In the playbook of our January 11th “Bear Beware” Compass, we followed this setup:

The price could consolidate in a small range to gather strength and aim for $97.2K-$98.5K again. However, the $95K-$97K zone is "no man's land," and a breakdown below $94K could lead to another test of $92K. Do the bulls have the arsenal to counter the bears? As it stands, liquidations are accumulating to the upside, favoring the bulls with a higher volume of bear liquidations.

Now that Bitcoin is trading at $104K and approaching the all-time high zone, everything is looking green in the middle of winter. Will this extend beyond Trump’s Inauguration Day? Let’s find out.

A National Priority

At the beginning of the week, bearish predictions suggested that Bitcoin was heading directly and without pause to $74K. Now, after Bitcoin touched $105K, the bears have retreated to their caves, waiting for the bullish fever to subside. All it took was a single piece of news (or rather, a rumor): Trump is reportedly planning to include an executive order related to Bitcoin and the crypto ecosystem among the series of orders he intends to issue on his first day in office.

Since then, Bitcoin has been pumping and has reached the culmination of this move with another significant implication: Donald Trump plans to issue an executive order making crypto a national policy priority. This has given bulls renewed confidence, driving the price to a new all-time high.

Beyond the FOMO, it’s important to recognize that this rally is not solely a product of the news. First come the technical and on-chain fundamentals that support the price—then the news follows.

Amid this euphoria, it’s easy to overlook technical and fundamental aspects that might later suggest a different picture than what is currently unfolding. It’s crucial to determine whether Bitcoin has the support to continue rising or if this is merely a short-lived relief rally.

Fear Disappears When Bitcoin Rises

For some traders, red candles on a chart signal a time to sell; for others, they’re a buying opportunity. Neither approach is inherently right or wrong—it’s a matter of perspective. Some buy when chart candles turn green, while others are already seeking an exit, and vice versa. These dynamics are driven by FUD and FOMO, which fuel all markets.

Currently, we’re not seeing a sudden, irrational jump into extreme greed. Sentiment is already in a moderate greed territory. Could it be that traders are staying on the sidelines, not fully believing in the rally?

The positive takeaway here is that during a rally like the current one—so far spanning a 17% weekly range (from $89.5K to $105K)—we haven’t seen sentiment quickly shift into greed. This indicates a price increase that, in terms of sentiment, is more sustainable and tends to last longer, though this isn’t a guarantee.

In a previous analysis, we suggested that this rally could be a “sell the news” event or that the real action might begin after Inauguration Day.

