Dear subscribers,

In this edition of Uncharted: Bites, we start by analyzing bitcoin’s run towards $47k and the breakout of the previous trading channel. We later analyze the catalysts of the run, focusing on stronger demand, coming from institutional investors, and the potential rotation to an altcoin season. All in the context of recession indicators emerging in the last week.

Let’s dig in!

TL;DR

Bitcoin broke out of the $42-$45k trading channel and holds the converted support level at $45k.

Institutional capital flowed into crypto despite the fragile macro environment.

Swissblock’s Altcoin Cycle Signal shifts to an altcoin regime.

Demand for physical bitcoin picks up, with Terra leading the way.

Derivative positions are skewed to the long side.

Swissblock Technology’s proprietary signals provide insights for near-term trading.

If you're interested in receiving frequent updates of our structural signals with an explanation of how to incorporate the said signals in your trading framework. Sign up for the waitlist here:

Bitcoin kicked off the recovery in cryptos

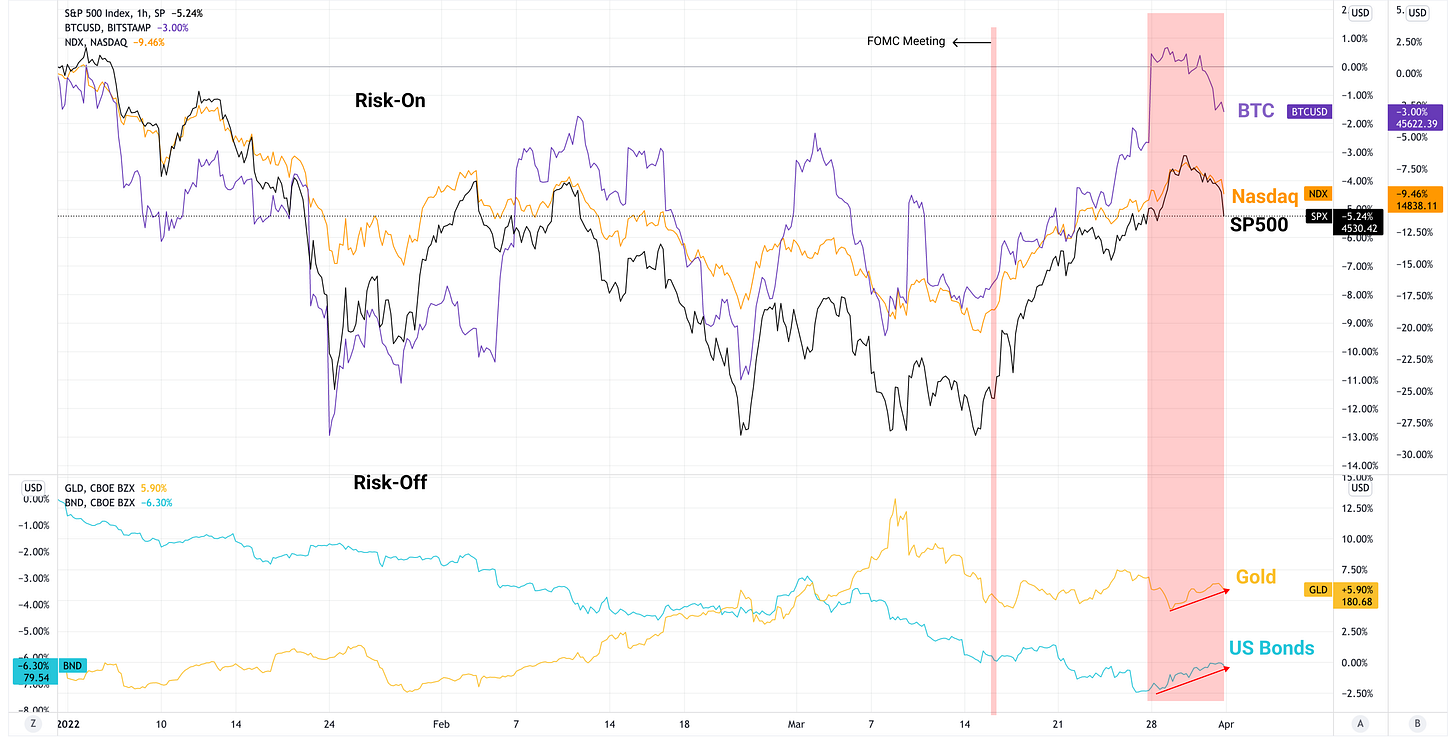

Bitcoin finally broke out of its tightening trading channel between $38k-$42k, mentioned in Uncharted #11, and converted the $45k resistance level into support. Bitcoin decoupled from equities as it made its way steadily towards $47k. Towards the end of the week, however, safe havens reverted as equities logged the first losing quarter in two years, driving risk-on assets down.

