Dear subscribers,

One of the key issues the crypto industry faces as a whole, is the ability to rely on a set of tools that have been verified & tested over the course of decades, like we have for other asset classes.

Unlike equities and bonds, we don't have a universal framework yet that we can use to understand if something is over or undervalued since we cannot look at discounted cash flows or interest rate environments to understand the potential of a company to grow and to generate returns.

In this Uncharted: Special Edition, we plan to propose the first of these tools that we believe can provide you with an edge when looking at the macrostructure of bitcoin and crypto as a whole. Through these tools, we hope to provide our users with a framework that allows them to understand the growth potential of the emerging crypto asset class and its fundamental value across all the different types of protocols.

We won’t be releasing frequent iterations of the Uncharted: Special Edition. For those interested, we are creating a waiting list for people interested to have access to it.

Let’s dig in!

TL;DR

The rapidly changing crypto environment requires a new set of tools to define the framework for thorough analysis and investment decision-making.

Using our proprietary signals we create a framework that shows structural changes in the system.

Swissblock’s Bitcoin Risk Signal portfolio allocation schema mitigated a 50% loss for the simulated portfolio.

The proposed framework enables efficient portfolio management during cycle regime shifts as Swissblock’s Altcoin Cycle Signal indicates capital rotation between bitcoin and altcoins.

Bitcoin Risk Signal: Risk of Pronounced Drops

Since December 2021, we have been in the middle of a multi-stage unwind in bitcoin’s price. The unwind started back in mid-November, as evidenced by Swissblock’s Bitcoin Risk Signal.

