Dear subscribers,

Bitcoin remained within our previous trading channel. The charged macro-environment continued to pressure the price action as different investor profiles weight the current conditions.

We kick off this Uncharted considering a strong demand for bitcoin from a traditional market perspective and a weakening long-term holder demand coupled with short-term holder selling pressure. Bitcoin has gone mainstream, but the fear of a recession has discouraged retail investors. Risk remains high, and bitcoin's best bet is decoupling from US equities.

Let’s dig in!

TL;DR

Bitcoin’s trading channel was compressed between $29-$32k, yet support is slowly shifting to $30k.

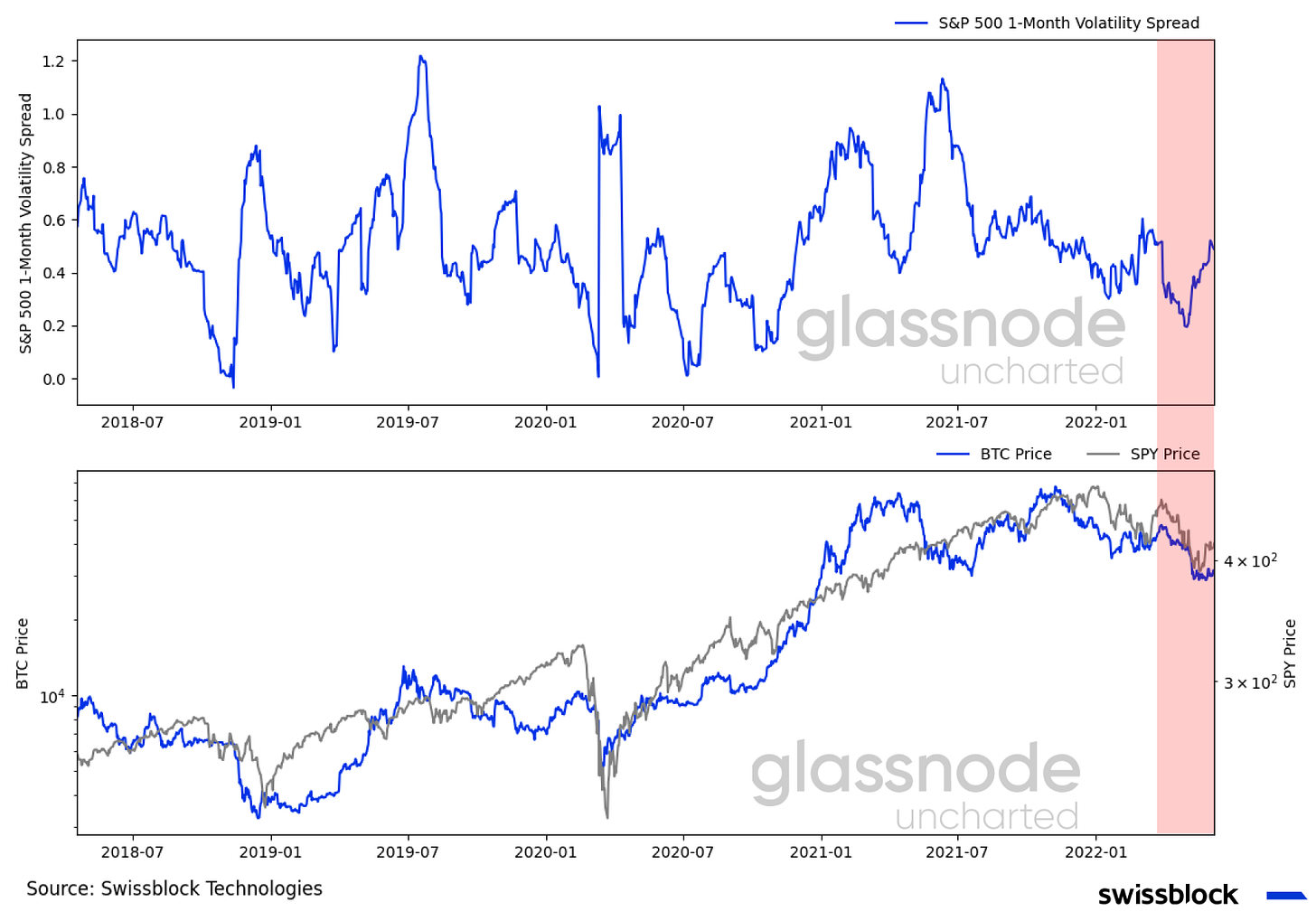

Ties to US equities remained at an alarming level as volatility rattles bitcoin and the S&P 500.

