Dear subscribers,

Bitcoin's short-term bearish trend faded as the local support level resisted the intense price action last week. Altcoins underperformed, and bitcoin is at no man's land. Despite the low volatility, there is no clear direction or momentum. Apathy is the biggest obstacle.

Let’s dig in!

TL;DR

Swissblock's Bitcoin Risk Signal increased as the price action compressed at the $18-$19.2k support level.

Bitcoin is sensitive to incoming data, yet realized volatility is significantly low.

The Swissblock Momentum Index depicted a fading short-term bearish trend, but there is no clear direction due to a shy demand.

The Swissblock Altcoin Cycle Signal remained within the bitcoin regime as altcoins underperformed.

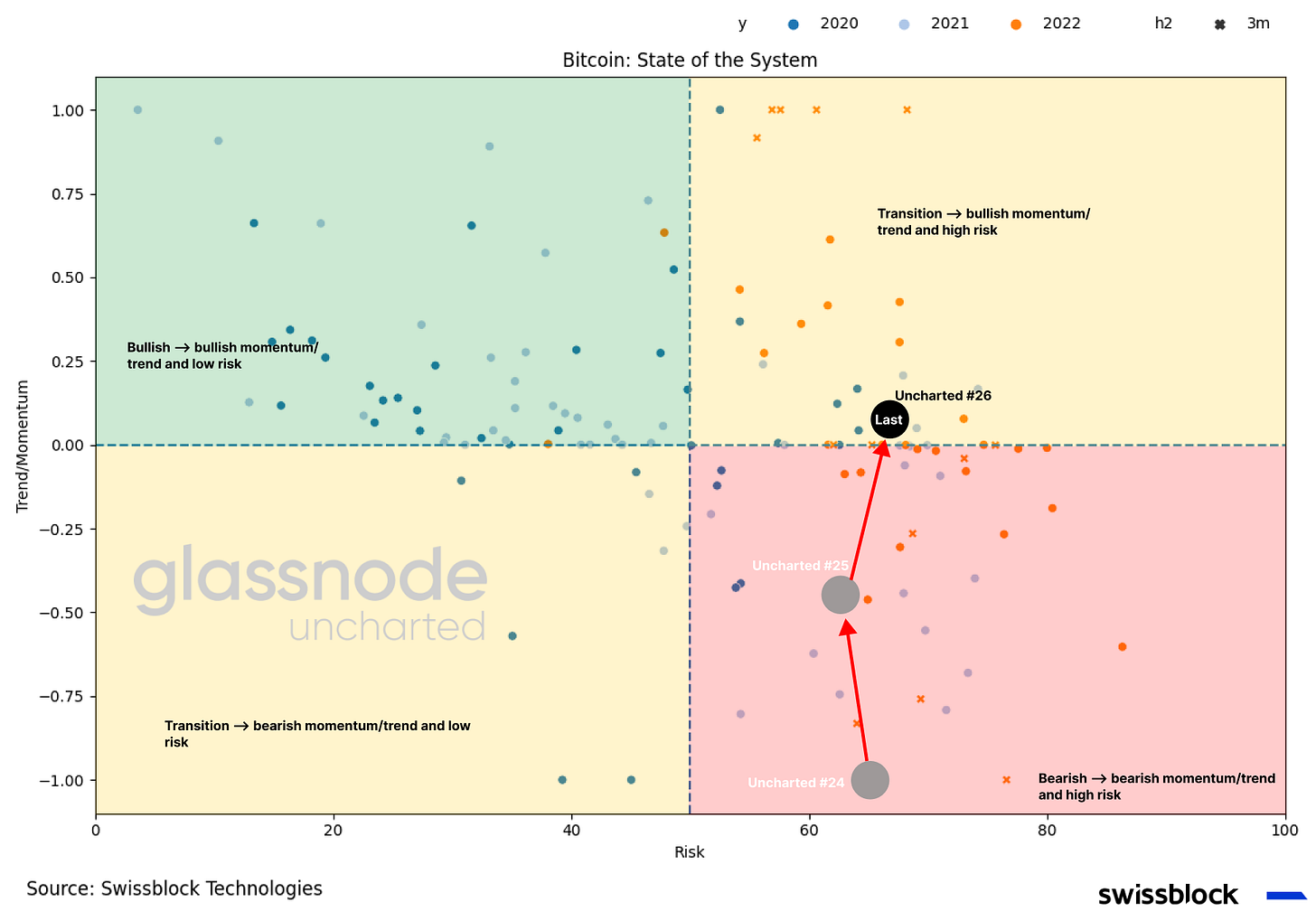

The state of the system developed since our previous Uncharted. Risk slightly increased, and the bearish trend lost steam, which positioned bitcoin within the transition quadrant in the SBT State of the System compass (Figure 1).

Figure 1: The State of the System

However, it is unlikely that we see renewed bullish momentum, considering the macroeconomic environment and state of the market. The risk remained high despite the recent decrease in the SBT Risk Signal (Figure 2) as apathy spread to the crypto market. Let’s break it down.

