“If you really look closely, most overnight successes took a long time.” - Steve Jobs

🇨🇭 Join our Swissblock Telegram Group! Get daily updates, in-house content, and technical analysis on crypto & macroeconomics. Tap into a hub of knowledge and insights. Stay ahead with Swissblock. Sign up now! 🚀

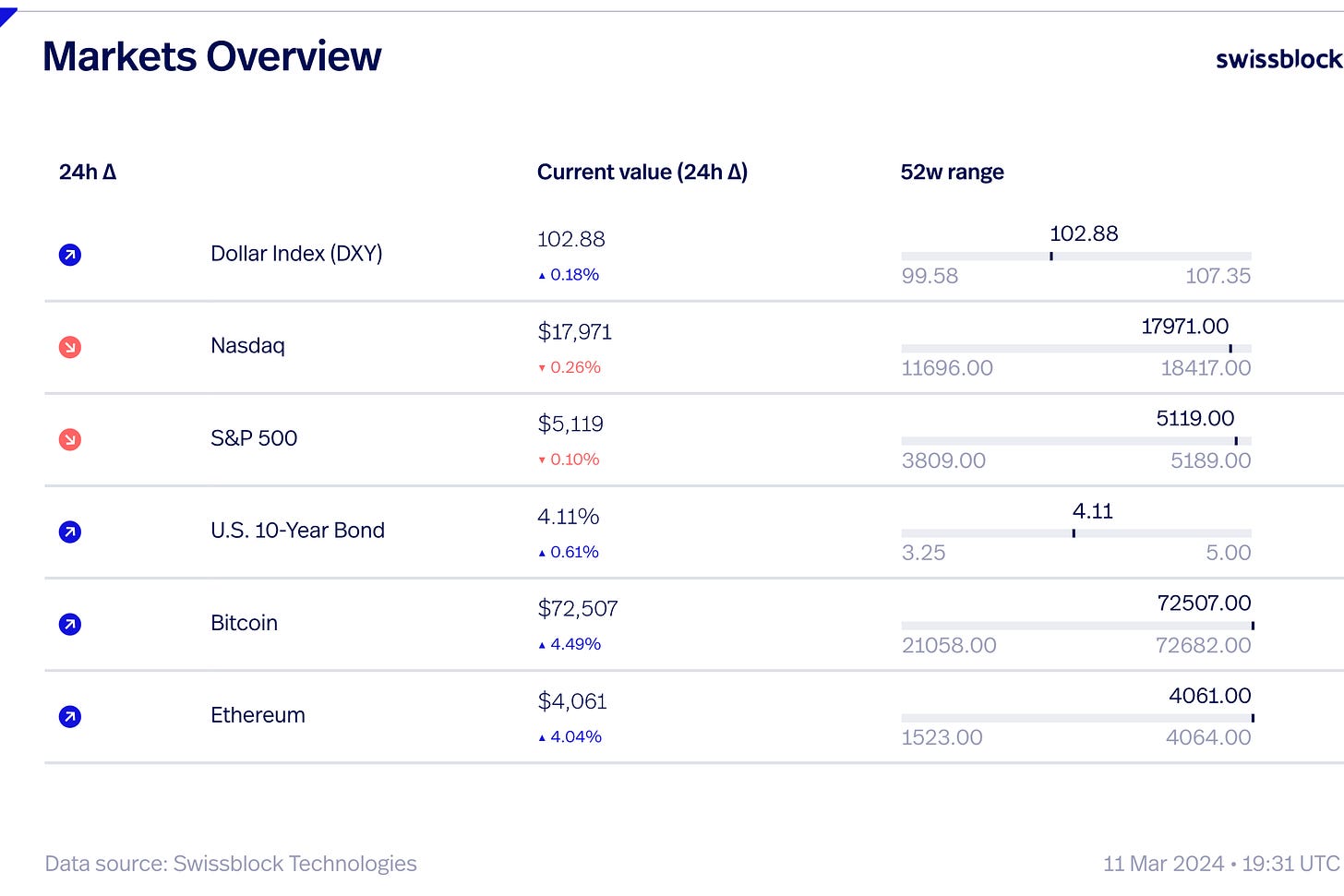

BTC experienced a significant gap higher today, followed by a brief pullback before attracting buyers once again, propelling it well above the $70k mark and into uncharted territory. Without established reference points or indicators like Fibonacci extensions, analyzing the current situation relies heavily on recognizing the prevailing upward trend.

In the absence of concrete metrics, players are inclined to assess key support levels, with $65k emerging as a significant level, backed by psychological significance and the presence of the 20-day EMA. Additionally, $60k and $52k are anticipated to offer support, reflecting the remarkable 190% gain in the market since its low point in August of the previous year.

The Consumer Price Index (CPI) report holds immense importance as it provides the first hard data on inflation, a focal point for the Federal Reserve. Unlike jobs data, CPI results offer clear interpretations; high inflation favors the US Dollar. It's a binary figure, leaving no room for ambiguity.

Given its significance, the CPI report typically triggers highly volatile market reactions, heavily influenced by existing market positions. Subsequent triple releases on Thursday further intensify price action, with market trends contingent on the alignment of all three releases and their components. If the data points move in the same direction, markets are likely to respond accordingly.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.