Dear subscribers,

In this version of Uncharted: Distilled, we deep dive into bitcoin’s retrace and the new support level forming at $39-$40k. We break down bitcoin’s structure and determine if the catalyst was an exogenous factor or if it was move brewing from within. For the full, in-depth analysis be sure to check out Uncharted #13.

Let’s dig in!

Summary

Uncharted #13 kicks off by analyzing bitcoin’s trading channel, the stronger ties to traditional markets, and capital flowing into the US dollar. We then transition to bitcoin’s supply and demand dynamics and conclude with Swissblock’s proprietary signals in an altcoin-driven market.

Bitcoin was rejected at the $47k resistance level and retraced to the year-to-date trading channel: $38-$45k, erasing most of the progress made towards the end of Q1 2022.

A new support level is forming at $39-$40k.

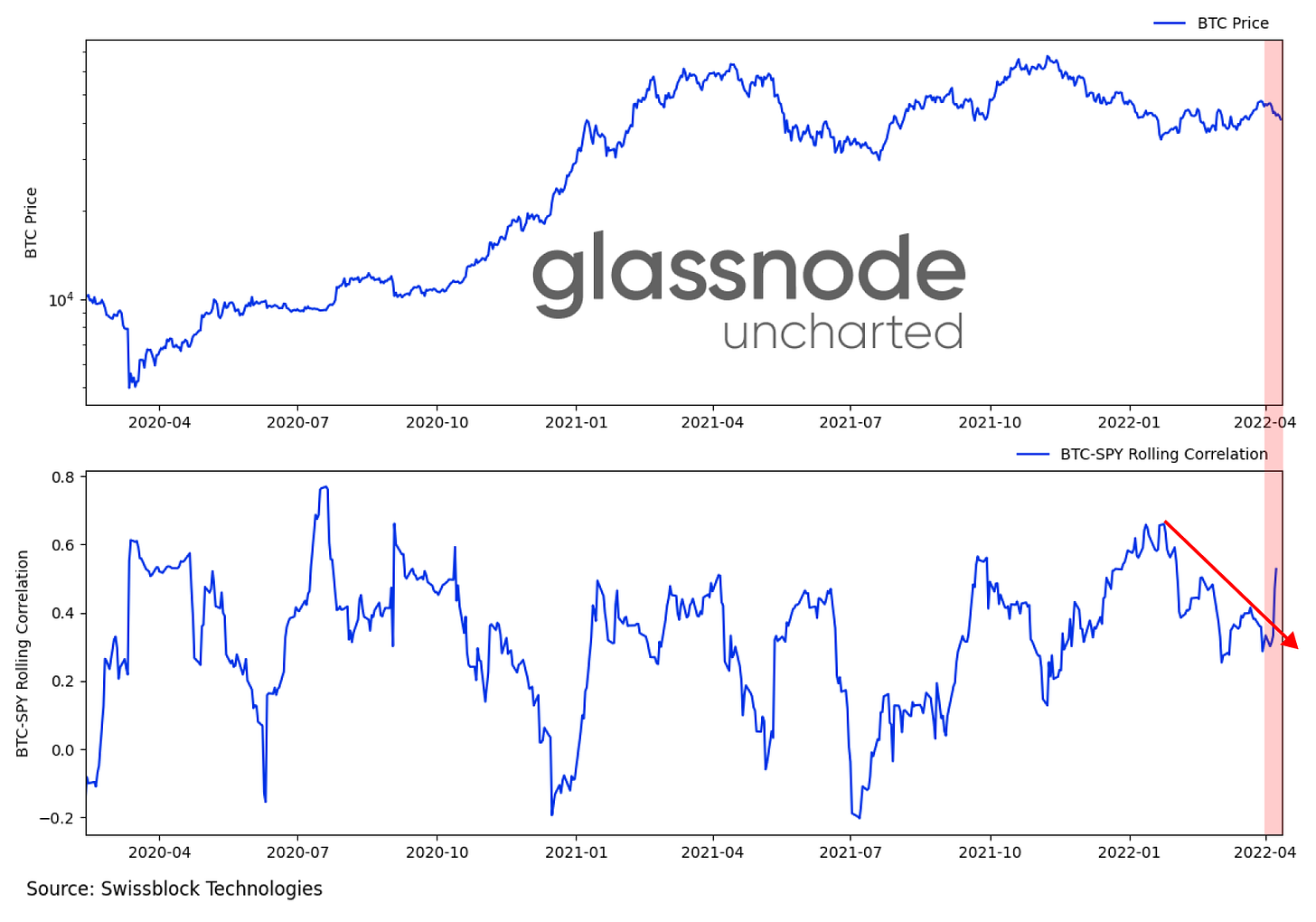

The correlation to US equities strengthened just as bitcoin peaked and reverted downward.

