Dear subscribers,

The risk in the market is unchanged since our previous Uncharted. Although bitcoin’s structure is robust, a strong dollar and the high rate of inflation shook the market. A week ahead of the Fed May meeting, the worst could be priced in, leaving room for further upside development and a stable altcoin season, while developments on the front of the conflict in Ukraine add an element of significant uncertainty.

We kick off this Uncharted by analyzing the effect of the macro-environment on the dollar and bitcoin’s price action. We deep dive into the systematic selloff that spread to all asset classes before transitioning into fresh new capital flowing into crypto. After, bitcoin’s state is outlined keeping in mind a long-term holder accumulation fighting a short-term holder capitulation and derivatives hedging. We conclude with a potential outlook after positioning ourselves under the framework of Swissblock’s proprietary signals.

Let’s dig in!

TL;DR

Bitcoin dropped below $40k one week ahead of the Fed May meeting.

A break above the DXY significant resistance level of 102 could drive bitcoin lower, particularly if the DXY strength is led by monetary policy.

Uncertainty on the war front can lead to a stronger DXY due to a weakening euro.

April VC crypto investments are above the median in a continued environment of high overall institutional interest.

Long-term holders accumulated while short-term holders capitulated.

The widening gap between bitcoin fundamental strength and overall market weakness has led to increased hedging on the derivatives side.

Altcoin season loses steam, as attention veers to bitcoin’s next move.

The Fed’s planned balance sheet reduction seems priced into the latest correction in equities, therefore near-term upside is possible.

Bitcoin versus a strong dollar

Bitcoin dropped below $40k for the third time in April. A strengthening dollar, amidst macroeconomic agony, pressured risk-on assets. Hence, the trading channel narrowed down to $38.5k and $42k. It’s armageddon for risk-on assets, considering that the DXY is at a significant resistance level, and the next big move is highly dependent on making or breaking the said level.

Figure 1: Bitcoin’s trading channel: $38.5-$42k

At the moment, the inverse relationship between bitcoin and the DXY (Figure 2) depicts that if the index holds above the 102 DXY resistance level, this could weaken bitcoin, and the price action could retrace to the $35k and below area, particularly if the rising DXY can be attributed to the tightening of monetary policy. It is also likely that the dollar continues to push higher due to the US plans on exporting more natural gas to replenish Europe’s supply, accelerating the conversion to dollars. This kind of catalyst as explored further below (Figure 5) could potentially elevate the critical threshold the DXY can reach prior to another shake-up in crypto markets. However, failure by the DXY to break above the said resistance level could thrust bitcoin over to the $42k plus channel.

Figure 2: DXY vs bitcoin

The development of the USD is highly dependent on the Fed’s course of action. The rising inflation and potential 50bps rate hike in early May could strengthen the DXY. Figure 3 denotes the end of the Fed’s behemoth shopping spree, yet compared to the Great Recession, tapering has not been as pronounced.

Figure 3: The Fed’s fight against threatening inflation

Overall, we follow the consensus belief that the Fed will accelerate its tightening policy, given that input prices will augment the rate of inflation. Since the pandemic, supply chains have been under pressure while demand has remained strong overall, thrusting producer prices higher. This has meant many compounding changes creeping in on all levels of the supply chain and exacerbating the vicious cycle, with a vivid example being offered by Amazon’s 5% “fuel and inflation surcharge” levied on the platform's third-party sellers for prime shipments. This individual policy change affects the cost basis of around 2 million sellers on the platform who in 2020 alone was the source of more than $80bn of the company’s revenues.

The strong dollar, coupled with the high rate of inflation, will accelerate the cost of goods, services, and construction (Figure 4), which will add further headwinds for bitcoin and other risk-on assets.

Figure 4: Producers getting hammered by inflation

To put the dollar into perspective, we compare the spreads between two currencies, to gauge an upcoming move based on supply and demand dynamics between both. The differences in the 5-year yields between European, Japanese, and US bonds suggest a stronger incentive to lend in USD, which can push the demand for the US dollar higher (Figure 5).

Figure 5: Stronger incentive to lend in USD

Note that a weak euro alone can have an upward effect on the DXY, and we are seeing continuous risk factors threatening the euro stemming from the war in Ukraine. For instance, April 27th’s gas import stops to Poland and Bulgaria hit the euro and helped to push the DXY well above the critical 102 level to 103.5. There is a myriad of possible escalations that can lead to further euro weakness. Nevertheless, it is questionable to what extent idiosyncratic, likely war-related catalysts will have a negative effect on cryptos compared to those stemming from the Fed’s tightening of monetary policy.

