Dear subscribers,

In Uncharted 36, we will discuss the current shaky state of the crypto market and the potential for a full-blown altcoin season. Since our last update, bitcoin has traded sideways, ethereum has revived, and liquidity has dried up. The short-term outlook is skewed to the downside, yet we remain structurally bullish. Are we closer to the long-awaited alt season?

Let’s dig in!

Patience is a superpower. - Jake Rosser

At a glance

State of the System

Bitcoin remains range-bound between $27k - $28.6k, with no clear direction in sight, and alt season remains uncertain.

Bitcoin Risk Signal remains stable at the lower extreme, suggesting a reduced likelihood of a drop below $25-$26.6k.

Altcoins are showing signs of a possible upcoming altcoin season, but further confirmation is needed to solidify this possibility: mainly liquidity and interest.

The macro environment

Risk assets are expected to continue outperforming in the mid-term, as the Fed will likely pause and we are at the end of QT.

In the short term, a bullish setup in the DXY could lead to a potential dip in bitcoin to the $25-$26k range.

Crypto’s course

Bitcoin leads, altcoins follow: mid-term bullish outlook for bitcoin extends to altcoins, with ethereum expected to outperform first, followed by large caps, and then riskier altcoins.

Currently, a transition phase from bitcoin to ethereum is around the corner, with both price momentums trending downward, and a full-blown altcoin season yet to be solidly confirmed.

The zK narrative amongst others and a group of altcoins (figures 10 and 11) are believed to lead the upcoming altcoin season.

Outlook

Bitcoin's short-term shakiness is not necessarily bearish. As long as bitcoin holds above $25-$26.5k and interest increases, a full-blown alt season may occur, even if bitcoin remains in a ranging state.

Clear bitcoin buy (demand) and sell (supply) walls around $27k and $29k respectively.

State of the System

A lot and nothing has changed since Uncharted 35. Bitcoin remains within the $27k - $28.6k trading channel, the Bitcoin Risk Signal remains at 0, and we remain well within the bullish quadrant (figure 1). Momentum is slowly fading as seen by the slight retrace along the y-axis of the compass (figure 1); yet bitcoin’s price action remains untouched. Two very puzzling questions remain unanswered: Why haven’t we gone lower or higher? When is the alt season coming?

Bitcoin continues to trade within the upper range ($27 - $28.6k, figure 2), unwilling to breakout (up) or break down: there have been two $27k retests since the previous Uncharted, while the price has been sold (rejected) 6 times at resistance. What does this mean? Despite the short-term shakiness, the price has been pushed to the upside of the range, consolidating between $27.7k (pivot point) and $28.6k. The longer we hover within the range, the likelier that bitcoin drops to $25-$26.5k to catch liquidity, leading to the full-blown alt season.

From a Bitcoin Risk Signal perspective, nothing has changed. The signal is stable at the lower extreme (figure 3), suggesting that a risk of a pronounced drop is relatively low. However, what defines a pronounced drop under this environment? According to bitcoin’s daily average true range, every move within $1171 is within a reasonable range, which on a weekly basis increases to $2600. Thus, we believe that the low risk of a pronounced drop refers to a reduced likelihood of a drop below $25-$26.6k. On the bright side, the price could climb to $29.2-$30k.

There are still risks that we should consider: ongoing crypto scrutiny and the macroeconomic environment. The risks are the main reasons behind the low activity in bitcoin - low spot volume (figure 4), futures volume, and open interest. Bear in mind that intense volatility is a consequence of low liquidity (low volume and thin order books), which defines our current state: a shaky low liquidity environment.

In terms of bitcoin vs altcoins, the former continues to drive the market. Notice how the Altcoin Cycle Signal remains well within bitcoin territory (figure 5). However, we saw a long-awaited pulse in ethereum. Is this the sign of a looming altcoin season and weakening BTC dominance? We will need to see large caps outperforming first, but more importantly higher interest and explosiveness across the board. Interest can be translated into capital coming into the system, be it through bitcoin around $25-$26.5k or one of the trending narratives which we’ll explore further down. So, we are seeing signs that the altcoin season is coming, but we await a solid confirmation, such as numerous altcoins going off (exploding). As of now, only 4 show explosiveness.

