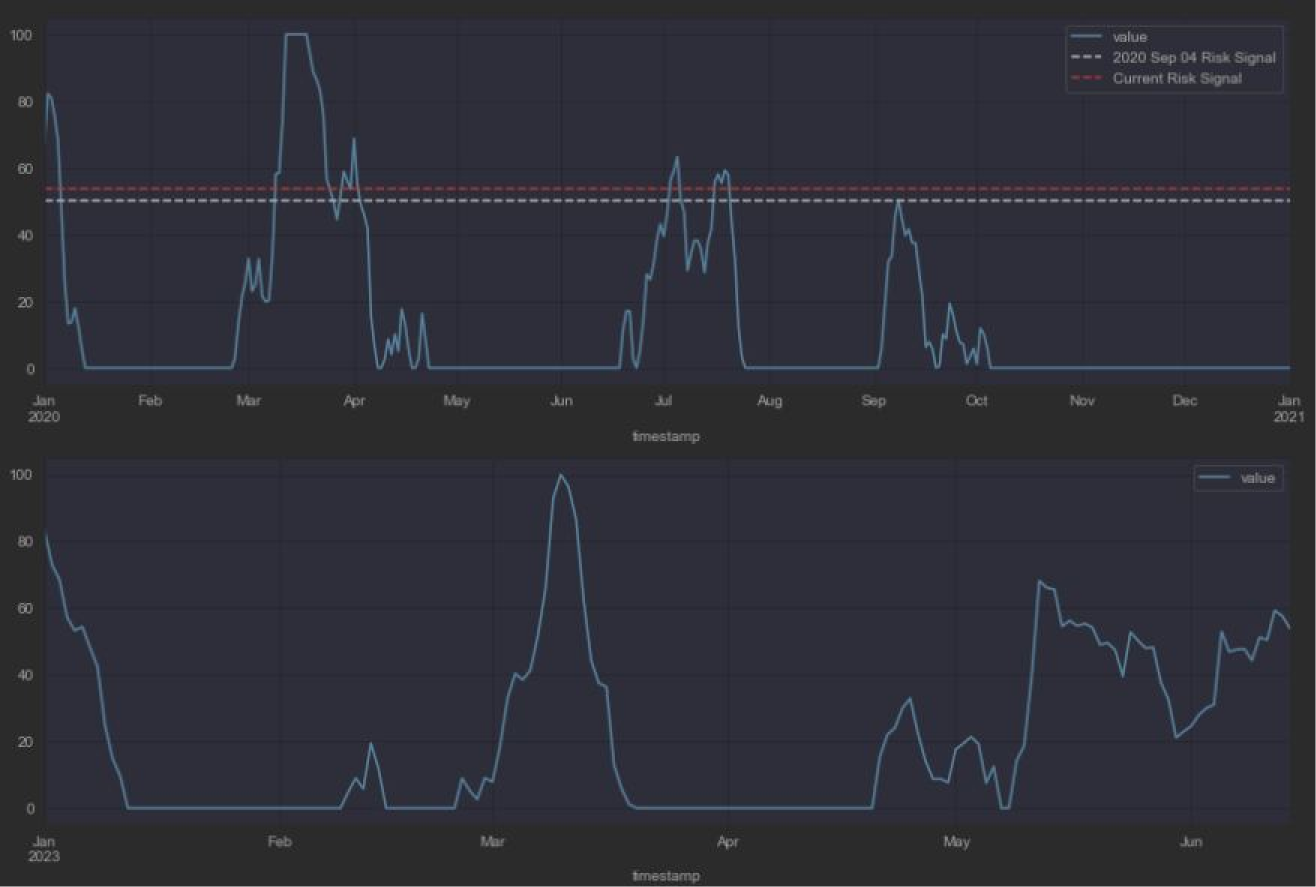

at $24.2k, and the mid-term resistance matches the last Compass edition target at $27.2k. The similarity to the September 4, 2020 bottom leading to the 2021 bull run is remarkable (figure 3), providing many clues. Bitcoin's price dropped to $9.9k on that date, rallying to $69k the following year. The RSI is comparable to 2020, exhibiting some bearish momentum but not entirely oversold. The Cipher B wave trends are also overextended to a level similar to September 2020. These similarities hint that bitcoin's current price action is bottoming.