From a return perspective, neither risk-on nor risk-off assets have flourished under the current economic conditions. Gold remained the only asset class trading in the green year-to-date, yet last week it followed US equities, bonds, and bitcoin in their downward trend (Figure 6). As the asset classes shed value, we infer that more capital flowed into the greenback, increasing the likelihood of enduring above 102.

Figure 6: Risk-on and a risk-off selloff

Furthermore, investors pulled out $13.7 billion of US equities in panic, marking the second consecutive week of outflows. Awaiting an upcoming hike in the Fed’s May meeting, $3.3 billion flowed into US fixed-income securities (Figure 7). Yet the stronger dollar could draw more capital from international equities and fixed-income into US markets and commodities as returns denominated on a weaker currency are unattractive - for further reference, see Uncharted 13.

Figure 7: Capital flows

Fundamental health leads to hedging

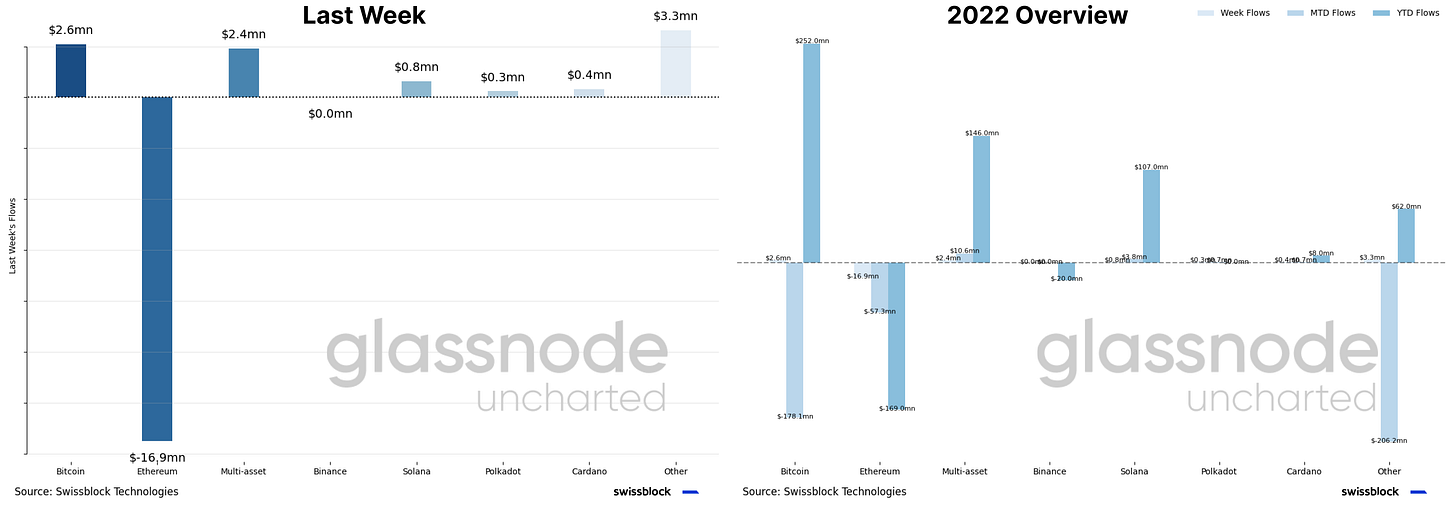

Despite the turmoil in traditional and crypto markets and outflows from US equities and bonds, the rate of institutional capital flowing out of cryptos eased. A total of -$7.2 million outflows were logged last week, with ethereum (-$16.9 million) taking the biggest hit and altcoins as a whole gaining ground ($5.7 million) (Figure 8).

Figure 8: Crypto outflows decelerate

As bitcoin’s weekly net flows remained positive ($2.6 million) and capital continued to flow to altcoins, April marked the highest VC investments in 2022. Looking at the figure below, 9, we can observe that despite the fewer deals this month, the size, in dollars, increased. The latter confirms the ongoing belief in the crypto market’s long-term viability and alternative investment amidst a systematic selloff and strong dollar.

Figure 9: VC’s divesting in the crypto space

The crypto space is healthy as ever, considering last week's capital flows into riskier altcoins while the dollar and macro environment encouraged selling pressure. Yet, Swissblock’s Altcoin Cycle Signal struggled to remain at the extreme of the altcoin regime. When analyzing the figure below (Figure 10), it becomes evident that in order for an altcoin season to take full effect, bitcoin must be in a stable state.

Notice how Swissblock’s Altcoin Cycle Signal extends at the extreme (100) when the Bitcoin Risk Signal depicts a stable trend. At the moment, the intense selling across asset classes driven by stronger demand for the USD has debilitated bitcoin in the short run. The latter is represented by the significant correlation between bitcoin and the S&P 500.