Dear Subscribers,

In this Uncharted:

We explore the small fluctuations in price that BTC has experienced over the last few weeks, currently ranging from $29.3k and $29.7k, and the possible scenarios that may occur based on the next move.

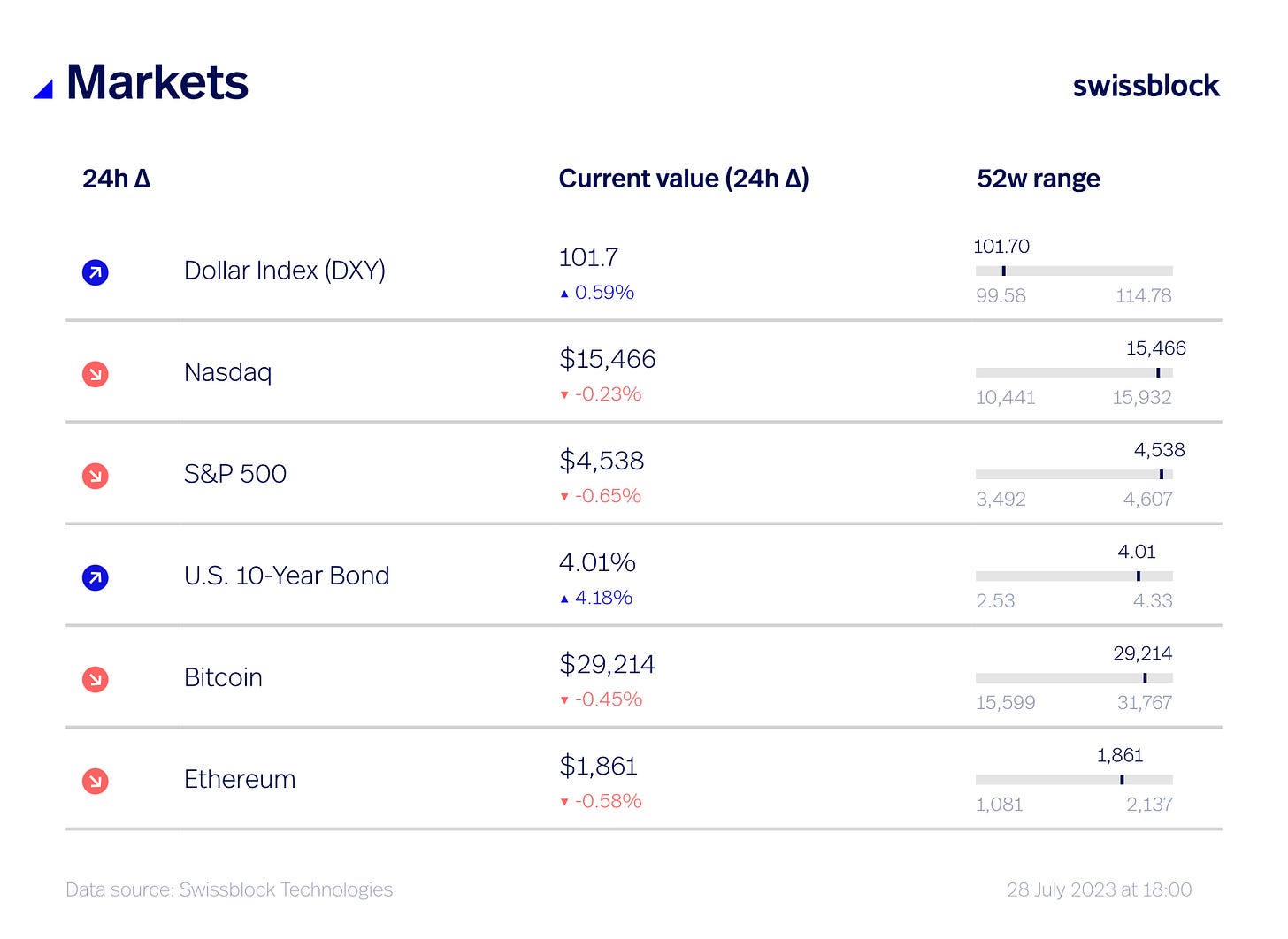

We review the most important data after a strong week for the macro outlook; how rising interest rates have affected TradiFi and how BTC can use this to its advantage.

We focus on the future scenario that is still weeks out from an altcoin season, factors that need to be in place for this to happen, and how to diversify your portfolio in these uncertain times.

