“There are 3 eras of currency: Commodity based, politically based, and now, math based.” - Chris Dixon, Co-founder of Hunch

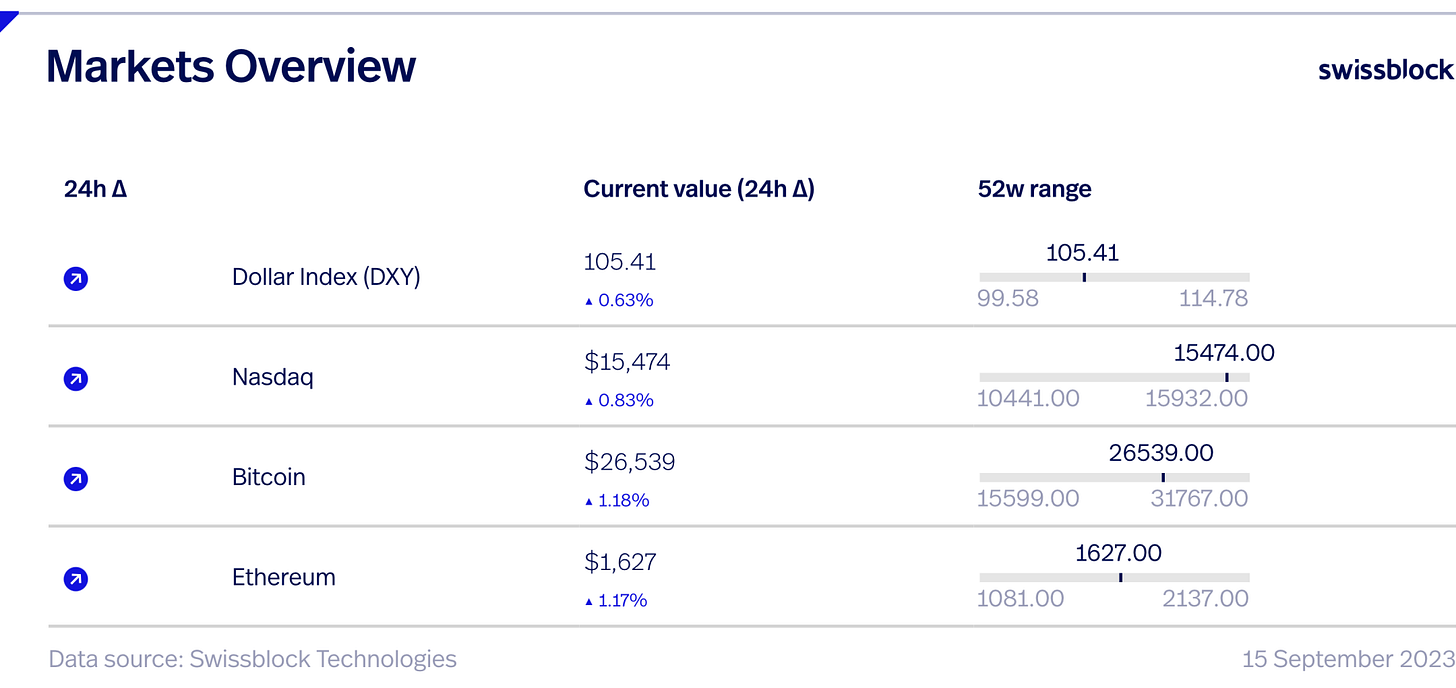

We expected a BTC price response to the United States Consumer Price Index (CPI), which jumped by 0.6%. Price has reclaimed support above $26k and is attempting to break out over $27k, where bulls will be out of a multi-week range channel.

This shift in attitude is reflected in the Risk Signal, which has plummeted to the 60s for the first time in weeks. Given the possibility of profit booking pressure around $27.4k and $28.2k, this climb could be a lock-step before breaking through the psychological hurdle at $30k.

Following the release of macroeconomic data showing favourable indicators for the US economy ahead of the Federal Reserve's meeting next week, stocks are down in early trade, but not enough to wipe out the market's gains for the week. The S&P 500 dropped 0.4%, the Dow fell 37 points, and the Nasdaq composite dropped 0.5%.

Bitcoin's 30-day correlation coefficient with the Nasdaq 100 has risen from a negative 0.1 in June and July to nearly 0.4. This year, the IT bellwether has climbed more than 40% amid the frenzy surrounding artificial intelligence, which may give BTC the required pressure for a surge up.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.