“Price is what you pay; value is what you get.” - Ben Graham

🇨🇭 Join our Swissblock Telegram Group! Get daily updates, in-house content, and technical analysis on crypto & macroeconomics. Tap into a hub of knowledge and insights. Stay ahead with Swissblock. Sign up now! 🚀

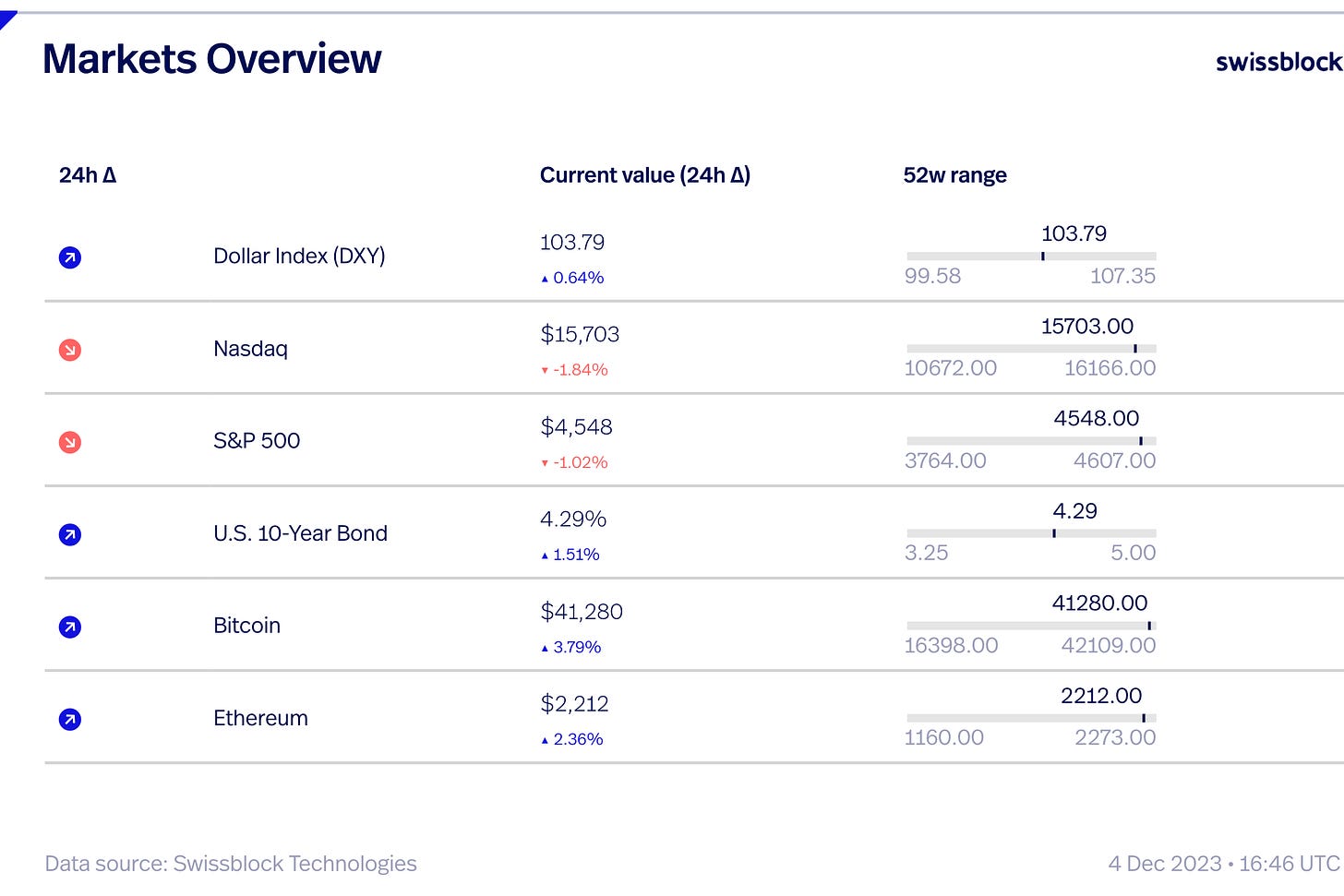

Over the last day, there has been a notable increase in the price of BTC, with a 5% rise to almost $41.75k. BTC has reached its highest point since April 2022 due to this rally, which also overcame the critical resistance levels.

Given its prior function as resistance and the market's memory, $40k will likely provide strong support if the BTC market's momentum continues with strong bullish sentiment and low risk environment.

Even while 4h timeframes show that BTC is overbought, this does not always mean a correction is necessary. BTC may continue to rise for many more days, causing investors' FOMO to spread to more and more layers.

Technically, BTC is in thin air up to $46k, and price swings between $40k and $46k can be extremely dramatic. The 20-day Exponential Moving Average (EMA) is considered possible short-term support, offering a market floor in case of a pullback, and shorting is not recommended. The general pattern points to a potential shift toward the $45k.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.