Dear subscribers,

Following a rough two weeks since our last Uncharted, bitcoin dropped below $40k as a raddled macro-environment caused a ripple effect across all asset classes. The charged endogenous factors impeded bitcoin’s price action despite further adoption and robust fundamentals. However, bitcoin is as stronger as ever, and its long-term viability encouraged short-term investors to expand their investment horizons.

Uncharted #13 kicks off with a thorough analysis of the systematic risk driving bitcoin’s retrace. Later, we deep dive into bitcoin’s robust fundamentals as saving behavior and network growth extend the accumulation phase to 221-days and counting. Caution is advised as fear spreads in the derivatives market, indicated by stronger demand for downside hedging.

Let’s dig in!

TL;DR

Bitcoin drops below $40k as investors sell off US equities and US fixed-income.

New support level forming at $39k to $40k with robust fundamentals and capital flowing into riskier altcoins.

The derivatives market shows fear, despite growing spot demand and Swissblock’s liquidity index turns bullish.

On-chain data shows a continuing accumulation phase with short-term holders expanding their investment horizon.

Swissblock’s Bitcoin Risk Signal crosses over to the high-risk zone as bitcoin correlation to US equities intensifies.

The crypto space is growing, as denoted by Swissblock’s Network Growth Index and greater adoption.

Bitcoin in the eye of the storm

We find ourselves in a continued pattern of highly volatile geopolitics combined with volatile markets. Despite the close ties to US equities, war breaking out in Ukraine, high inflation expectations, and higher volatility, bitcoin erased most of its losses in Q1 2022. It closed the quarter at -4.53% (Figure 1, red area), while the S&P500 logged its first losing quarter in 2 years, at -4.6%.

Figure 1: Bitcoin’s quarterly returns

Bitcoin’s on-chain metrics and trading structure seem to imply a new support level forging at $39k to $40k (Figure 2), yet as the correlation to traditional risk-on assets remains high, caution is still advised.

Since our last update when bitcoin had broken out and edged towards $47k, the price has dropped back to the year-to-date trading channel between $38-$45k after hawkish comments from the Fed on planning to rapidly reduce its balance sheet spooked investors. While this has reduced upward price momentum, we still believe that support has shifted upwards to $40k.

Figure 2: Support level forming around $39k to $40k

Swissblock’s Bitcoin Risk Signal has shifted back into the high-risk territory. Our analysis continues to suggest that this renewed sensitivity to market risks and a higher likelihood of stronger drawdowns has not been due to a lack of confidence in the asset but rather due to a charged macroeconomic environment.

For instance, when observing how the (once believed transitory) inflation risk transcends to 1, 2, and 5-years according to consumers’ expectations (Figure 3), it becomes clear how growing global uncertainty has put pressure on investor sentiment.

Figure 3: Inflation risk extends into the future

Consequently, as mentioned above, the Fed has taken a more aggressive hawkish stance, announcing a monthly reduction of its balance sheet of up to $95 billion with hopes to fight the rising inflation. Institutional investors quickly followed suit and pulled nearly $5 billion in assets from US fixed-income securities (Figure 4).

Figure 4: Rising inflation drove US asset outflows

Despite the US equity markets’ outflows, a strong USD has encouraged investors to move the capital from US-foreign assets to dollar-denominated assets. As the euro weakens with respect to the dollar, investors struggle to make relative returns with euro-denominated plays.

Meanwhile, the looming risk of the war in Ukraine expanding into EU territory makes a short-term euro crash ever more likely. Notice how US equities dominate fund flows from a year-to-date perspective in Figure 4, above, while the dollar has been gaining considerable strength versus other global currencies throughout the last year and a half (Figure 5, black line).

Figure 5: Capital flowing into the US dollar

With capital flowing into the US dollar, and out of US bonds, Bloomberg’s US Treasury index recorded its worst drawdown since its inception in 1994: -10.88% (Figure 6). What is interesting, however, is that investors are not rebalancing their portfolios with US equities, just yet, either (Figure 4).

Figure 6: Rate hike and US bonds selloff caused the largest US Treasury Index drawdown

Zooming into the crypto space, last week saw $134 million in fund outflows, marking the second-highest weekly outflows in 2022. Solana received $3.7 million in inflows, and altcoins (multi-asset in Figure 7) recorded $5 million in inflows, while a massive $131 million flowed out of bitcoin (Figure 7, red areas). Bitcoin is already traded by many institutional investors like a blue-chip stock, hence saw outflows in accord with US equities.

