Once more unto the breach, dear friends, once more.

The breach is open for Bitcoin to continue its path towards the all-time high zone, and from there, head into uncharted territory. It has cost us FUD, red days, and turmoil, but here we are, about to go through the breach toward the next battlefield that could take us to the long-awaited post-halving bull run.

Since quantitative tightening began, the Bitcoin market and the crypto ecosystem have had to focus more than ever on macro data as a fundamental factor to consider for BTC's performance. These are no longer times when Bitcoin plays in its own league, separated from what happens in the TradFi world.

Next week is projected to be free of significant fundamentals; it's not until the key week between October and November that the barrage of fundamentals begins, culminating on Monday, November 4, with the U.S. election. Some believe that a hypothetical victory for the pro-Bitcoin candidate from the Republican Party, Donald Trump, would be the catalyst for Bitcoin to break toward new highs. However, there are other, much more important fundamentals, indicating that this moment is coming regardless of external catalysts.

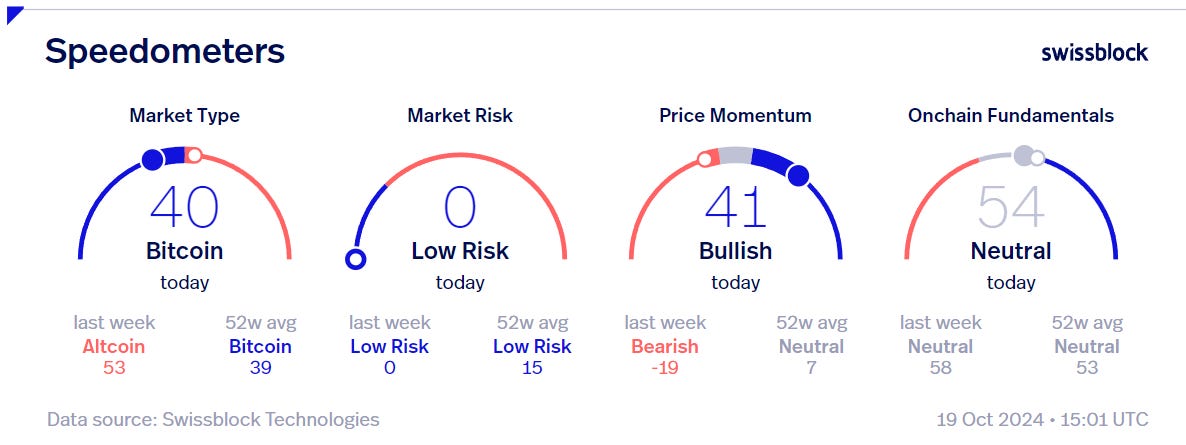

The speedometers indicate that we are in a regime slightly dominated by Bitcoin, with bullish price momentum, a reading of zero on the Bitcoin Risk Index, and fundamentals steady in a neutral zone. Let's see what signals we have to support the idea that Bitcoin can continue its path towards the all-time high zone.

Everything Under Control.

In previous analyses, we mentioned that the Bitcoin market is more mature. News like Tesla moving its holdings between wallets would have previously triggered a wave of unnecessary FUD (fear, uncertainty, and doubt) and a chain reaction of sales and liquidations. However, we saw that the news went unnoticed in the price, showing that Bitcoin investors are no longer easily shaken.

Similarly, we mentioned earlier that the U.S. presidential election could be a price catalyst. It's often thought that if Republican Donald Trump wins, it would be a positive catalyst. In contrast, if Democrat Kamala Harris wins, it would be negative, given her vague and unclear support for the crypto space. However, as Larry Fink of BlackRock points out, the election outcome is irrelevant for Bitcoin because "the utilization of digital assets is going to become more and more of a reality worldwide."

We don't rule out that a Trump victory could create FOMO, but that wouldn't be the reason for Bitcoin's price increase, just as a Harris victory could increase risk and temporarily stir FUD while the pieces are repositioned. Currently, Trump is leading on Polymarket, but the projections on that platform raise suspicions and speculation about manipulation.

We can't doubt Trump's good intentions regarding Bitcoin, but at the same time, we can't unconditionally give the benefit of the doubt to a politician's promises during an election campaign. Regardless, if FOMO creates a "Trump pump," we certainly won't complain.

Bullish Signals, Bullish Trends.

The price momentum has returned to positive territory, as we anticipated at the beginning of the week. This leg-up has been marked by Bitcoin's rise from $65k to $69k, a price we haven't seen since the end of July. Although we've witnessed aggressive liquidations during this move, both from longs and shorts, we can see how the price has been fueled by both spot purchases and futures.

Open Interest broke a record this week, reaching an all-time high as Bitcoin approached the $68k zone. This created the sense that a market flush

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.