At the beginning of the week, we anticipated a Bitcoin move that would provide greater momentum to altcoins, but as we saw, it was a short-lived movement.

The point of control we need to reach to resume the short-term bullish trend is $99.5K, but for that to happen, Bitcoin’s momentum must penetrate the $97.2K-$98.5K resistance, a zone from which we were previously rejected.

As we observed, Bitcoin was rejected at that resistance and is now in a neutral point within the range it has been building. What is next?

Ace in the Hole.

This Friday marked the last options market expiry of the year, with $14 billion worth of Bitcoin expiring. The "max pain" level was at $85K, which created FUD over a potential correction to that zone. In the end, Bitcoin held its ground, staying within the neutral zone of the range it has been forming.

The Christmas rally was cut short by a move that retraced all the progress made in the previous days. However, it is still possible that Bitcoin has one last card up its sleeve to deliver a bullish move that could turn into a year-end rally.

Although volume remains low, there is potential for a movement that could wake up market participants and trap bears expecting a price collapse. Low-volume periods demand greater caution, as Bitcoin's apparent inactivity can often be misleading.

Living on the Range.

The price momentum has remained in bullish territory, though it is feeling the strain of low volume and liquidity. It appears to be hanging by a thread, but we have reasons to believe it will hold and rebound in the final days of the year and the first week of 2025.

Bitcoin is currently in a range between $90K and $100K, right mid-range, making this a neutral zone. A breakout is necessary to visit one of the range edges and define the movement.

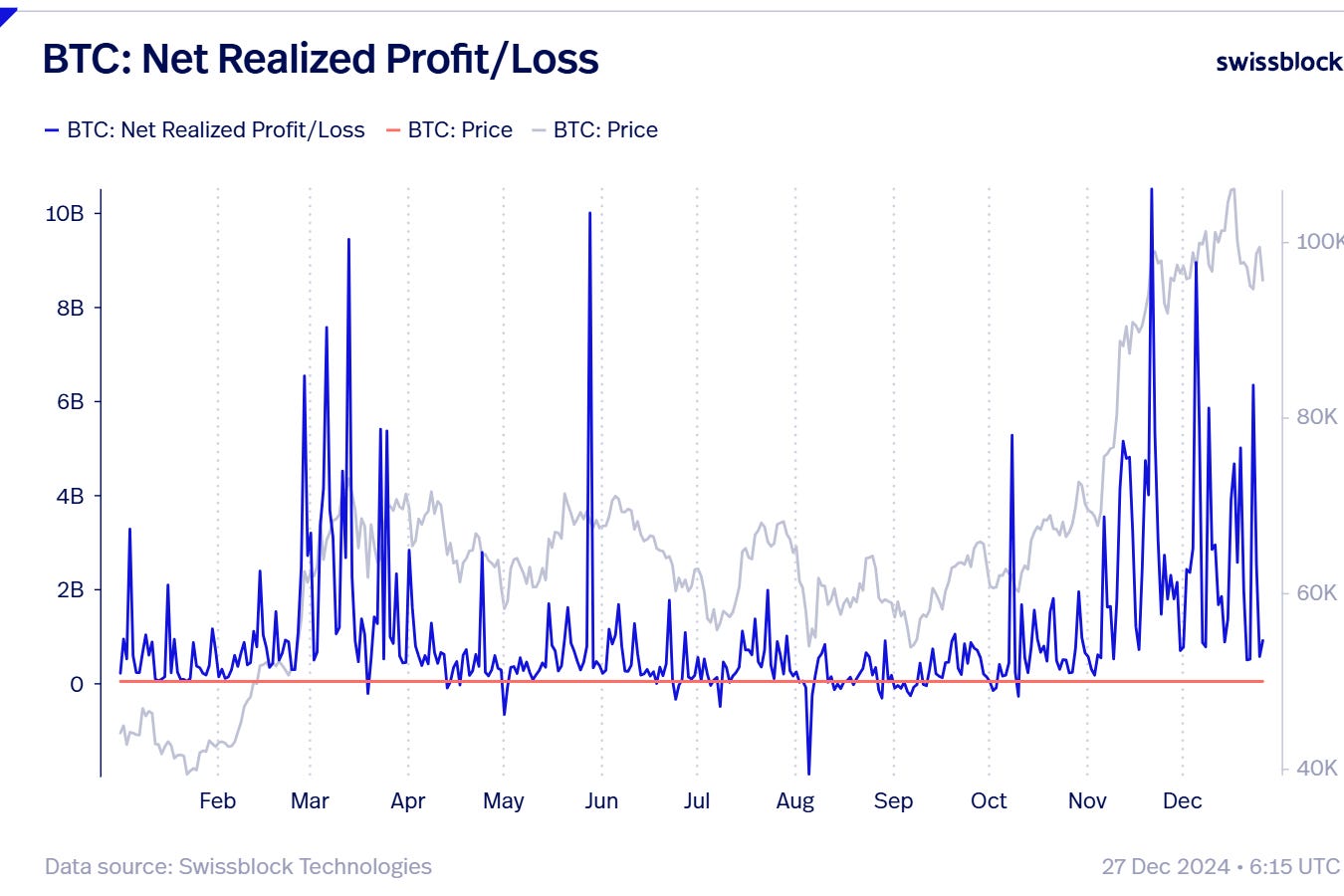

Profit-taking above $90K and near $100K has persisted among market participants (no surprise, as long-term holders continue to take profits). However, this selling pressure is gradually losing intensity. For price momentum to resume within the bullish territory, profit-taking must stabilize, and we need to avoid large volumes of selling that create spikes on the chart.