Figure 7: Bitcoin outflows following US equities

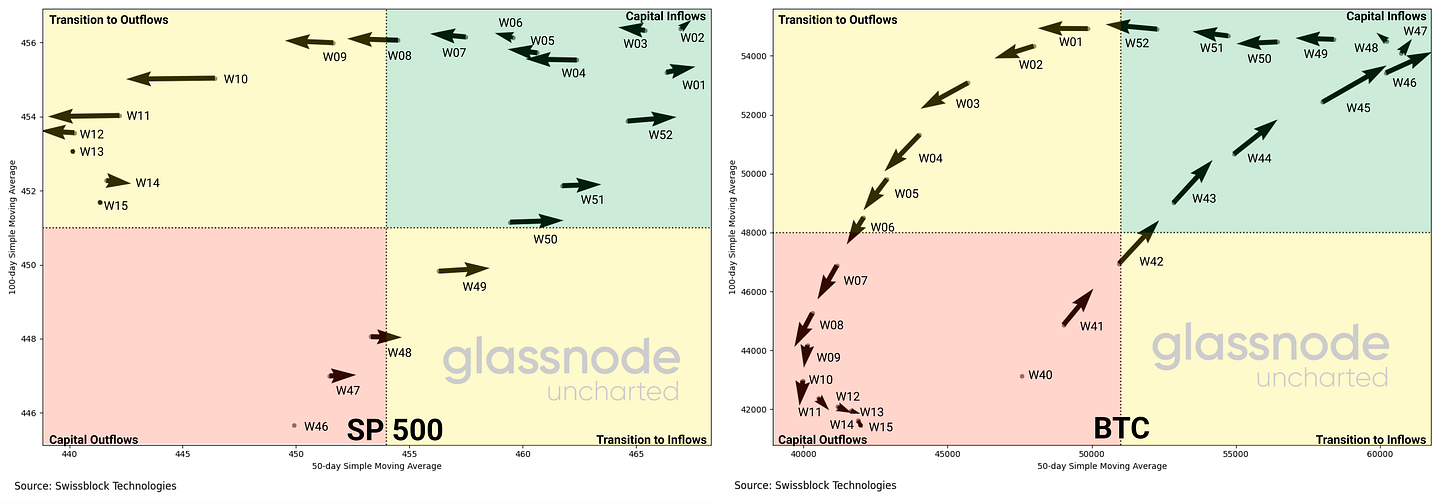

Overall, when comparing the performance of bitcoin and the S&P500, we can see a strong relationship between the two. As both assets lose steam, their faster (50-day) moving averages, or recent price actions, lose ground against their longer moving averages (100-day). Hence, it can be inferred that capital is flowing out of the two asset classes. Notice how in Figure 8, the arrows show a descending trend (capital outflows) for both asset classes.

Figure 8: Capital flowing out of bitcoin and US equities

While funds may have reduced some of their physical bitcoin exposure, from a stock market perspective, demand for bitcoin exposure has persisted as the Grayscale Bitcoin Trust discount continued to narrow further since the last Uncharted (Figure 9). Even though selloffs occurred for both bitcoin and equities, supply and demand dynamics in the stock market pushed GBTC’s market value closer to the NAV or total net value of the bitcoin holdings.

Figure 9: Bitcoin demand picking up in the stock market

Furthermore, the ratio between on-chain and off-chain volume (Figure 10), that is futures and spot volume, shows that bitcoin’s price action is being driven by increased speculation created on exchanges. In other words, even though bitcoin fundamentals are strong, the dominant force moving the price is exogenous and occurs on exchanges.

Figure 10: Exogenous factors driving bitcoin’s price action

The path forward

We believe that bitcoin’s move towards $47k, our previous resistance level, got impeded by the selloff in traditional markets. Notice how bitcoin peaked and reverted to $38k once the correlation to the S&P500 broke out of its downward trend (Figure 11, red area).

Figure 11: Stronger ties to US equities

From a fundamental perspective, Swissblock’s Network Growth and Liquidity indices show strong organic growth that coincides with the period when bitcoin erased most of its losses (Figure 12, left graph red area). Both indices crossed over to a bullish regime (50 or higher), as bitcoin’s traded volume reignited (Figure 12, right graph red area) during March 2022, underpinning increasingly strong growth in fundamental networks factors.