Weekly crypto inflows showed that institutional investors bought at the weakness and at a discount.

The market reflected signs of weakness as the recession-related Google queries increased, however, bitcoin turned mainstream.

Bitcoin was pressured by weaker long-term holder demand coupled with short-term holder selling pressure.

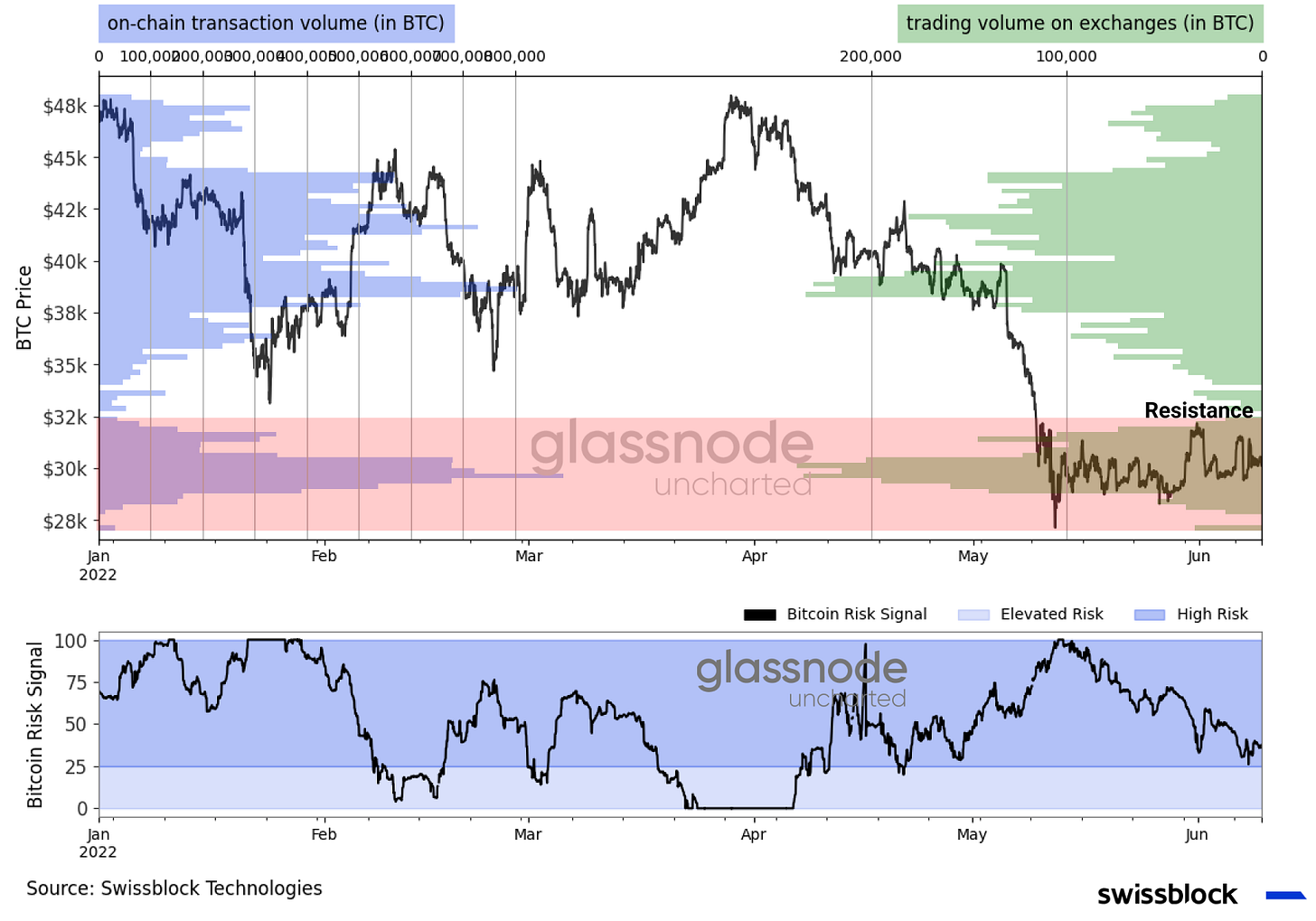

Swissblock’s Bitcoin Risk Signal extended into the high-risk zone regime which discouraged speculation and reduced the leverage in the system.