Figure 1: Risk-on vs risk-off performance

Focusing on bitcoin, the risk of a pronounced drop subsided (Figure 2, bottom graph) as the price holds above $45k after the brief retrace. For now, we keep an eye on the $45-$48k range, considering that bullish sentiment reignited.

Figure 2: Bitcoin’s trading channel ($45-$48k) and risk

We should remain cautious as the macro environment drives crypto investor behavior and sentiment dropped in traditional markets. US equities saw the first weekly outflows (-$14 billion) since September 2021 as US fixed-income led the way in fund flows.

Figure 3: Capital flowing from US equities to US fixed income

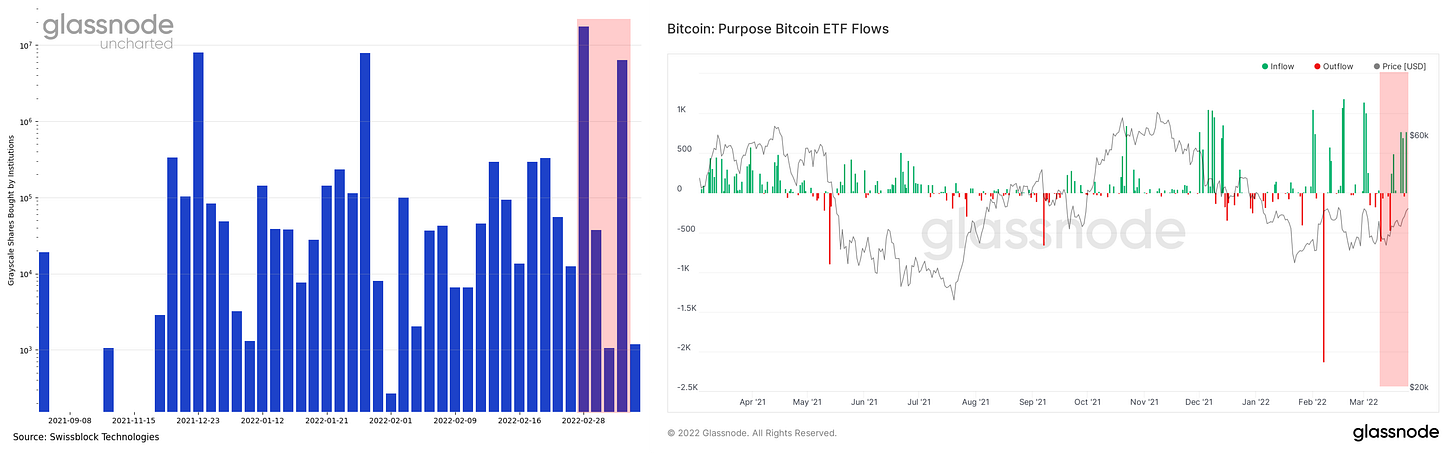

Bitcoin, on the other hand, saw significant institutional inflows from Grayscale Bitcoin Trust and Purpose Bitcoin ETF (Figure 4, red areas). The latter signaled a stronger demand for bitcoin as an alternative risk-on investment.

Figure 4: Institutional investors buy bitcoin exposure

We see the potential of a sizable crypto-wide move forthcoming since bullish sentiment spread to other assets (Figure 5) in the space beyond bitcoin.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.