Following last week's price retracement, the market has regained its bullish momentum, and the Bitcoin Risk Signal dropped to around 30, indicating that the mid-term outlook remains favorable for continued growth.

The current market hypothesis suggests that $20k serves as a robust support level for the mid-to-long-term, with resistance levels remaining undefined, signaling potential for even greater upside in the coming period.

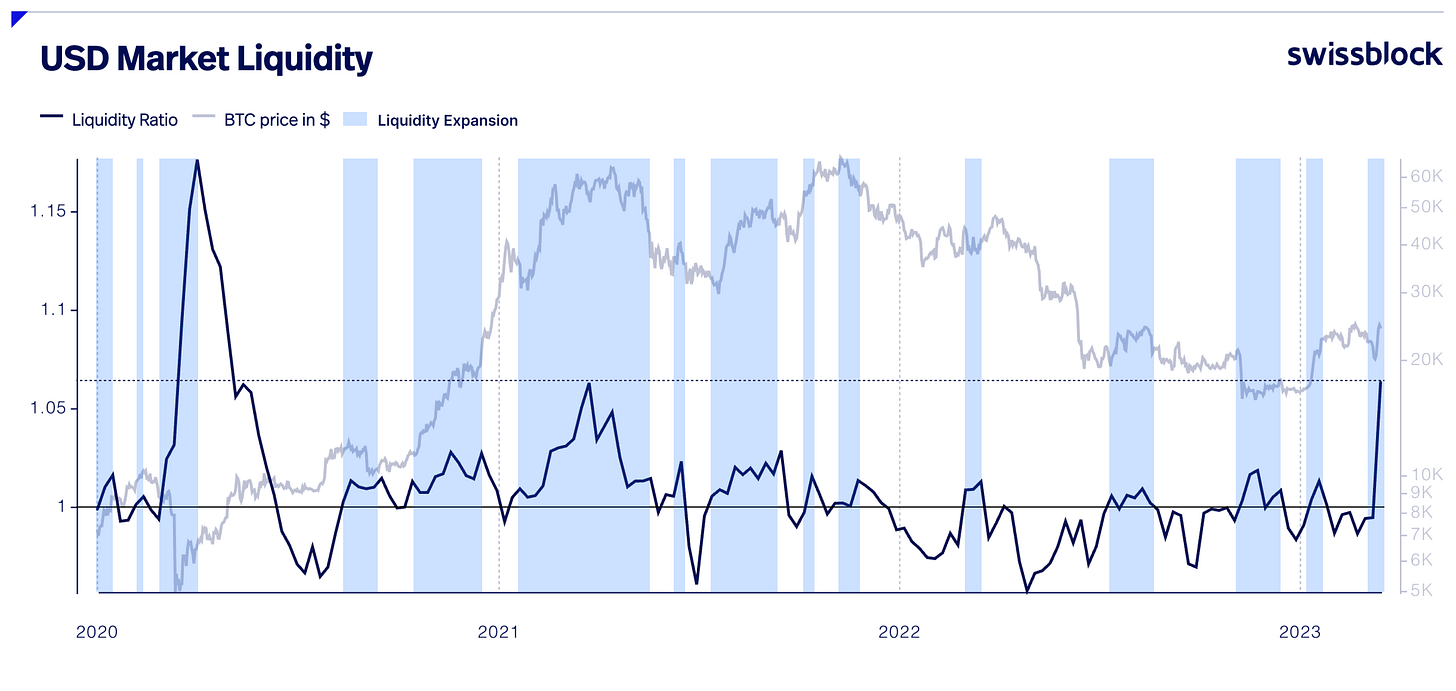

The short and mid-term outlooks for the global markets are decidedly optimistic, driven by an influx of liquidity ($2 trillion), which is expected to flood the markets and overshadow positive job data that has encouraged rate hikes in the US.

US treasury yields are witnessing a rapid decline, and the market is pricing in a 25 basis point (bps) hike in March, primarily due to the strong job market, before an anticipated pause in May.

Analyzing the relationship between bitcoin and altcoins (alts lagging bitcoin), it appears that we are either at the end or the beginning of the next mid-to-long-term move. Given the described environment, there is increased confidence that a strong crypto-wide rally is imminent.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.