Elevated Risk since mid-November

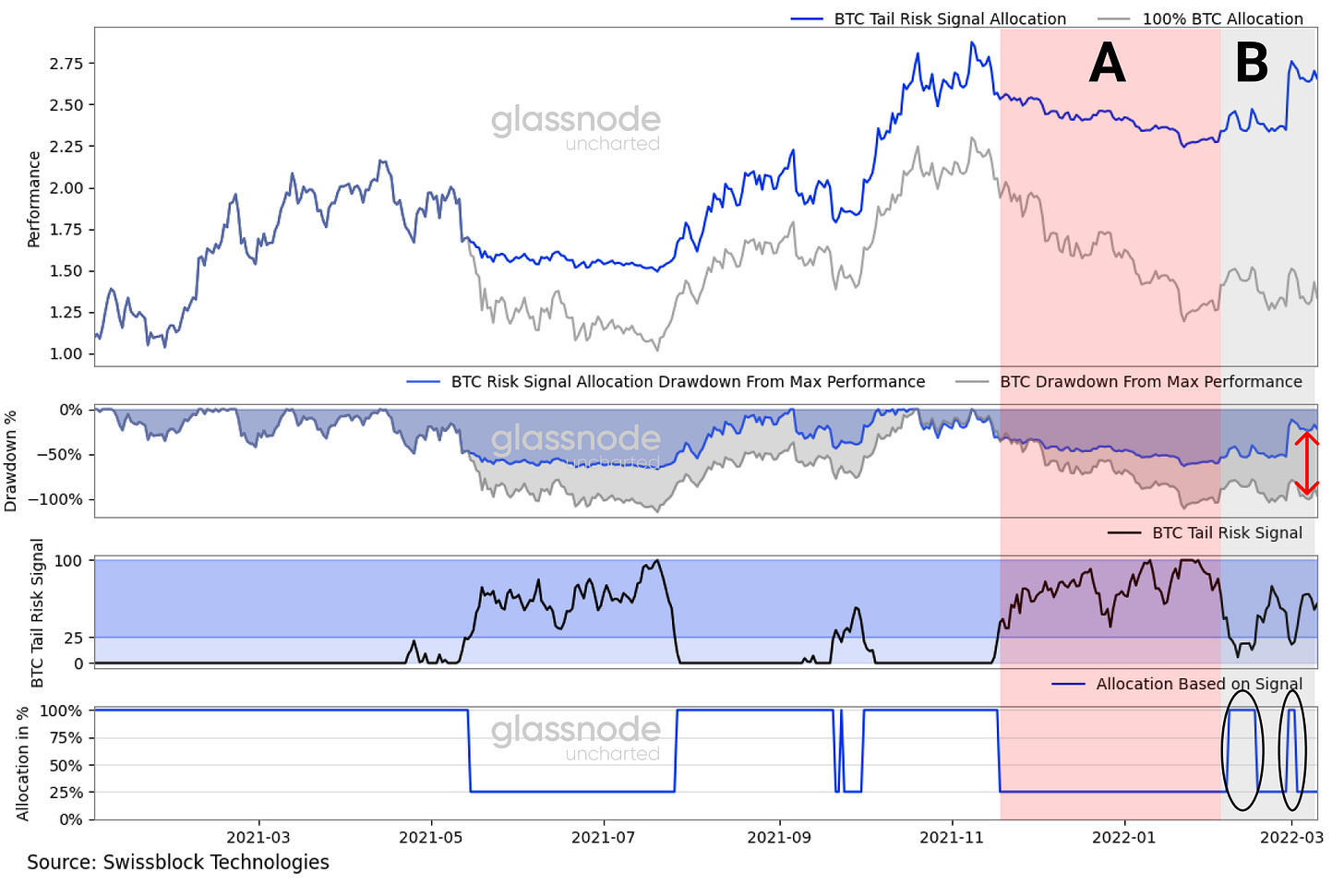

Following the crash on December 4th, due to an overleveraged system, Swissblock’s Bitcoin Risk Signal turned into the high-risk territory with swift drops in February and March of this year. To showcase the potential of this signal, we simulated a portfolio rebalancing schema for changes in Swissblocks’s Bitcoin Risk Signal during tense times.

Portfolio Rebalancing Schema

When Swissblock’s Bitcoin Risk Signal is at a value of zero, the portfolio is 100% allocated to bitcoin, given the minimum risk (red circles on the bottom graph).

When Swissblok’s Bitcoin Risk Signal is at a value of 25 or higher (flat blue line in the bottom graph), the portfolio’s bitcoin exposure is reduced to 25%, while moving to 75% stablecoins or cash.

In hindsight, the signal would have saved you a 50% drop in asset price rebalancing your portfolio twice since mid-November.

In hindsight, the signal-drive portfolio rebalancing outperformed when the lower risk was triggered (area B).

100% BTC Allocation vs Bitcoin Risk Signal Allocation Schema

The Rise of Altcoins

Over the past few years, the crypto space has increased exponentially and changed in many fundamental ways. Despite being the largest asset by market cap, bitcoin is slowly losing its position as the key driver behind the ecosystem, meaning that we need to redirect part of our focus to ethereum and the remaining top 20 digital assets.

Altcoins and Ethereum vs Bitcoin

Bitcoin is the trend driver at the beginning of rallies, as it serves as the gateway asset, being the most known & liquid asset. Once bitcoin defines the trend, market participants diversify into other assets within the ecosystem looking for new opportunities to make higher returns.

The aftermath is a decoupling between the base asset bitcoin and the rest of the ecosystem, reflected by a correlation that reduces until we see an exodus back into the larger assets and stablecoins/fiat as the market goes into profit-taking and eventually panic mode.

