“The way to get started is to quit talking and begin doing.” -Walt Disney

🇨🇭 Join our Swissblock Telegram Group! Get daily updates, in-house content, and technical analysis on crypto & macroeconomics. Tap into a hub of knowledge and insights. Stay ahead with Swissblock. Sign up now! 🚀

BTC has reclaimed the $44k psychological level, holding above the midline of the buy wall at $43.86k, but the market lacks a decisive directional bias. The aftermath of the January 3 crash has left BTC in a cautious phase, with the need for positions to build up again before a clear directional bias emerges.

While the probable approval of a Spot BTC ETF is exciting, the short-term prognosis is dependent on a number of factors, including the speed with which the ETF goes online. Furthermore, real demand for the ETF and probable GBTC selloffs could have an impact on the projected BTC price rally.

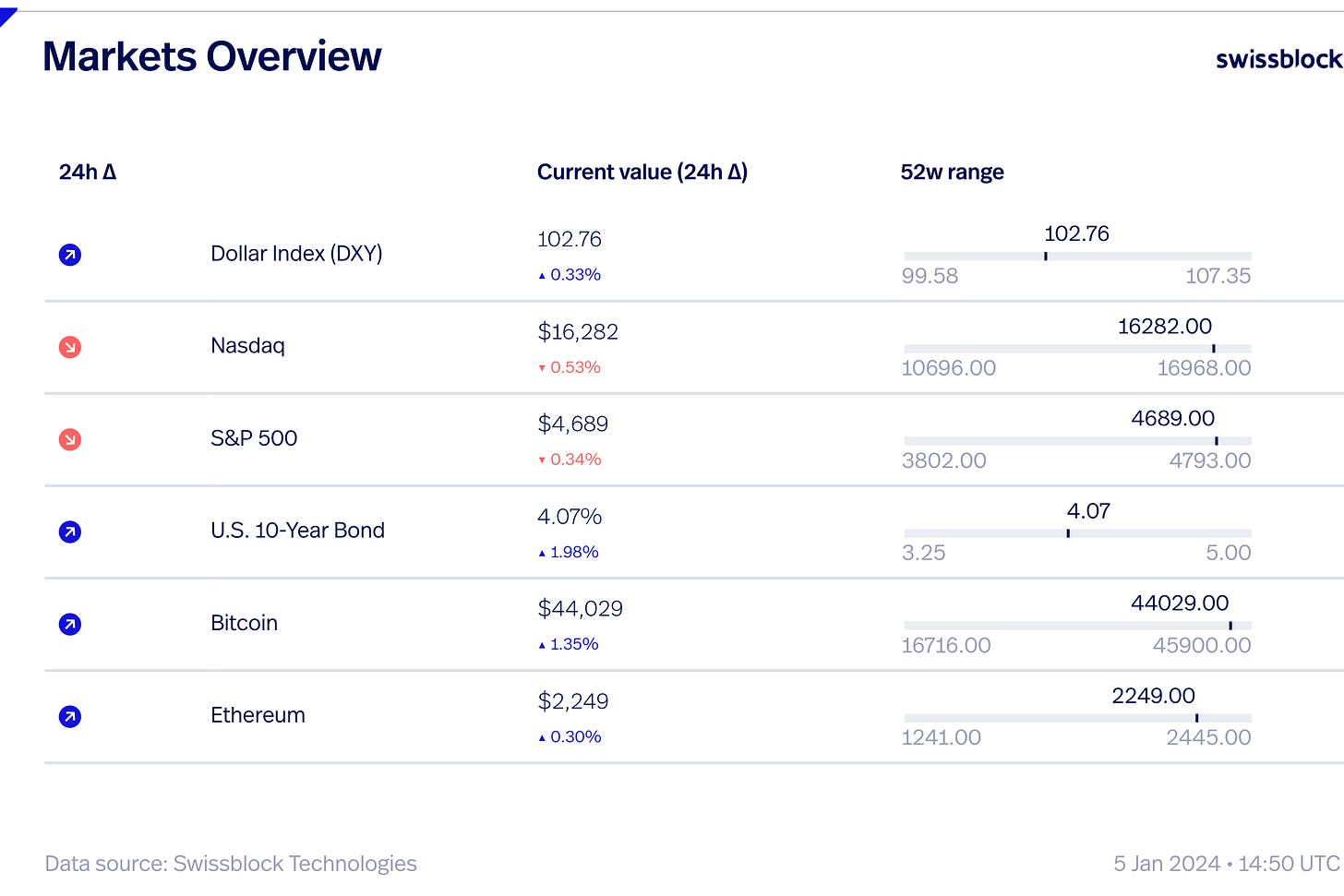

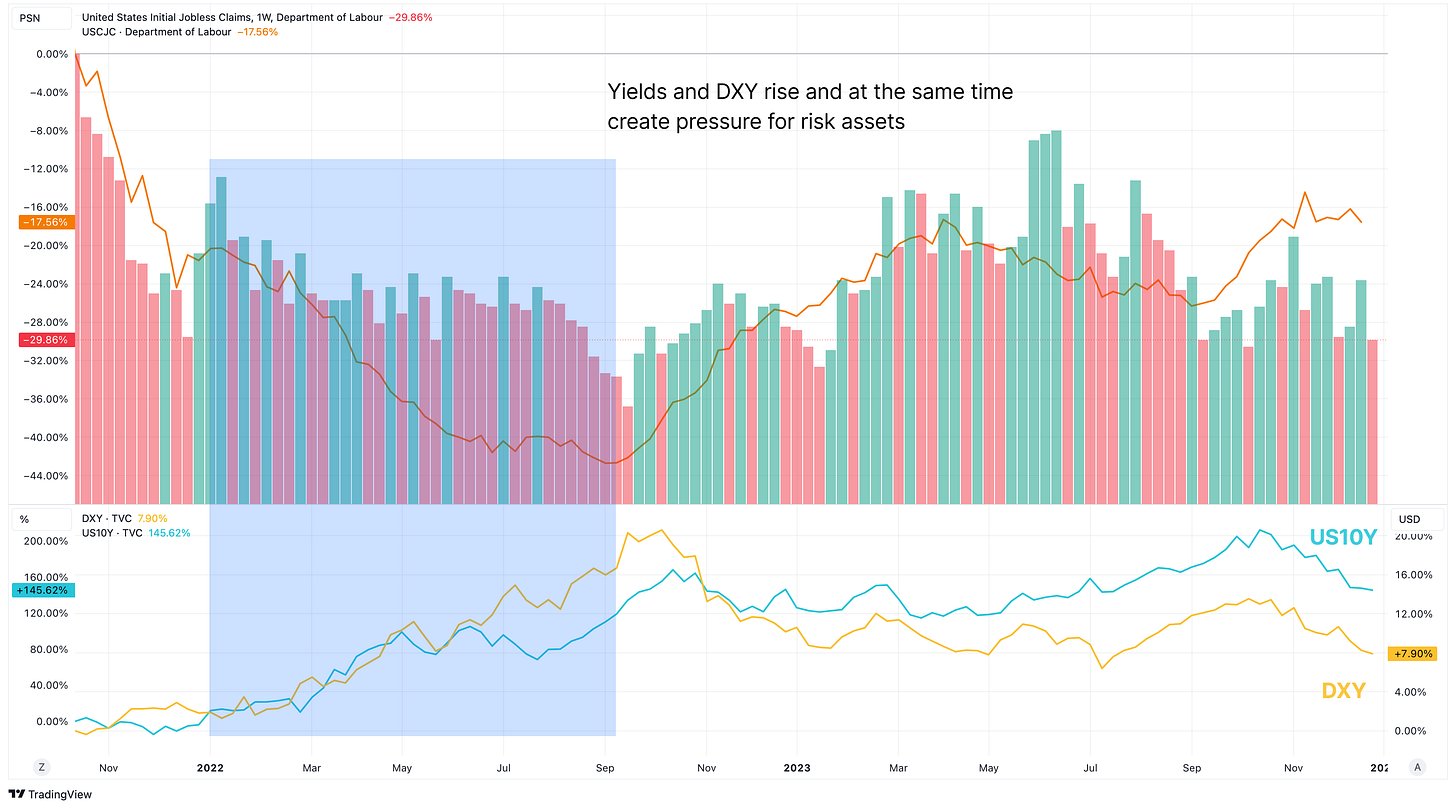

Recent economic data indicates a Goldilocks scenario, with a strong economy, cooling inflation, and a balanced labor market. The labor market is not too hot and not too cold at the moment. The total number of Americans on the jobless rolls receiving benefits remains elevated relative to prior year levels, but at the moment there is not enough unemployment to say the economy is on the downward slope to recession.

Leading indicators are showing signs of contraction, hinting at a potential severe correction and recession around April. Both yields and DXY are increasing simultaneously, putting pressure on risk assets. The likelihood of BTC reaching $50k is a matter of when, not if.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.