In the weekend update of the playbook, we anticipated this scenario:

For the weekend, the price could consolidate in a small range to gather strength and aim for $97.2K-$98.5K again. However, the $95K-$97K zone is 'no man's land,' and a breakdown below $94K could lead to another test of $92K.

Over the weekend, the swift rise to $96K was quickly countered by the bears, turning what seemed like a promising bullish move into a classic bull trap that has left us again above $94K after retesting $92K.

The macro environment isn't making things easy for Bitcoin. With the PPI data release scheduled for Tuesday and U.S. inflation data coming on Wednesday, the stage is set for a volatile environment that could be decisive in defining Bitcoin's next move.

What it Gives, it Takes.

After Bitcoin spent seven months in consolidation before hitting a new all-time high, discussing another consolidation period between $92K and $100K feels disheartening for the bulls. So far, the "bull run," where an altcoin pumps 3x in one week and continues the next, hasn’t materialized. The "easy mode" that was expected to activate once Bitcoin broke out of its previous accumulation range feels more like a distant dream.

Nevertheless, for seasoned Bitcoiners, this is just another step toward Bitcoin asserting itself with a definitive show of strength. It may mark a transition into an era of institutional legitimization, followed by cultural adoption.

Previously, we speculated that Bitcoin's movement before, during, or after Trump’s Inauguration Day might be a classic "buy the rumor, sell the news" event. But what if the reverse is true? What if Bitcoin is gearing up for the bullish move that breaks out of its current accumulation range after Inauguration Day?

The news that Donald Trump will be issuing executive orders regarding Bitcoin and the crypto ecosystem, clearing the path for adoption, is precisely the fundamental scenario we had been anticipating. We must recognize that, beyond Bitcoin's immediate environment, very few people are actually talking about Bitcoin. This could be the breakthrough it needs to become a widely discussed public topic.

We’re in a market environment where macroeconomic factors, geopolitical context, and inherent risks all play critical roles. Once the new government takes office, many of the uncertainties and tensions surrounding the transition could ease. Until then, we must prepare for the opportunities this scenario could bring.

Let’s examine how Bitcoin is shaping up in this atmosphere of expectation, uncertainty, and hope.

A Little Fear Isn’t So Bad After All.

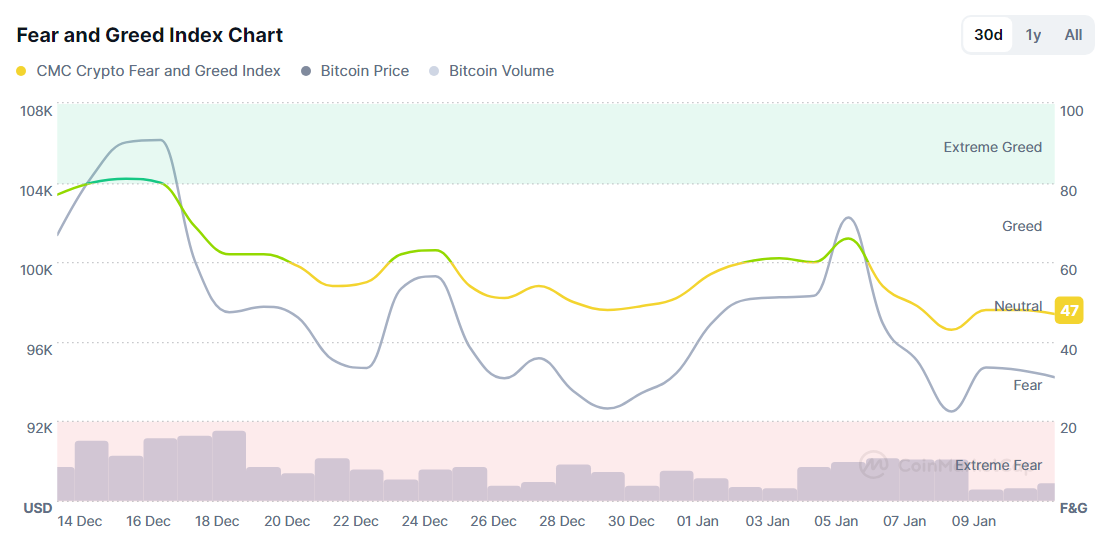

Bitcoin sentiment deteriorated over the past week after the price seemed poised to break out of the $92K-$100K accumulation range and resume the bull run (which would have also activated altcoins). However, the price plummeted following Tuesday's macro data release, raising caution in the markets.

Sentiment has returned to neutral territory after briefly entering the "greed" zone. These spikes in sentiment, as we've seen, are on a downward trend. If Bitcoin breaks below the lower part of the range at $91.5K, sentiment will likely turn red, signaling "fear."

Zooming out, we remain in a long-term bullish trend. Historically, moments of "fear" on this indicator coincide with market bottoms and the start of a rebound.

Warning Signs.

Price momentum has slightly recovered after last week's decline, where it transitioned from bullish to bearish for the first time in three months.

In previous analyses, we noted that Price Momentum, in tandem with the Risk Index, often signals trend changes and volatility in either direction. We also mentioned that as long as the Risk Index remained at zero (as it had since late September), we were unlikely to see a bearish breakdown of the range that could dangerously drive prices lower.

Now, the Risk Index has

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.