Bitcoin outperformed altcoins as investors seek safety within the crypto space in a fear-induced market.

Bitcoin’s best bet is decoupling from US equities. The price action has struggled in periods of extreme correlation.

In fearful times institutions are buying

Bitcoin’s longest weekly losing streak of 9 weeks was shattered last week, as the price action stabilized within the $29-$32k trading channel (Figure 1). However, we are not out of the woods yet: Uncertainty on the monetary policy and the geopolitical fronts kept the markets on edge, and Swissblock’s Bitcoin Risk Signal shows that we remain in an extended high-risk period (Figure 1, bottom graph).

Figure 1: Bitcoin’s trading channel: $29-$32k

Bitcoin is not the only asset facing weak market conditions. The S&P 500, bitcoin, and ethereum started June in the red, and so far are -9%, -33%, and -45% down respectively in Q2 2022. When looking at bitcoin and US equities' 50-day SMA and 100-day SMA, we can observe that both assets have seen potential outflows (Figure 2) and downward mean-reverting price action.

Figure 2: Bitcoin and the S&P 500 outflows and mean-reverting price action

Bitcoin’s underperformance should not come as a surprise after considering that its volatility is nearly double that of the S&P 500. Notice how the volatility spread between the said assets rose since the beginning of May (Figure 3), during which bitcoin dropped 15.9% and the S&P 500 erased its monthly loss closing the month flat.

Figure 3: Volatility spread

As a consequence, the strong ties between bitcoin and US equities loosened (Figure 4), as seen in Uncharted #16: Macro Extension, and the pre-market performance of the Nasdaq became less impactful in bitcoin’s intraday price action (Figure 4, right graph) than it was in April.

Figure 4: Strong, but loosening ties to US equities

What is interesting to observe is that the demand for bitcoin exposure in traditional markets strengthened. Following bitcoin’s $69 million inflow noted in Uncharted #16: Macro Extension, the capital flows nearly doubled last week as institutional investors bought into weakness at a discount (Figure 5).

Figure 5: Institutional investors seeking bitcoin

A similar appetite was noted in the VC market, as the year-to-date capital raised is at 63% of 2020 (Figure 6, $19.7bn vs. $31.2bn). This continued acceleration in VC interest reinforces the narrative of bitcoin and crypto as an alternative risk-on investment class during a time of debilitating economic growth, which is impacting the expensively valued earnings of the Nasdaq and S&P 500. Keep in mind: Even when bitcoin’s price behaves like a tech stock’s price, bitcoin’s underlying structure of an incorruptible, limited asset that is open to every individual is a fundamental diversifier for any portfolio and institutional investors seem increasingly aware of this.

Figure 6: 2022 VC crypto investments

Turning our heads to traditional markets and institutional demand, we can see a stronger investor sentiment as US equities reeled in $6 billion in fund flows last week (Figure 7, left graph). However, looking at the breakdown of the top 10 ETF creations (Figure 7, right graph), we can see a clear preference for less risk while investors continue to seek high yields.

Figure 7: US equities inflows reflected stronger investor sentiment

From a year-to-date perspective (see Uncharted #15), US equities continue to lead in inflows (Figure 8), presumably due to the high buyback rates, which increased from a 0.29% of total market value in 2020 to 0.69% in Q4 2021. Amidst the recent downturn in the market, buyback yields have surpassed dividend yields, as less expenditure is required to acquire shares, pushing the earnings-per-share higher.

Figure 8: Buyback yields drove the demand for US equities

Considering the high inflationary environment pressured by geopolitical conflicts, it is unclear whether the year-to-date buyback trend will extend beyond Q1 2022. An insipid bond market due to flat rates led to overvalued equity earnings, but now corporate cash flows are taking a hit. Investors, funds, and ETFs are readjusting their positions, seeking yield in high dividends and elsewhere.

Weakening market conditions

Bitcoin has become a household name and an established alternative investment among risk-on assets. Its high and enthusiastic volatility has pulled in investors from traditional markets, as seen above. Even though the search term ‘recession’, has increased in 2022, the number of Google queries including ‘bitcoin’ is higher than at the end of the 2019 and 2020 bear markets (Figure 9).

Figure 9: Recession vs. bitcoin Google queries