Dear subscribers,

Investors are surprised to see bitcoin holding up at the upper $16k range following the FTX debacle. Volatility stabilized, liquidity dried up, and momentum remained bearish. A big move is ahead of us, but the question remains, where are the sellers and buyers?

Let's dig in!

State of the system

Bitcoin retraced to the bearish quadrant after the swift bullishness preceding Uncharted #27.

The SBT Risk Signal accelerated and edged towards the 100-extreme as an idiosyncratic risk tumbled the market.

While bitcoin continues to drive the market, the $16k range is on thin ice, and given the strong correlation within the crypto space, the market as a whole is vulnerable.

Trading bitcoin’s range seems most suitable amidst the charged environment (see Figure 17).

Everyone’s asking why aren’t we lower. Following the demise of FTX, the risk of contagion is high (see Genesis and Multicoin, for example) and bearish momentum took hold of crypto. As can be seen in the figure below, bitcoin swiftly returned deep into the bearish quadrant after it had gained a strong footing at $20k. While idiosyncratic dumping might well cause further short-term drawdowns, bitcoin’s fundamentals are strong (Figure 2).

Investors are massively withdrawing from exchanges (Figure 7), finally taking “not your keys, not your coins” seriously. And we see clear signs of seller exhaustion (Figure 16).

Figure 1: Bitcoin at the bearish quadrant

The above compass is a new development by Swissblock Technologies, and it is rapidly becoming a mainstay in the Uncharted. Note that since Uncharted #27, SBT performed further backtesting and both the risk and trend/momentum axes were refined.

Figure 2: Where do we stand?

Risk

All seemed well after Uncharted #27. The SBT Risk Signal reverted and reached 0. Then came a tweet from CZ, calling out a shady FTX and company - SBF - and abrupt selling pressure led to the 10th bloodiest week for bitcoin (-19% on Week 45). The panic, selling, and threat of contagion detonated the SBT Risk Signal (Figure 3).

Figure 3: Detonated risk in the system

The price action stabilized around $16-$16.8k, and in this eerie environment, bitcoin and ethereum outperformed traditional markets as crypto decoupled (Figure 4). What has held up crypto?

Figure 4: Idiosyncratic risk

The general sense is there should be more idiosyncratic dumping, so our attention turns to risk measures within crypto.

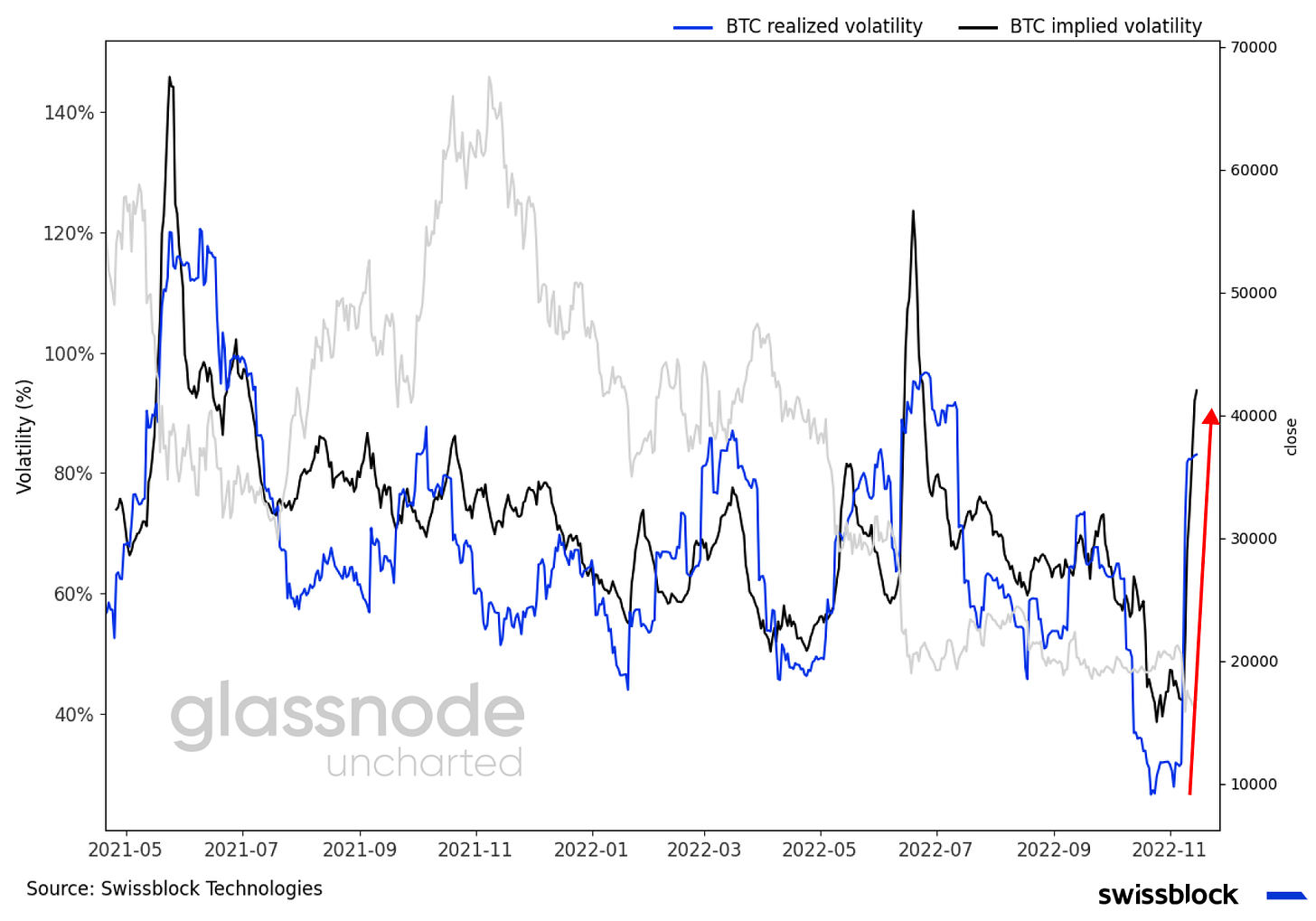

The intense volatility has gradually normalized and slowed around 80% - relatively low - as the price consolidates at current levels (Figure 5). However, as news propagates slowly and the contagion begins, backward-looking volatility - realized volatility - becomes noise because it cannot capture the scale of a future move.

Figure 5: 80% realized volatility is nothing under current conditions

The problem is that the crypto options market is premature, so implied volatility does not provide a clear direction. Notice how both the realized and implied volatility bands failed to capture last week’s move (Figure 6).

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.