Figure 2: High-risk environment

Apathy

Bitcoin dropped -4.18% since Uncharted #25 (Figure 3) and apart from abrupt intraday price swings, the overall sideways trend endured.

Figure 3: -4.18% since Uncharted #25

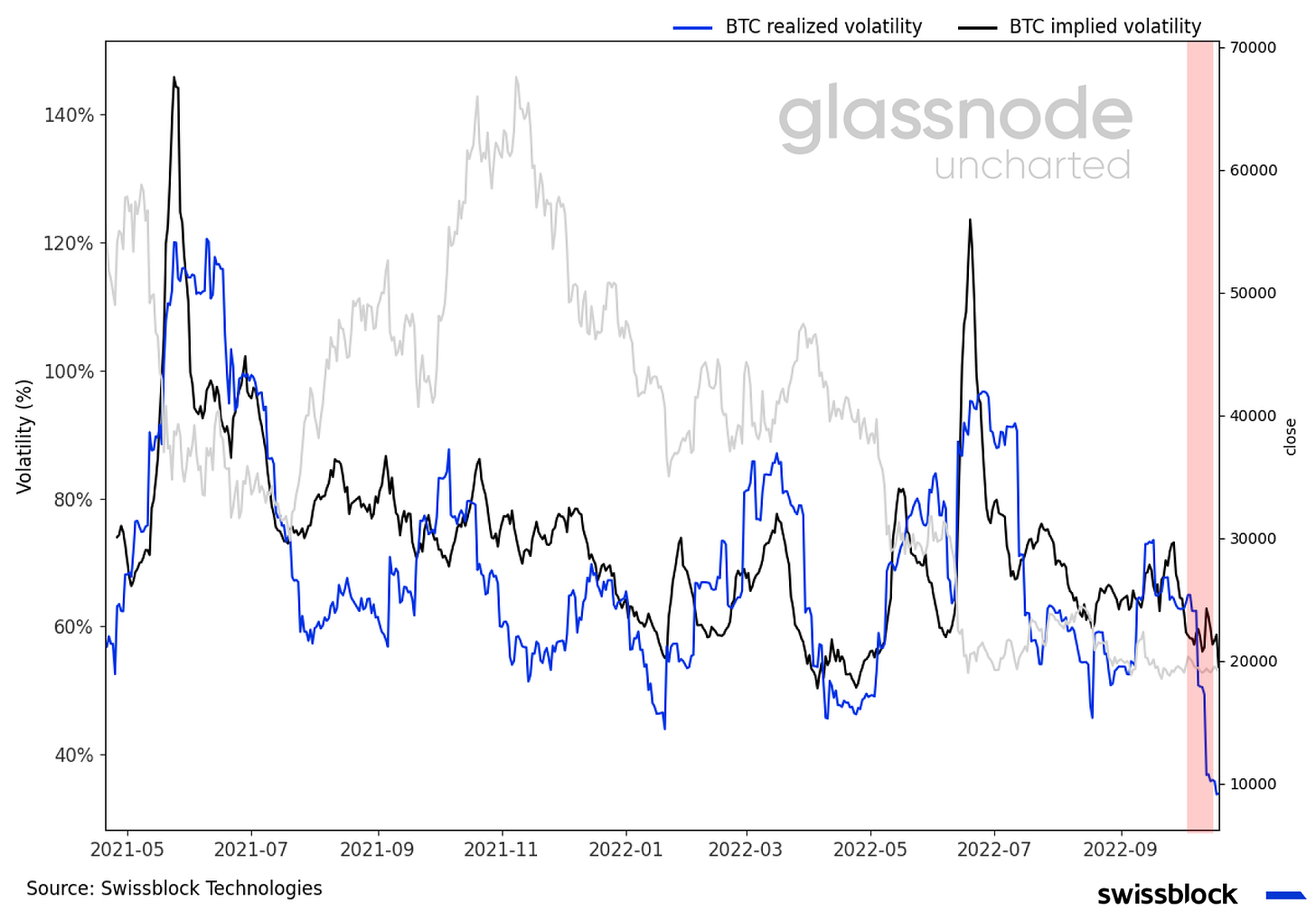

Sideway trends occur during low-volatility environments and break after the price compresses at a significant price level. We believe that the sideway trend will break for two reasons. For one, the realized volatility is low and has decreased significantly this month (Figure 4), which has led to strong moves in the past.

Figure 4: Low-volatility environment

Secondly, bitcoin has become more sensitive to incoming data and external factors, as seen by the higher intraday volatility (Figure 5). Once the intraday price action breaks through support or resistance, bitcoin will drop or rise to the next significant level, marking the next move.