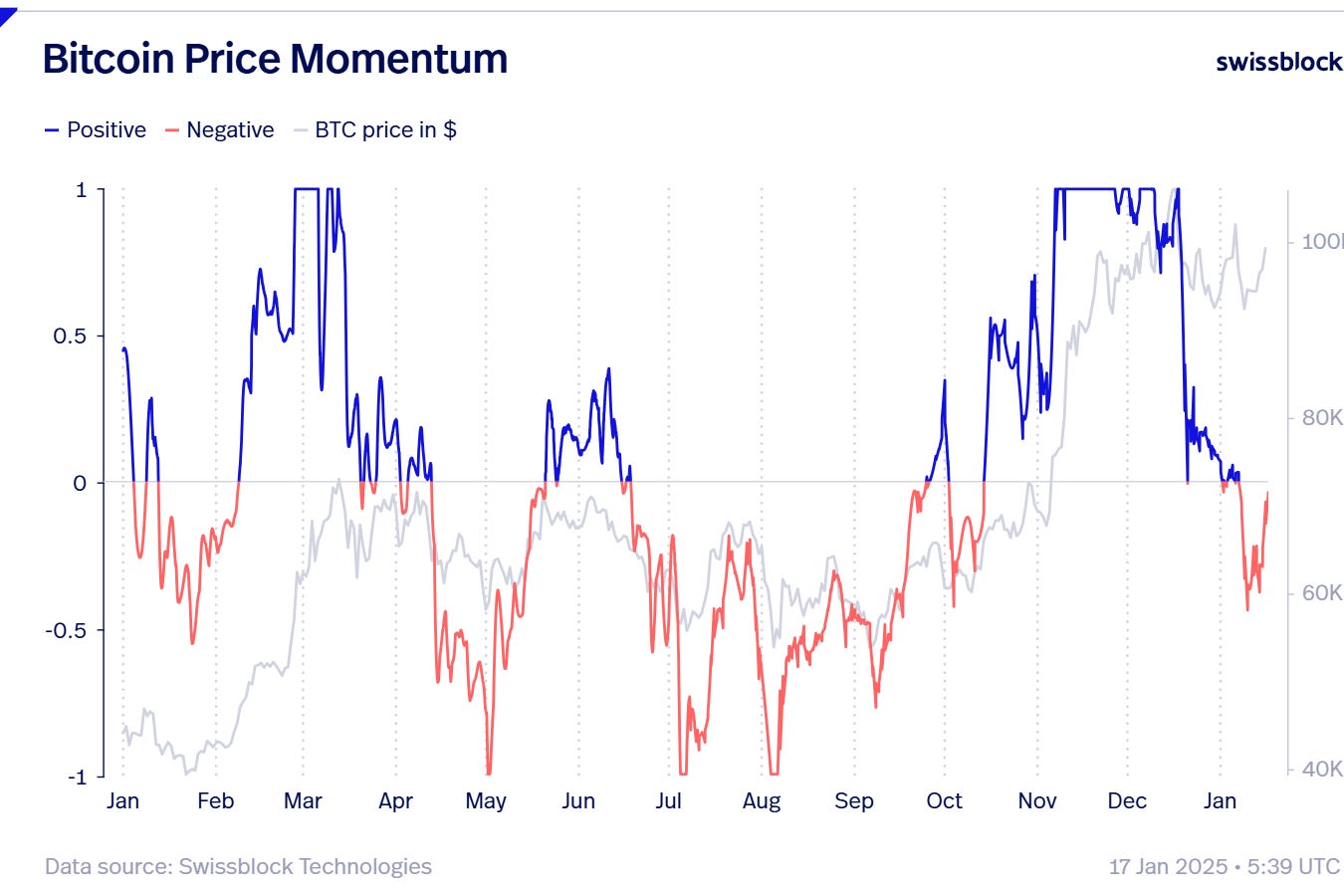

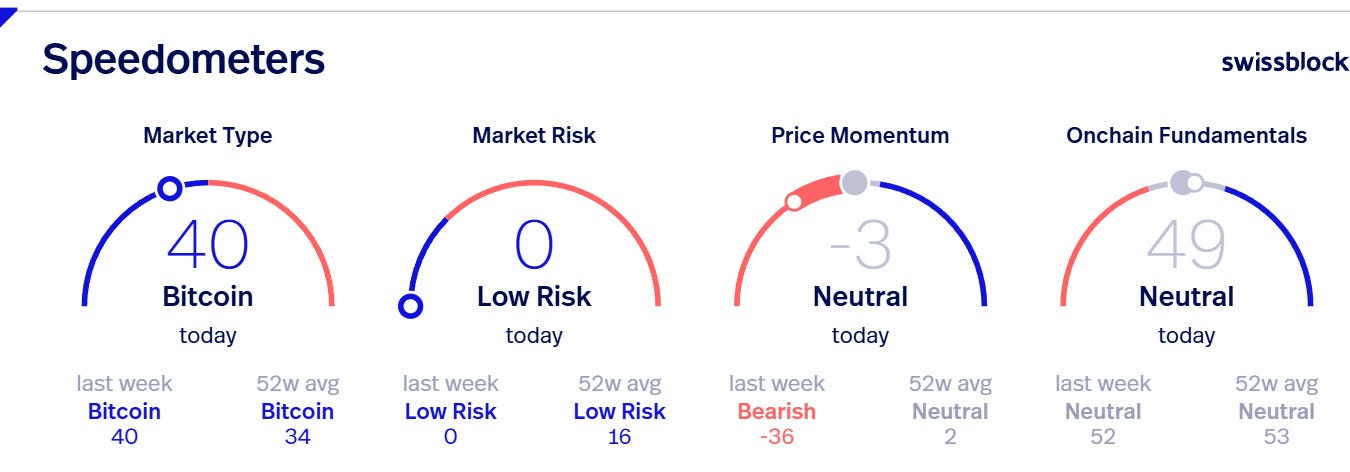

In terms of price momentum, Bitcoin has recovered and is once again in bullish territory. This is a positive sign, especially because the recovery coincides with the price pump. When both price and momentum rise together, it reflects strength—this is not a concern.

Additionally, risk has returned

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.