Furthermore, the Bitcoin Risk Signal is currently at a similar level as it was in September 2020, as figure 4 shows. This suggests that the risk of a sell-off is high. However, the fact that the Risk Signal is decreasing suggests that selling pressure could begin to subside.

The market shows fear, and more players are underwater, meaning that more participants have bought bitcoin at a higher price than the current price. Many participants will trigger the sell button if the price continues to fall or volatility kicks in. This could lead to a panic sell-off. So it’s likely best to buy at the confirmation that the Risk Signal is dropping, ideally below the 25 thresholds.

Bitcoin’s short and mid-term trends turned bearish this week, yet, the long-term trend remains steadfastly bullish (figure 5). Bitcoin has weathered a similar storm to the FTX collapse without crashing in the same way as during the Luna debacle months earlier. Nevertheless, the key is to hold the $24k support level to keep the long-term trend in bullish territory. If it doesn’t hold, say hello to the bears.

Altcoins took a greater hit than BTC due to their beta. The Altcoin market, as a whole, typically has a higher beta than BTC, which means altcoins are more likely to experience more significant price swings. When the market declines, altcoins tend to drop more than BTC. Unlike in September 2020, we are in a deep BTC regime, with dominance reaching a critical level. Since the 2021 bull run, whenever BTC dominance has reached this level, the Altcoin Cycle Signal has reverted, signaling an Altcoin Season. However, it is too early (and riskier) to go all into Altcoins. Buying alts only makes sense for the long run and if you can withstand short-term pain.

The Macro Environment

The macroeconomic outlook is growing increasingly bullish week by week. On the one hand, the Nasdaq continues its ascent, with tech stocks benefiting from strong earnings growth and bolstering the S&P 500 and small caps. These are early signs of capital dispersing within markets. More importantly, the Federal Reserve has temporarily halted but not entirely ceased rate hikes, maintaining its benchmark interest rate at 500-525 basis points.

The standoff between the Fed and inflation still needs to be resolved, despite the May CPI report indicating a lower-than-expected inflation rate. Fed Chairman Jerome Powell may have relaxed his stance, but his finger is still on the trigger. Inflation may be weakening, but the Fed vigilantly monitors economic data, particularly employment reports. Traditional finance indexes like the S&P 500 reacted favorably to the rate release but plummeted following Powell's speech. The Fed chairman clarified that while there is a pause in rate hikes, the Fed isn't finished yet—two more 25 basis point increases are forecasted for 2023 (figure 7). Actual rate cuts seem unlikely this year, given the long-term objective of 2% inflation. The ultimate goal is to rein in inflation by slowing the economy without precipitating a recession. Powell may not be eager to pull the trigger, but he clarified that he remains hawkish and isn't done yet.

The US Dollar Index (DXY) has been losing steam in recent weeks (figure 8), which has helped ease pressure on bitcoin. However, we could see one last move up before the DXY cascades down.

The correlation between BTC and traditional finance (TradFi) assets has been weak recently. Despite the weak correlation, the overall cross-asset structure and macro environment are showing signs of improvement. This is positive for BTC, suggesting that the broader market is becoming more bullish.

Crypto’s Course

Bitcoin is currently at a crucial juncture, hovering at the lower end of $25k. The short and mid-term trends are skewing bearish, but we are nearing a possible bottom. The macro environment is ripe for a significant upward move, but the timing remains uncertain. Altcoins are recovering from the massive dump's negative impulse, but BTC is stagnant, indicating a consolidation period and suggesting it's not ready for a breakout (figure 9).

The macro environment is strengthening, and the overall economic outlook is improving. This could lead to increased demand for risk-on assets like bitcoin (so far). Institutional adoption is becoming a reality, for instance: BlackRock, the world's largest asset manager, filed paperwork for a spot bitcoin ETF on June 15, 2023. If approved by the SEC, it would be the first spot Bitcoin ETF in the U.S., allowing investors to invest in bitcoin directly without having to go through the trouble of buying the underlying cryptocurrency themselves. This could increase bitcoin's accessibility to a broader range of investors and further drive adoption. The SEC has shown hesitance to approve spot bitcoin ETFs, citing market manipulation and investor protection concerns, however, resisting BlackRock, the $10 trillion asset manager, may be challenging.