Market Phases

Bitcoin price rallies

Diversification into ethereum and altcoins

Decoupling between bitcoin and altcoins

Market correction

Money flows to stablecoins/cash

Swissblock’s Altcoin Cycle Signal

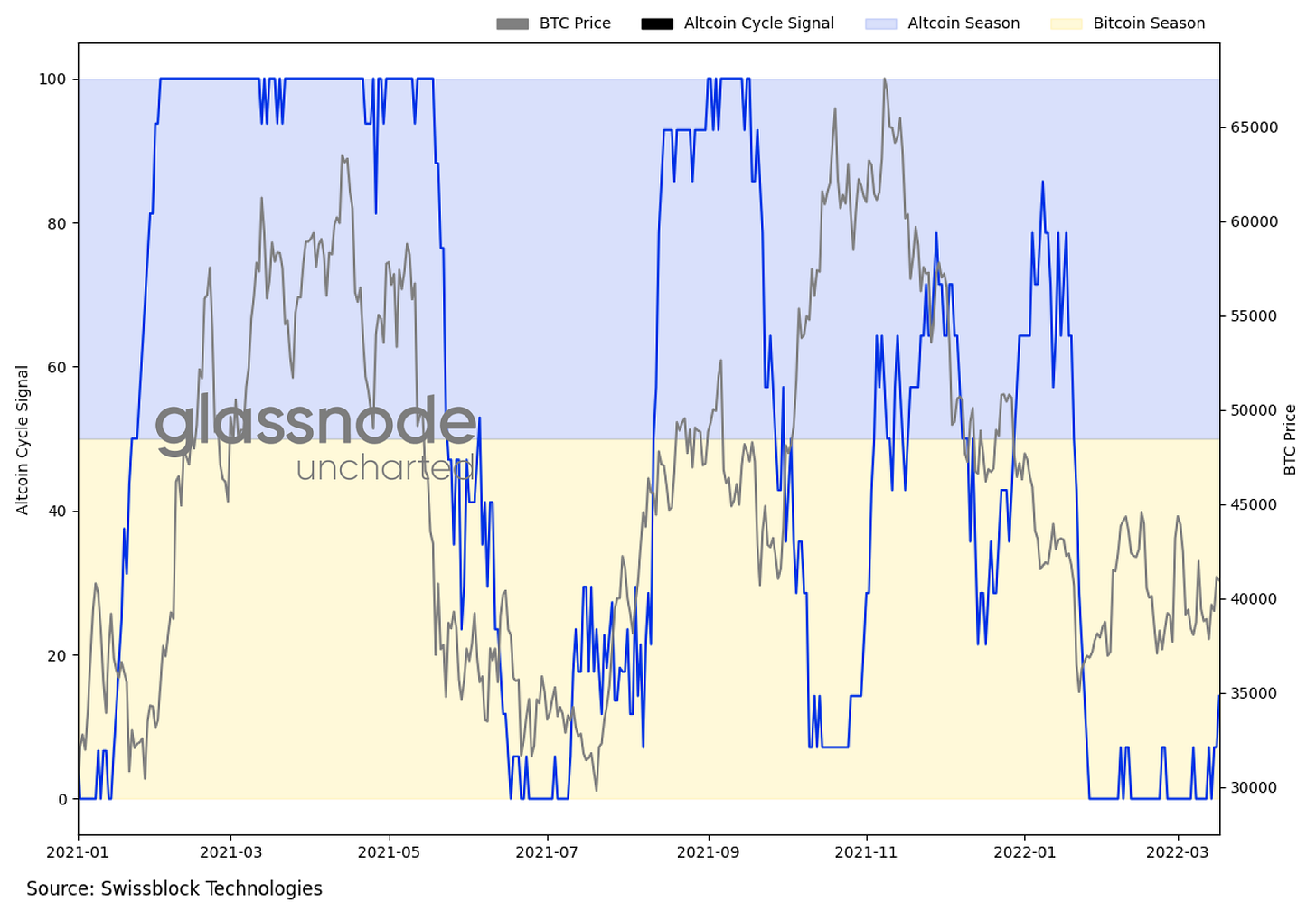

With these cycles in mind, we can provide the macro view on how this capital transition/rotation unfolds, giving a relative sense of the current market cycle. In the below graph, we provide an overview of one way this combination of signals can work. Using Swissblock’s Altcoin Cycle Signal, we can see two major types of altcoin cycles, denoted as A and B.

A-type-cycle: higher amplitude and intensity of the cycle

B-type-cycle: lower amplitude and intensity of the cycle.

This intensity can be further reinforced by Swissblock’s Sector Momentum Signal (second graph below), which measures how exponential the trend is within each type of altcoin sector.

Two Types of Altcoin Cycles

Knowing now what the intensity of Swissblock’s Altcoin Cycle Signal is and what sectors it is affecting, it becomes important to know when major base assets like bitcoin and stablecoins start to move, as people start to take profits and move into safer and more liquid assets.

It is important to underline the fact that, the rotation usually happens into bitcoin first before we see a large move into stablecoins, due to lack of direct altcoin stablecoin pairs and relative liquidity concerns.

To identify the said phenomenon, you can add Swissblock’s Bitcoin Risk Signal as a third element to the above view, using it as an indicator to understand if bitcoin's price is normal or in an overextended phase during the current cycle.

Altcoin Cycle Signal and Bitcoin Risk Signal: Rotate With the Market and Avoid Drops

