“Fear is excitement without breath.” - Robert Heller

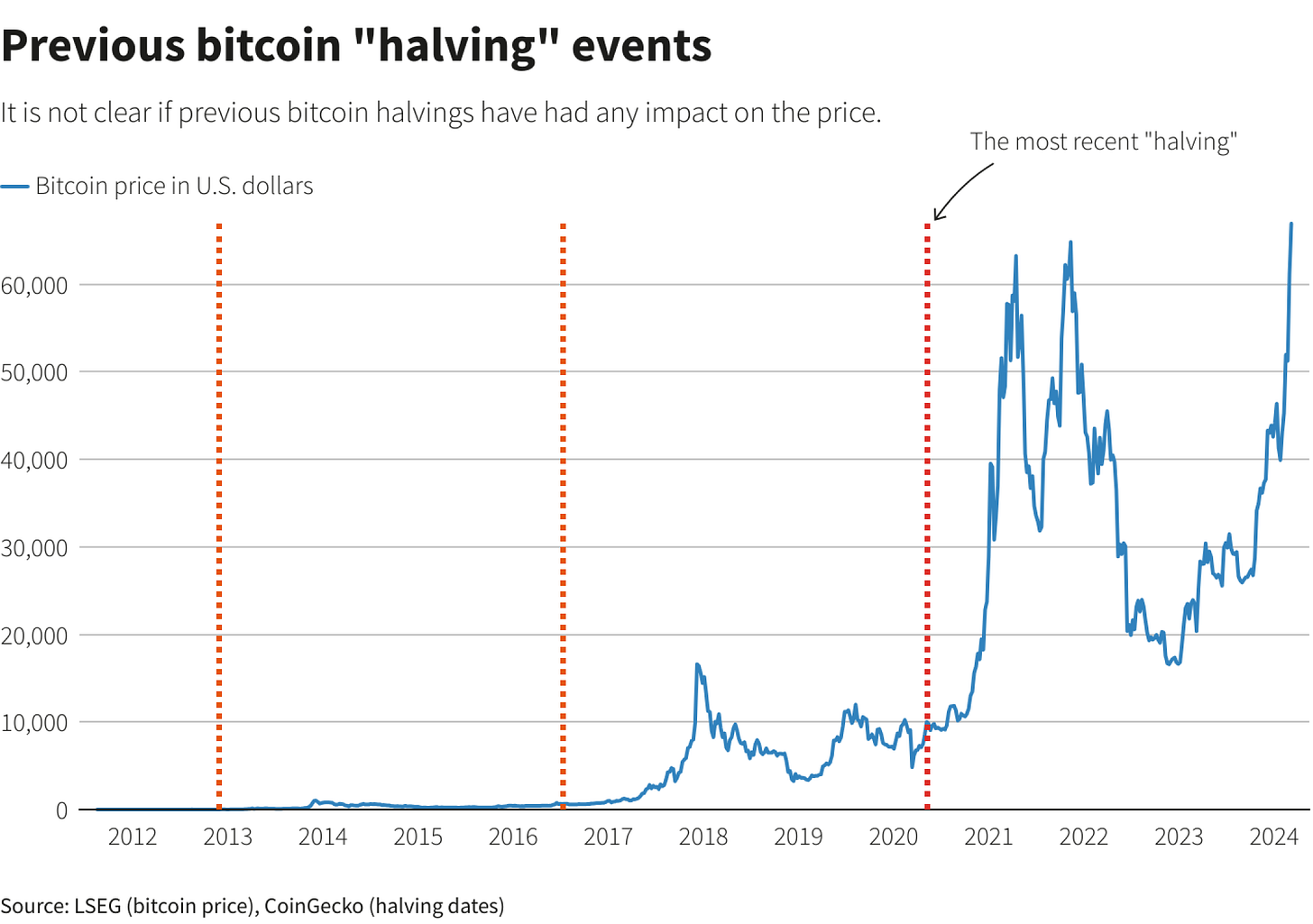

The recent BTC block reward halving, which occurred on Friday, reduced the reward paid to BTC miners from 6.25 to 3.125 BTC. Although this event is typically a catalyst for bullish price action, the impact on the market may not be immediate.

Post-halving, the average BTC transaction fees briefly surged to an all-time high of $127 but later declined. BTC’s current position above a key demand zone, with 1.66 million addresses purchasing it at an average price of $64.8k, could serve as a robust support level if the market faces additional downward pressure.

The halving introduced a unique aspect through the surge in on-chain activity, partly attributed to the rise of sequence Inscriptions. This resulted in the creation of over 59 million NFT-like collectibles, generating more than $200 million in transaction fees and enhancing the BTC ecosystem's utility. This significant increase in network activity and added utility marks a departure from the traditionally static nature of the network during the halving period.

The network's hash rate has doubled in a year, jumping from 255 exahashes per second (EH/s) to 516 EH/s. This rise underscores the increased energy and resources devoted to mining BTC. The unprecedented level of computational power not only boosts the network's security and resilience, but also its ability to adjust to the diminishing block rewards over time.

BTC’s 50-day EMA is located near the $62k level, providing a potential support zone that could help drive the price back to the top of the consolidation range, aiming for $72k. Shorter EMAs indicate a tendency to buy, while longer EMAs suggest a preference for selling.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.