Bitcoin, US equities, and US bonds saw significant outflows as more capital shifted to a strengthening US dollar.

Exogenous factors drove bitcoin's price action, as suggested by a dominant off-chain volume.

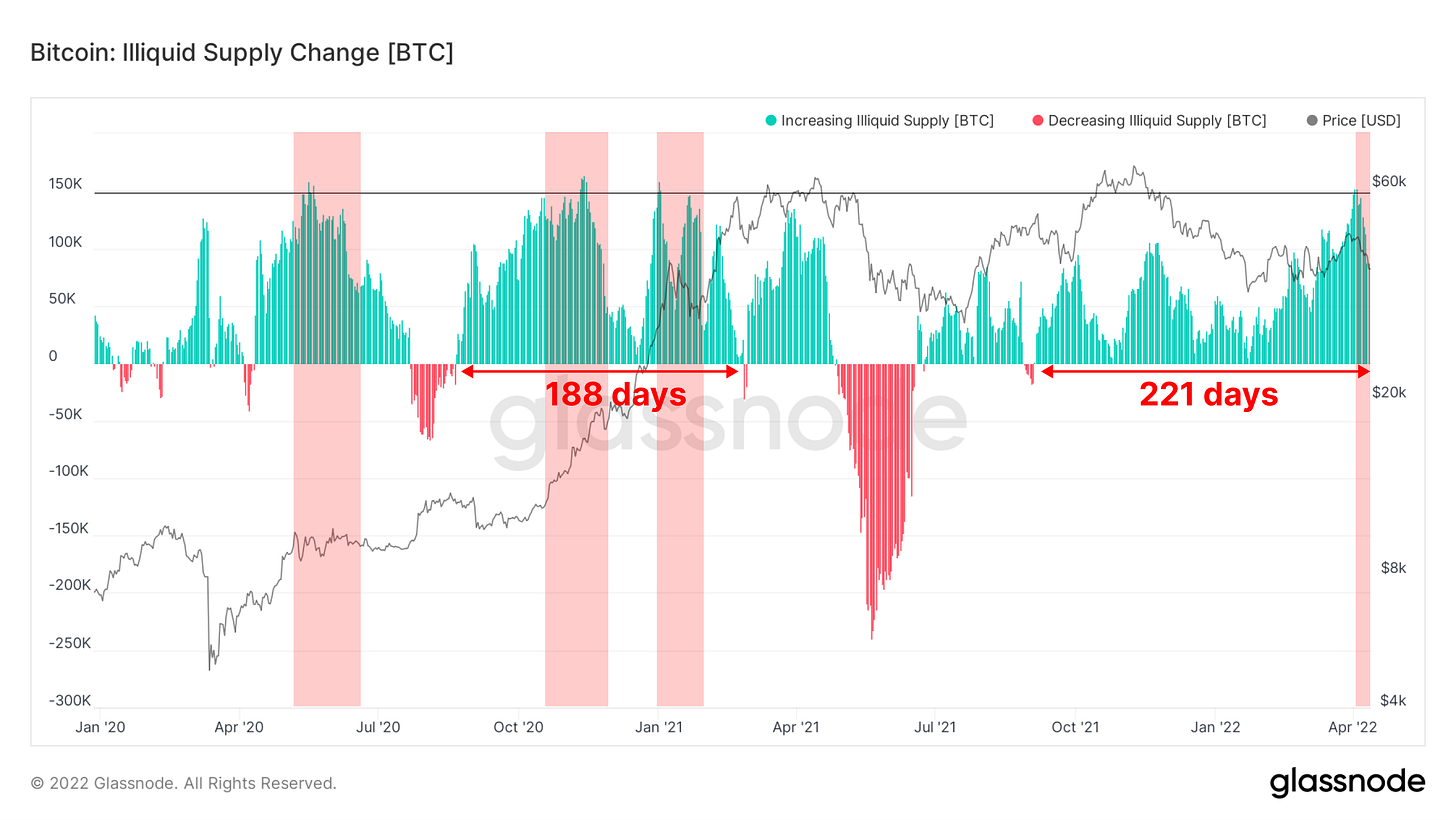

The accumulation phase extended to 221-days and counting, leaving fewer coins available to trade on exchanges.

Selling pressure resurfaced in the perpetual market as bid transactions surpassed the ask side.

The number of perpetual contracts with negative funding rates increased, reinforcing the downward pressure.

Fear spread in the derivatives market, denoted by the demand for downside hedging in the options market.

Altcoins are driving the market, while Swissblock’s Bitcoin Risk Signal advised caution despite robust fundamentals.