Due to the low volume, we see that the futures-to-spot ratio has bounced slightly from its yearly lows, indicating that futures positions have dominated over spot positions since this week.

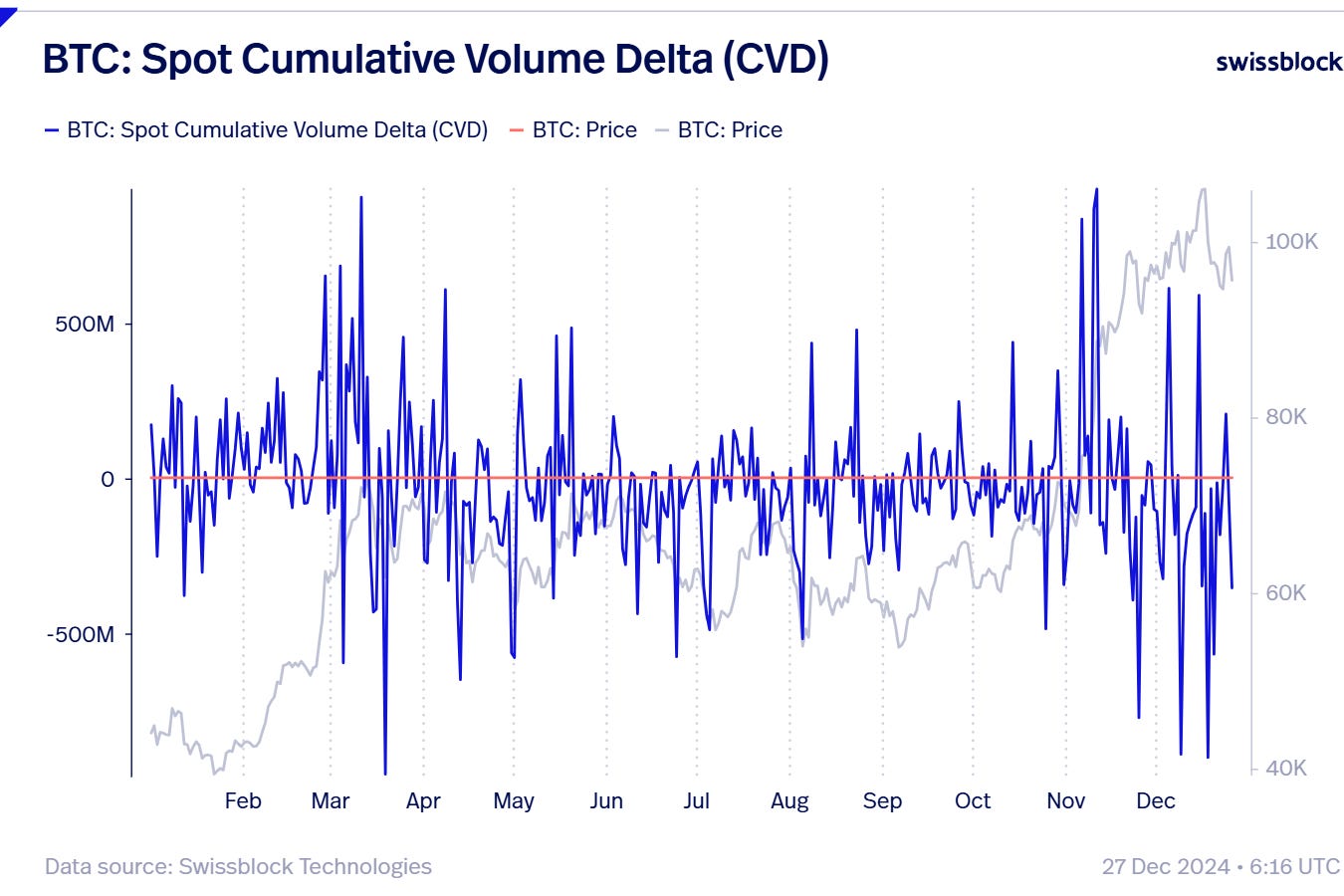

This is confirmed by looking at the CVD (Cumulative Volume Delta), which shows neutral territory, driven by the aggressive profit-taking near the $108K all-time high. At the same time, this bearish pressure is losing momentum.

Likewise, we see a similar scenario in the Futures CVD, with reduced interest in taking

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.