In the weekly playbook, we established this strategy for the coming days:

BTC has left a large wick on the daily timeframe, signaling an imbalance that is often filled, either partially or completely, in the short term… Similarly, considering that the midpoint of the wick on the daily timeframe is $95K, this could be a realistic target if enough liquidity accumulates in that area.

With the price at $96K, Bitcoin briefly approached $95K, a zone that bulls have defended after being beaten down in their attempt to reclaim $100K. The bears’ days are numbered, but the big question remains: will there be another drop, or are we already preparing to start climbing from here? Let’s start gathering clues to answer that question.

A Week of Indecision.

It has been a complicated week, not so much for Bitcoin, which has managed to hold its price zones, but for altcoins, which have struggled to recover after capitulating, generating a lot of doubt among investors.

This is not necessarily a bad thing, as FUD creates opportunities to assess the market. However, what is starting to weigh on investor expectations is not just the need to be more selective, but also less ambitious in potential returns.

And in a week like this, where Bitcoin had confirmation of very important fundamentals, yet the price remained flat after a V-shape recovery that lost momentum—and more importantly, failed to reclaim the psychological threshold of $100K—all of this contributes to a sense of apathy.

But for those who have been in Bitcoin long enough, they know that when price action gets boring, a breakthrough isn’t far away.

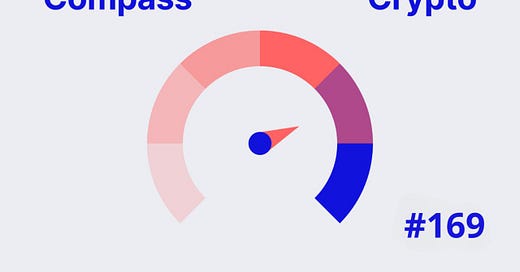

Sentiment Decline

We have reasonably seen a decline in Bitcoin and crypto market sentiment. Let’s not forget that we just experienced Monday’s flash crash due to the trade war, and although it was short-lived and indices didn’t collapse, the effect on altcoins was devastating.

In fact, fear levels have returned to pre-Trump pump levels, similar to early October, when Bitcoin started climbing from $60K. If we look at Bitcoin’s current cycle, these fear levels have often marked a bottom or a near-bottom, and historically,

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.