Efficient Portfolio Management

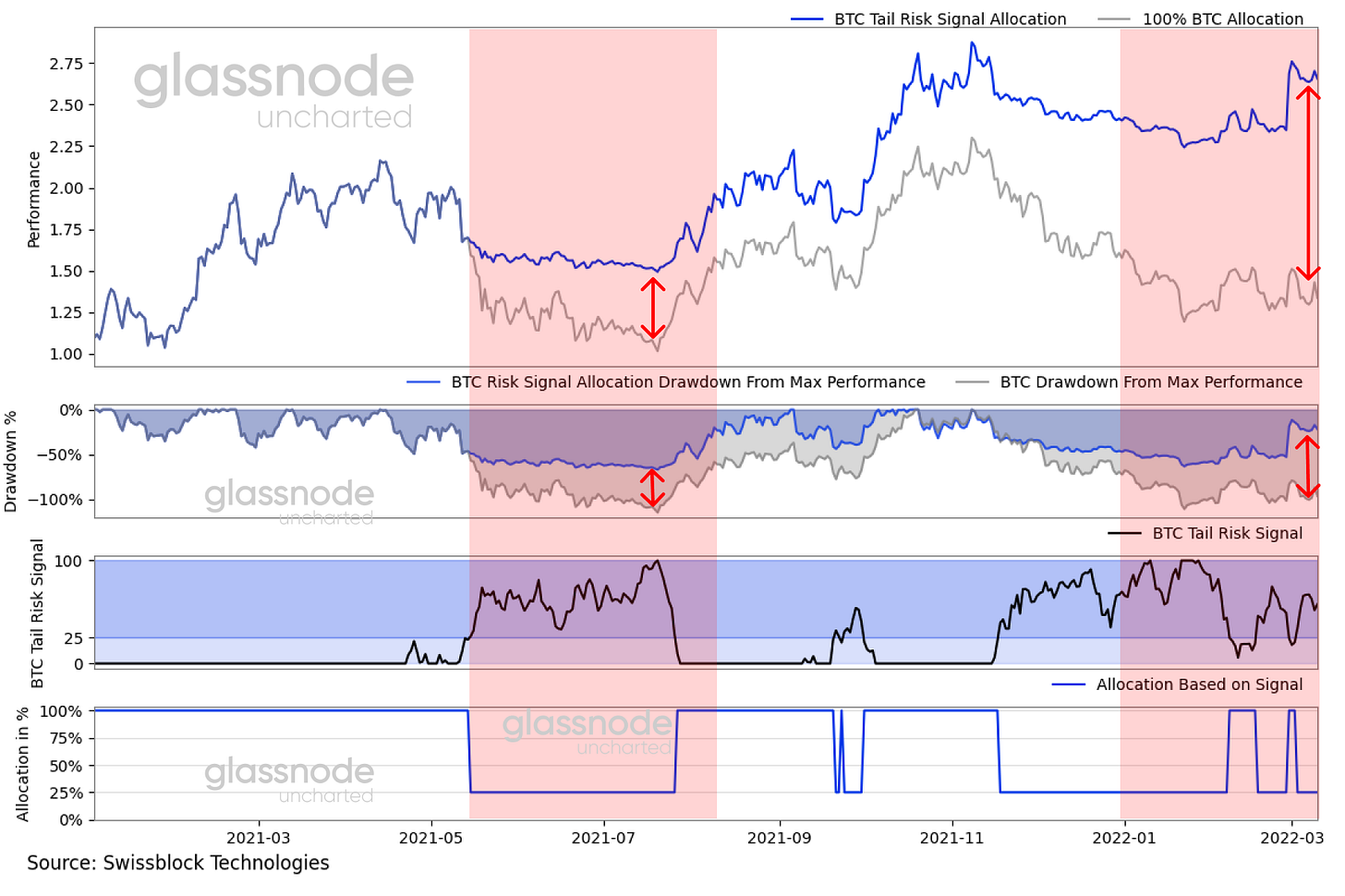

Using Swissblock’s Bitcoin Risk Signal, in this case, would have alerted users of a major downturn in bitcoin both before the May and November crashes, which simultaneously coincided with a shift of Swissblock’s Altcoin Cycle Signal towards bitcoin as the driver of returns in the market.

Bitcoin Risk Signal Allocation

Following the alert of a potential retrace of bitcoin’s price and the sign of a bitcoin-dominant market, Swissblock’s Bitcoin Risk Signal suggested reducing bitcoin’s exposure to 25% as the signal crossed the elevated-risk threshold (25).

Reducing exposure to bitcoin mitigated drawdown without incurring an expensive opportunity cost of not owning any bitcoin.

Bitcoin Risk Signal Allocation Drawdown

Portfolio Allocation During Altcoin Cycle

Swissblock’s Bitcoin Risk Signal serves as a proxy for potential downturns in price, given that the overall correlation between bitcoin and altcoins remains relatively high.

We can observe that following the A-type-cycle, defined by dominant altcoins, reducing exposure to altcoins (ethereum and large-cap layer 1s, for example) as the risk level elevated reduced the drawdown resulting in an optimized overall return.

Portfolio Allocation: 50% Ethereum and 50% equi-weight Top 5 Layer 1s by Market Cap

That is all for today. If you're interested in receiving frequent updates of our structural signals with an explanation of how to incorporate the said signals in your trading framework. Sign up to the waitlist here:

Is there a way to access Swissblock’s signals?