Getting into altcoins right now is not advisable in the short term. It is like being stranded in the middle of the ocean and drinking seawater. It may seem like a good idea at the time, but it will only make you more thirsty. It is best to wait until the market stabilizes before investing in altcoins.

Along these lines, the price momentum (figure 10) does not look great for the short term - it's trending downward. BTC is on the brink of a bearish momentum that could pull us further down. The prudent move is to stay put and buy BTC on the dips. The Altcoin Cycle Signal is deeply entrenched in the BTC zone, and the momentum could turn bearish if we break below $24.9k since a bottom hasn't been established yet. It's crucial to be wary of potential traps in this environment and to avoid altcoins until a bottom is confirmed and a trend reversal is evident.

Now is an opportune time to start strategizing your portfolio composition for when momentum picks up. Earlier this year, we noticed that the momentum of narratives against BTC was an early signal of the rally. Thus, it's wise to monitor trending narratives to anticipate if they can attract capital or trigger FOMO. It's premature to go all in on a specific narrative, so we recommend waiting for the first one to surge before investing. Now is the time to gradually establish positions in the most hyped narratives of the year. We're keeping our eyes on AI, Meta, and Liquid Staking Derivatives (LSDs), as well as ZK and Regional plays, for the next run.

Zooming in: Tactical short term

While things may seem bleak, we're confident that bitcoin's mid-term outlook is bullish. However, we acknowledge that we have yet to emerge from the thicket. A relative bet is desirable in this environment. By applying a close beta filter, we can identify altcoins less sensitive to bitcoin's retraces and more reactive when BTC pumps (figure 12). Lido DAO (LDO) and Stacks (STX) exemplify this. STX is a defensive play, as it tends to outperform during tough times but lags when momentum picks up. Our framework suggests prioritizing alts that are breaking out—those constantly testing/breaking local tops. The fact that the altcoin is rising while bitcoin is flat is attractive. We currently have our sights set on XRP as the ultimate breakout—it's nearing resistance and backed by a solid narrative. Remember, breakouts carry more risk as these coins have high beta and are susceptible to bitcoin's retraces.

Outlook

Watch USDT and stablecoins for the market’s next moves: Tether (USDT), the world’s largest stablecoin, briefly lost its 1:1 peg to the US dollar on June 15. The price of USDT fell to as low as $0.997, before recovering to $1.00. Tether’s CTO Paolo Ardoino blamed the de-peg on a single large trader who borrowed 31.5 million USDT and swapped it for Circle’s USD Coin (USDC). The trader then deposited the USDC into Curve Finance’s 3pool, which caused the USDT weight in the pool to increase. While this loan is repaid and this issue is solved, it’s clear that even such a small depeg can add to nervosity in the market, especially in the face of further regulatory threats that may extend to stablecoins soon.

So, where do we stand? The brittle environment is strengthening: the macro outlook and cross-asset structure are bullish, and bitcoin’s price structure resembles significant bottoms like the one on Sep 04, 2020. However, we haven’t seen the Nasdaq’s outperformance spill over as momentum remains low - with the risk of turning bearish. Buying at $25.5k seems risky, it’s best to wait for a dip and accumulate below $24.9k (short-term support level). If the price holds the $25.5k, we’re looking for a solid hold of the $25.7k level after retesting the $26.2k (short-term resistance level).

We believe the long-term trend is still intact even as bitcoin has encountered new, intensifying challenges. Michael Saylor, CEO of MicroStrategy and a bitcoin maximalist, has predicted that the cryptocurrency industry will become bitcoin-focused due to regulatory pressure. He believes that regulators and central banks worldwide will increasingly scrutinize and crack down on other cryptocurrencies, leaving bitcoin as the dominant player in the market.

So maybe we’re witnessing bitcoin overcoming what it was built to overcome. It remains to be seen whether bitcoin will continue to grow in adoption as a safe haven and rise despite - or maybe even thanks to - regulatory attacks on the space.