Mixed CPI, Mixed Sentiment.

A week that began with a recovery in the TradFi markets, after Bitcoin showed the way over the weekend with a rally that extended into Monday, was marked by anticipation for the inflation data release.

Despite an initially positive impression, the data left a mixed sentiment: CPI inflation came in slightly better than expected (2.5% vs. 2.6%), but Core Inflation disappointed by recording a figure higher than forecast (0.3% vs. 0.2%). This limits Jerome Powell’s options, as the Fed Chairman is left with no room for a rate cut larger than 25 basis points. A more aggressive rate cut now seems off the table for the time being.

Within Core Inflation, the rise in the shelter sector, among other inflationary components, indicates that inflation has not fully receded. This was initially reflected in the traditional markets (TradFi), with the S&P 500 retreating slightly as investors processed both the economic data and the aftermath of the recent U.S. presidential debate.

But not everything was set in stone: the S&P 500 had an outstanding recovery, closing the session with a 1% gain. From its lowest point, after pulling back, it climbed a total of 2.6%.

Bitcoin recovered after the U.S. market opened and the initial reaction to the inflation report. With no new price catalysts from TradFi until the FOMC meeting on Wednesday 18th, when the interest rate decision (already mostly priced in) will be announced, a short-term scenario is taking shape in which Bitcoin could consolidate, preparing for another attempt to break resistance levels.

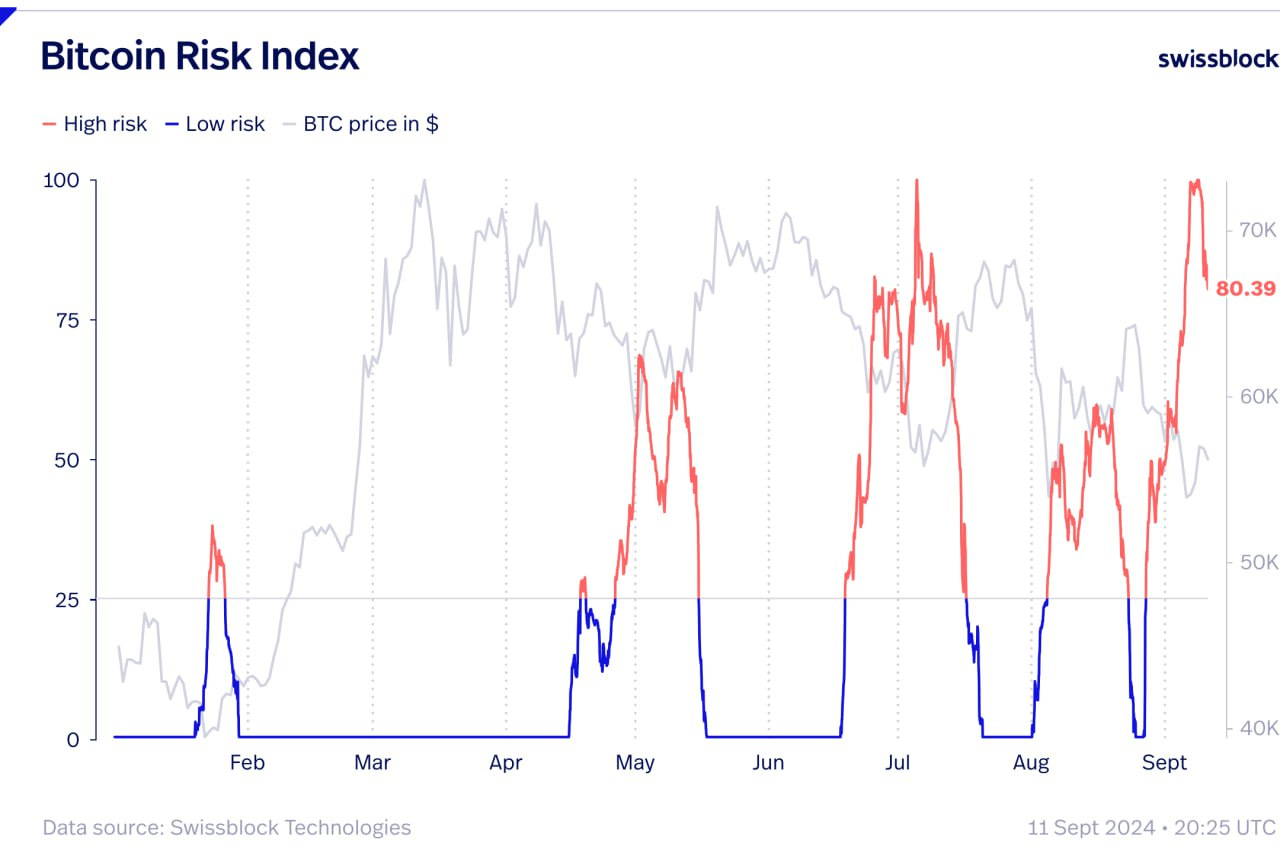

Compared to last week, risk has subsided, but it’s still high, momentum remains in the bearish quadrant, with fundamentals staying neutral. This suggests that, for now, Bitcoin is waiting for traditional markets to reveal their cards before making its own bigger moves. Nevertheless, there’s factors making the short-term look interesting.

Risk Peaks and Bull Runs.

Risk has decreased from its peak, which was briefly reached over the weekend. However, it remains elevated compared to previous readings of this indicator. It's noteworthy how well the price has responded to this spike in risk, once again reinforcing the reliability of this indicator in signaling bottom formations in the price.

Moreover, this behavior suggests that, according to the current cycle, the formation of these risk peaks typically precedes a significant upward movement. This rally often leads to the liquidation of short sellers, who are usually exhausted when risk reaches such high levels.

Likewise, the spike in risk indicates an excellent point for spot Bitcoin accumulation. Altcoins may experience greater volatility during this phase, though they still present attractive prices for accumulation, but with much more caution.

Keep the Volume Up, Keep the Momentum.

The Bitcoin Price Momentum has consistently indicated key impulses in BTC's price movements, signaling when a price capitulation precedes the beginning of

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.