“Obstacles are those frightful things you see when you take your eyes off your goal.” – Henry Ford

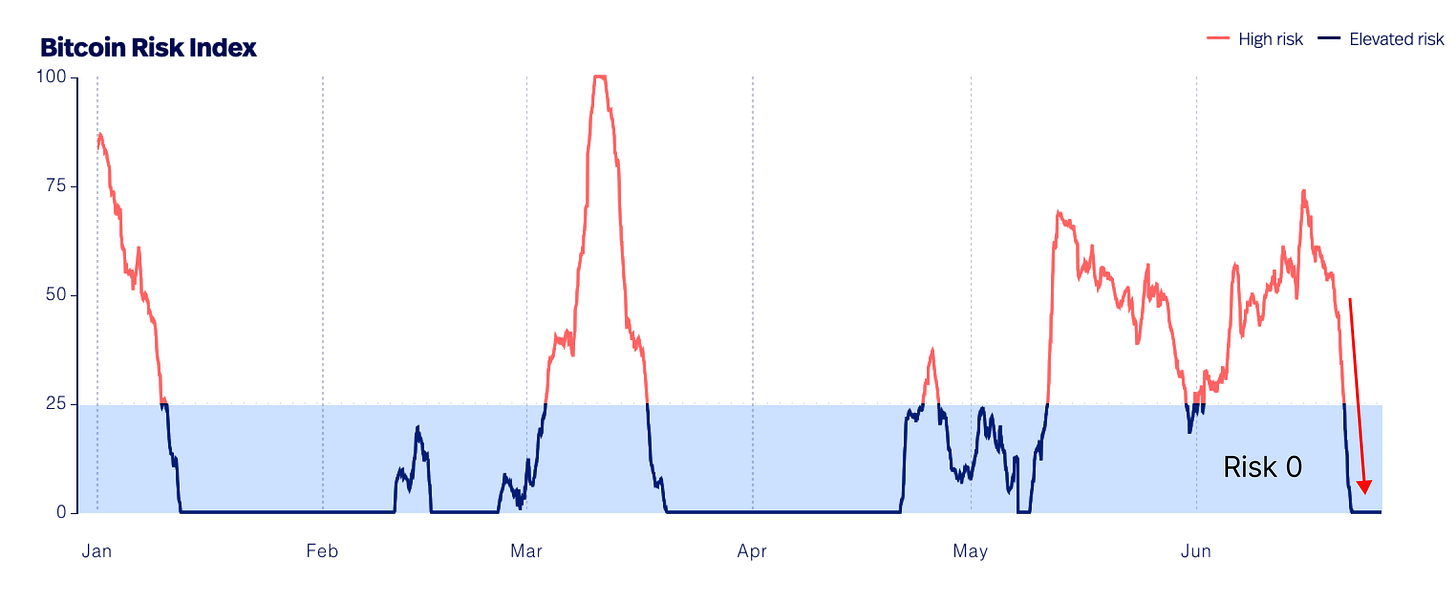

Why: BTC closed the week with the highest weekly closing of 2023 and began the new week in a strong position above $30k, maintaining last week's quick gains. Price action meets bulls expectations following weeks of sideways trade, providing some relief as the risk signal returns to zero.

Conclusion: This week is all about turning that $31k resistance zone into support. We could see higher prices if $30k clears in the following weeks. The optimistic shift from BlackRock’s news may also inspire new liquidity and investment inflows.

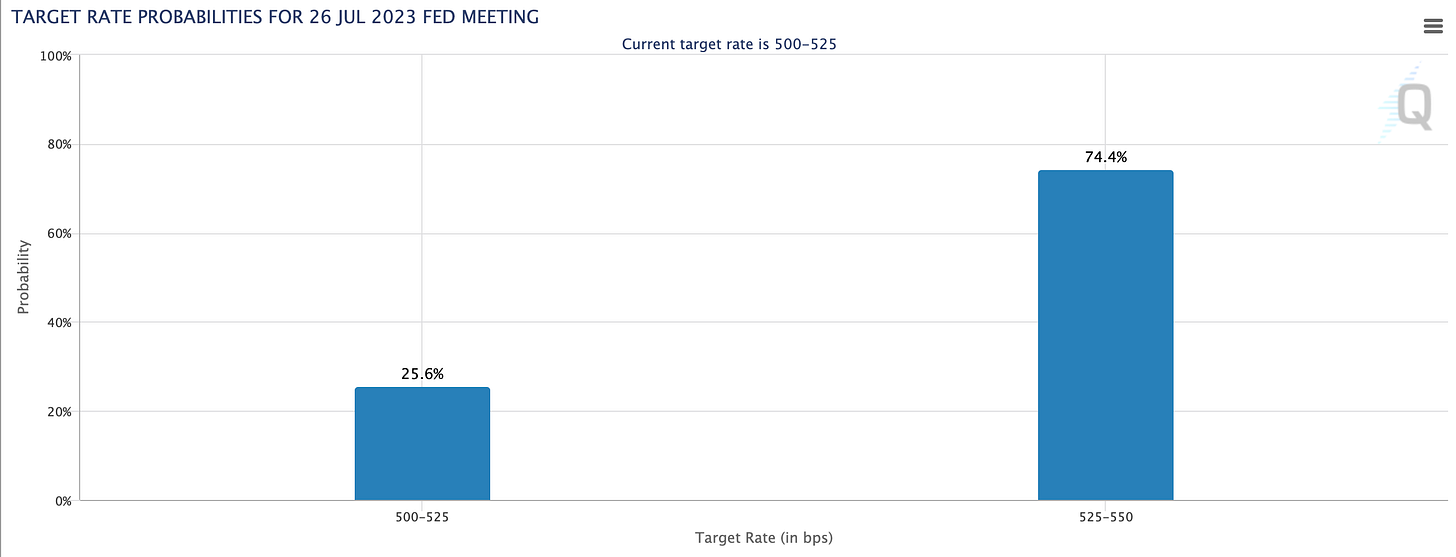

The week will be dominated by the release of the final estimate for first-quarter gross domestic product (GDP), Fed's Chair Powell speech (Wednesday June 28, 9:30 am EST) and the release of the latest Personal Consumption Expenditures (PCE) Index numbers. Fed Chair Jerome Powell had signalled that rises might resume after being held steady in June, and the most recent statistics from CME Group's FedWatch Tool put the odds of a July boost at more than 70%.

BTC's resilience will be tested this week, and we will have to wait until the end of the week to see how they respond. The last PCE publication on May 26th took BTC from $26k to $28k, and a favourable PCE report could spark new bullish momentum to higher heights.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.