Figure 5: High intraday volatility implies a sensitive bitcoin

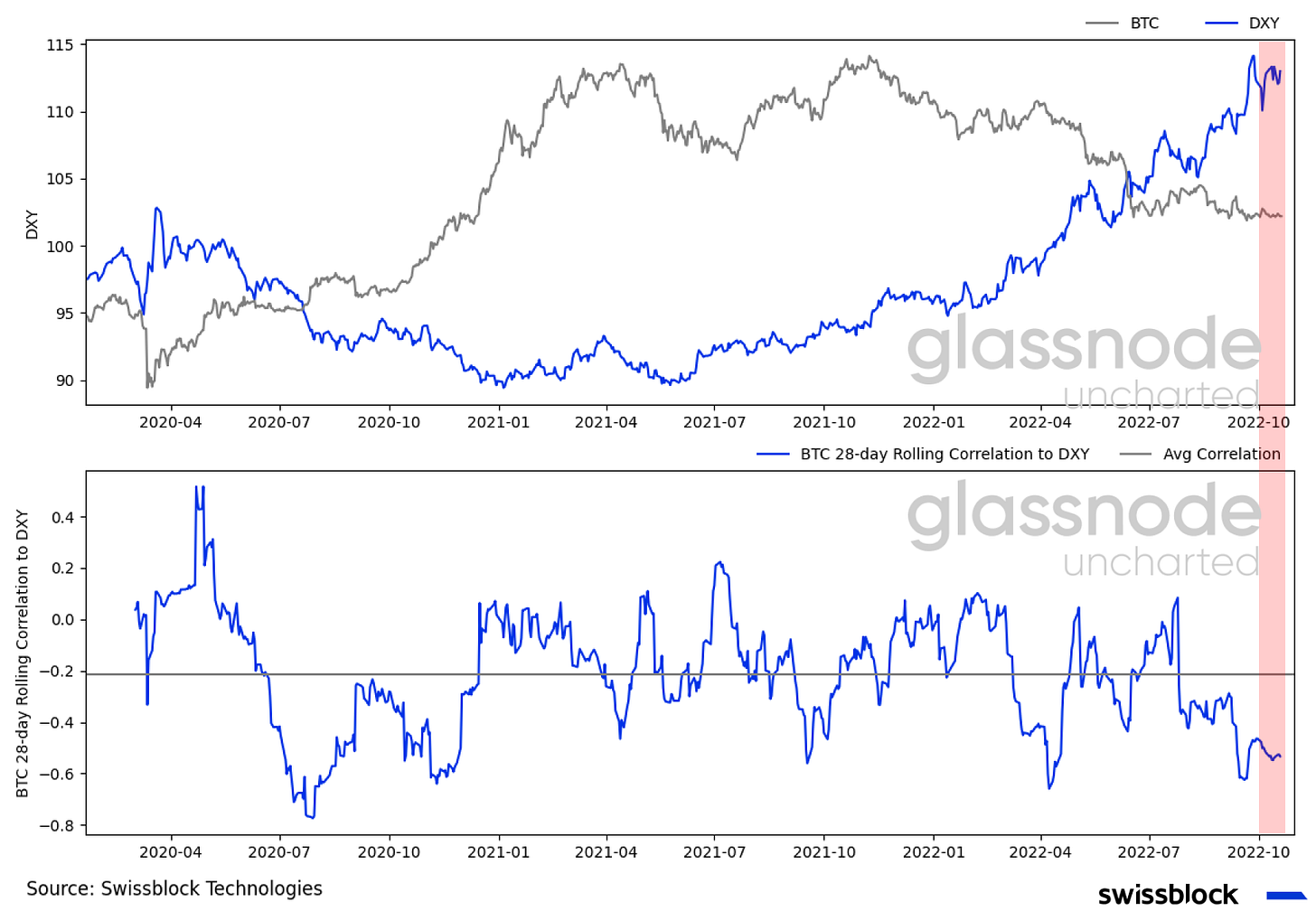

We believe that the key driver is the DXY, as fear dominates markets due to uncertainty around monetary policy, inflation, and global recessions. The strong inversed relationship to the DXY suggests that a strengthening dollar will continue to pressure bitcoin (Figure 6).

Figure 6: A strong DXY pressuring bitcoin

Last week’s fund flows (Figure 7) reinforced investors’ unwillingness to participate in high-risk markets, such as crypto. Despite bitcoin’s $8.8 million inflows, the $12 million net flows - were partly driven by short-bitcoin instruments - represented a mere 0.05% of the AUM. We interpreted this as apathy.

Figure 7: Reduced bitcoin fund flows

We noted a similar picture within crypto. Exchange signups and logins remained at a 2-year low, implying a lack of interest and low participation in the market (Figure 8). It’s as if we are at no man’s land while bitcoin trades sideways, and there is little indication of direction.

Figure 8: 2-year low exchange activity

Lack of direction

Even though bitcoin’s bearish short-term trend lost steam, the longer-term trend painted a pessimistic outlook (Figure 9). Notice how the price remained below the 50-day moving average and the SBT Momentum Index trailed to the 0 mark.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.