Dear subscribers,

Two weeks ago we published Uncharted 36, as we were in a seemingly perpetual range of around $28k. Back then we expected the range to break to the downside, followed by a return to the current levels with renewed strength. What we saw was a break to the upside, followed by a return to $28k. Altcoin Season was as elusive back then as it is today. Basically, the market gave us a do-over.

Let’s dive in!

Complacency is the forerunner of calamity. When comfort sets in, brace for the unexpected. - Anonymous

At a glance

State of the System

Bitcoin faced resistance around $30.5k-$31k and retraced below $30k.

Smaller fluctuations of +/- $1k are anticipated; and price action between $27.5k and $32k is still within the normal range.

Macro Environment

US Dollar Index (DXY) tests downtrend line and faces rejection.

Earnings season pressure may impact the crypto market: 74% of large-cap companies that reported earnings in April so far beat expectations, potentially contributing to more significant rate hikes.

Crypto's Course

The short-term trend is uncertain, but medium and long-term prospects for bitcoin remain bullish.

Growing maturity in the crypto market may make it more attractive to institutional investors, further supporting long-term bullish outlook.

Ethereum must establish a stronger footing to transition towards Altcoin Season in the bitcoin-altcoin cycle.

Outlook

Higher volatility levels for bitcoin are expected as volumes remain low.

Futures open interest development from the rise above $30k until today provides an interesting picture of how market players are acting now that we are back at $28k.

State of the System

Since Uncharted 36, bitcoin faced resistance in the $30.5K - $31k area and retraced below $30K, ultimately testing the $27.9-$28k support. Despite the recent dip, bitcoin's long-term bullish trajectory remains intact, albeit with weakened momentum (figure 1). The risk of a significant drop is relatively low, but the waning momentum can be attributed to low trading volumes. As bitcoin currently hovers near support levels, smaller fluctuations of +/- $1k are anticipated, while moves between $27.5k and $32k would still be within the normal range as shown by the weekly volatility bands in figure 3.

The $27.9-$28k support level (figure 2), which was once the resistance level of the upside channel, represents a technically healthy retracement. As this support is tested, brief downward wicks may occur for stop-loss hunting. The next support area lies at $25.5K-$26K, but on-chain volume data indicates a substantial liquidity pool lower, at $24.5K.

The bitcoin price action aligns with expectations, as implied volatility and realized volatility remain very closely aligned. This suggests that the recent drop was an anticipated fluctuation to test the price action channel (figure 3). The long squeeze from $30k to the lower $29k area, however, led to the liquidation of 260 USD million worth of long positions in recent days.

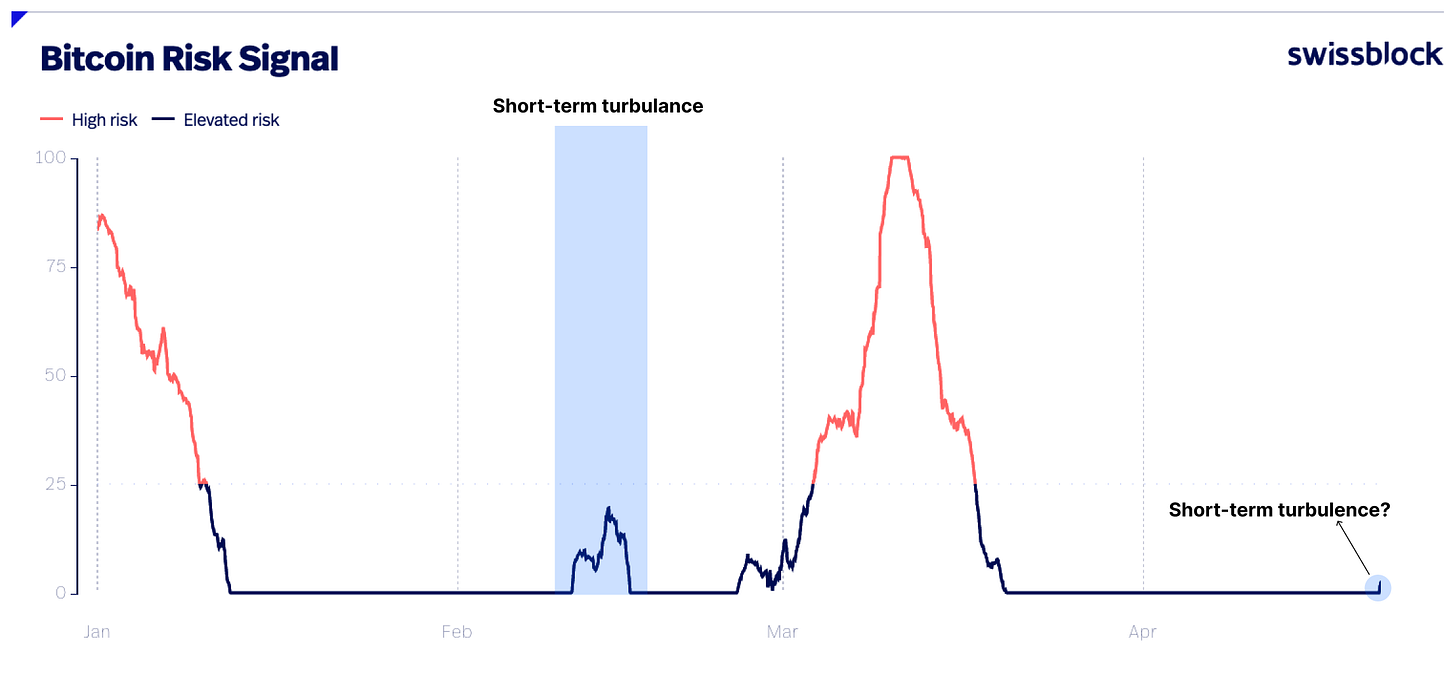

The Bitcoin Risk Signal is at 0 (figure 4) - looking a bit shaky in the short run - despite the recent volatility, indicating a lack of panic selling. The Fear and Greed Index retracted from the greed zone to a neutral position at 52 points. Meanwhile, the current market environment, characterized by unrealized profits outpacing unrealized losses (see NUPL on glassnode), implies optimism in the medium and long term.

Bitcoin dominance has reached a local peak, and ethereum has gained momentum, albeit without driving the market. Consequently, the recent pullback negatively impacted altcoins, pushing them into lower territories and leading to double-digit losses. For the Alt Season to commence, bitcoin dominance must decline and ethereum must outperform bitcoin (figure 5).

Enjoying the Uncharted so far?

👍 | 👎

The macro environment

The US Dollar Index (DXY) is presently testing its downtrend line and facing rejection. As the DXY generally rises in tandem with increasing interest rates, the current rate hike of 25bps has been factored into the index. Meanwhile, US 10-year bonds persist at high levels, testing support around the 5% mark. Hence, the external pressure on bitcoin. An uptrend continuation implies…