Enjoying the Uncharted so far?

👍 | 👎

The macro environment

It is likely that the all-out altcoin season does not kick off until we see improved sentiment in traditional markets, since that would trigger the eagerness of pursuing higher returns, through bitcoin and then altcoins. The market feels a bit apprehensive despite the recent strength in the Nasdaq and SP500 and bitcoin’s superior performance YTD.

We are confident that the risk asset outperformance will extend in the mid-term as the Fed will be finally forced to pause. We are at the end of QT. Or potentially, as

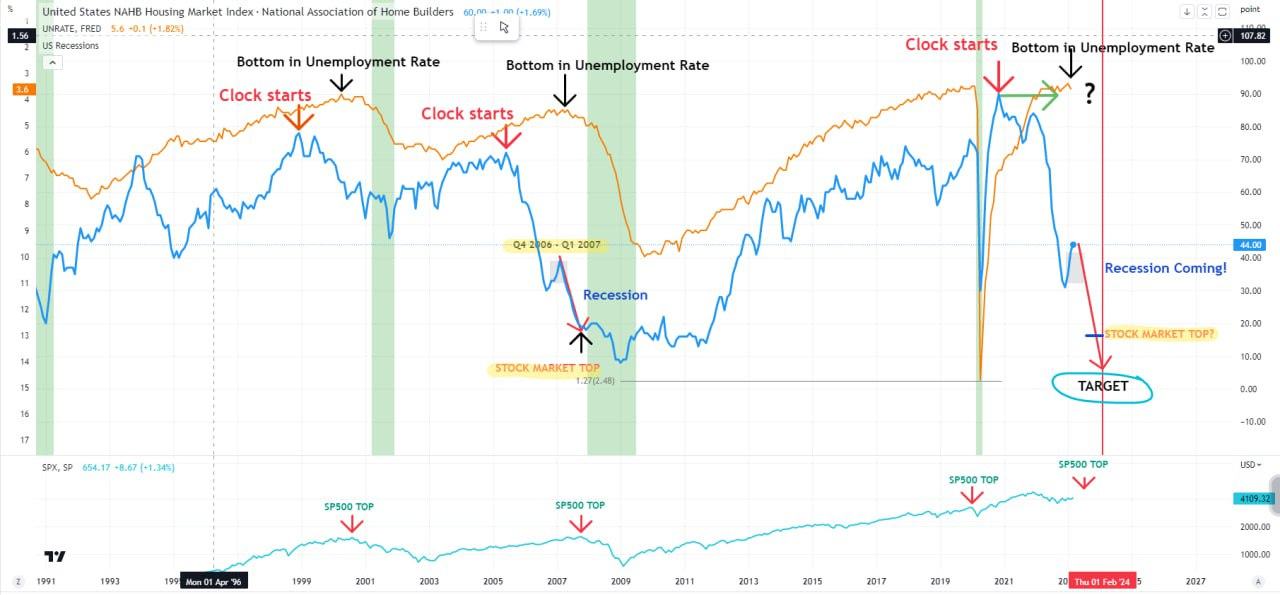

put it in , QE is back! When looking at the business cycle (macro indicators) we can observe that the leading indicators have rolled over, and the coincident indicators are beginning to follow: initial jobless claims came in higher than expected (228k vs 220k), reinforcing the shocking JOLTS data released earlier this week. However, numbers are not bad enough to scream recession, just yet. The housing market is already showing deterioration, but we await a bottom (top on the chart, figure 6) unemployment to confirm it.It’s a liquidity game now, which will come flushing into the market, pushing risk assets higher in the mid-term. In the short run, however, we continue to track the bullish setup in the DXY (figure 7) that could shake bitcoin down to the $25-$26k area.

Crypto’s course

Now that we understand the state of the system and the cross-asset structure, we can deepen our understanding of the crypto-verse. Bitcoin proceeds as the trendsetter, and altcoins will follow; so, our mid-term bullish outlook for bitcoin extends to altcoins. We will first see ethereum outperform, followed by large caps, and then investors will divest into riskier altcoins, triggering the altcoin season.

Does this mean the revived strength in ethereum confirms the second step to a full-blown alt season? Not exactly -

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.