Now let’s dive in!

State of the System

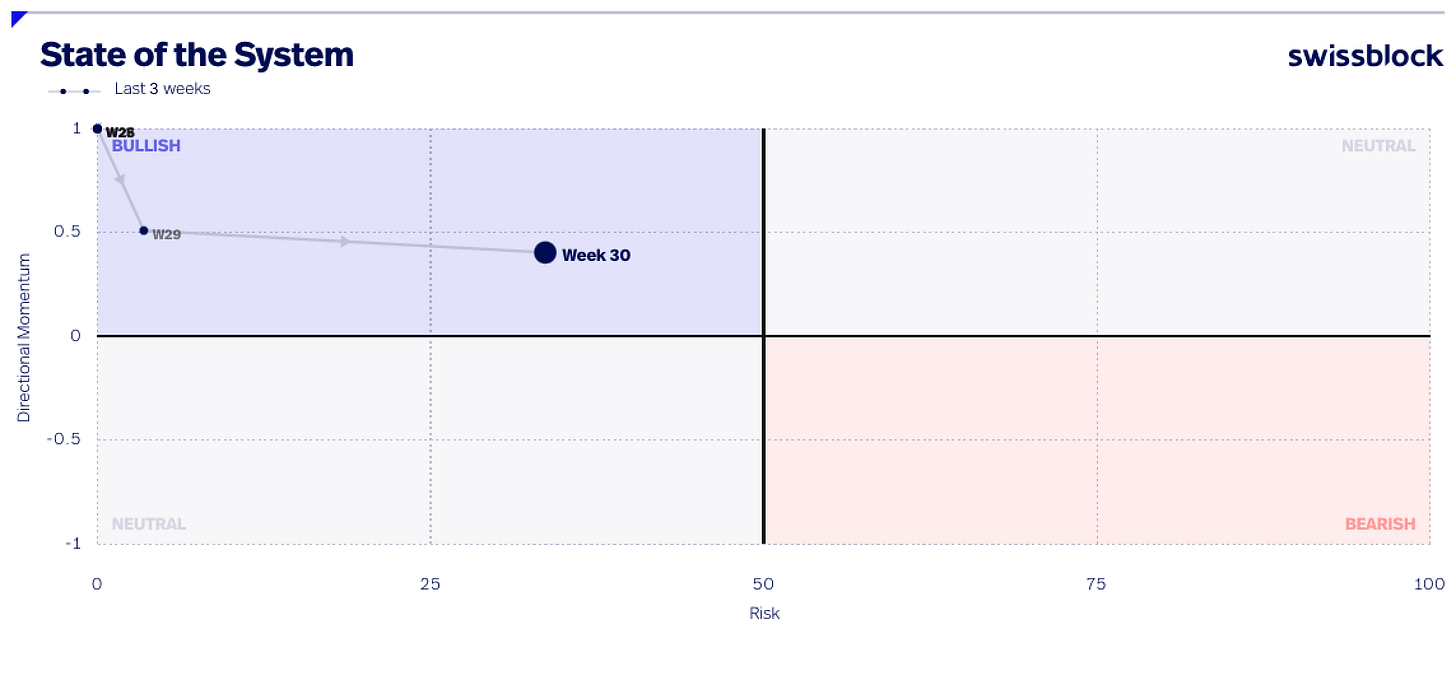

We are in a market environment where even the slightest weakness in bitcoin price can make us nervous if we forget the fundamentals. Especially as we broke below the psychologically significant $30k level on July 17th, the setback was palpable: The price trailed down to the low $29k range but managed to hold steady. Our bullish mid-term outlook (figure 1) remains in play despite the opaque short-term - lack of direction and momentum.

Let’s look at the year-to-date price action (figure 2): We are getting close to a bottom, assuming we can keep the current range. Short-term, we could see a retest of the $28.8k level, and a break could lead to $28.5k.

What would we accept as confirmation of a local bottom? We need to see BTC holding above $29.3k and attacking the $29.7k level. On the upside, regaining $30.4k - our previous pivot point - would lead to a retest of the $30.8k - $31k resistance area.

What about a crash back to $23k, where we saw quite some volume earlier this year? Well, this is where our bullish hypothesis comes back into play. As we will explore further down, there are many more elements pressuring the price of BTC upwards than downwards. It would take a significant downward catalyst to return to around $23k or below.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.