In our latest Weekly Playbook, we laid out the following scenario:

In the short term, we lean toward Bitcoin ranging between the prior resistance (now potential support) at $91.5K–$92.7K and the immediate resistance at $95K. Note that this range coincides with the dynamic resistance of the 4-hour 50 EMA. […] If Bitcoin retests the prior resistance zone ($91.5K–$92.7K), which could now act as medium-term support, and begins to establish a range above that level, it will mark a good entry point.

If you managed to enter within that range, you should now be in profit and setting your sights on the next levels. So, what’s next?

Not a Black Friday, but a Green One.

This week, Bitcoin dipped slightly below $91K, catching many off guard who were waiting for prices to drop below $90K. Despite this pullback, marked by extreme leverage liquidations and Bitcoin transferring from weak hands to strong hands, the price hasn’t collapsed.

Looking ahead to December, a historically quieter trading period for all markets, we may see a very active final month of the year. It’s possible that December will bring fundamental developments capable of moving Bitcoin.

One event worth noting is that Michael Saylor, Chairman of MicroStrategy will have a face-to-face pitch with Microsoft’s board, sparking speculation that this could signal an announcement of BTC acquisition by the tech giant.

From this perspective, if the U.S. government is contemplating BTC adoption, it’s logical that companies like Microsoft and others may have no choice but to follow suit—at least as a treasury asset.

Regardless of this potential game-changing development for Bitcoin, we are clearly entering Altcoin Season, as the Speedometers suggest. For this to truly unfold and not just be a short-lived celebration, several other factors need to align. Stay tuned as we break them down in below and in the days to come.

The Board Keeps Shifting; the Whales are Making their Moves.

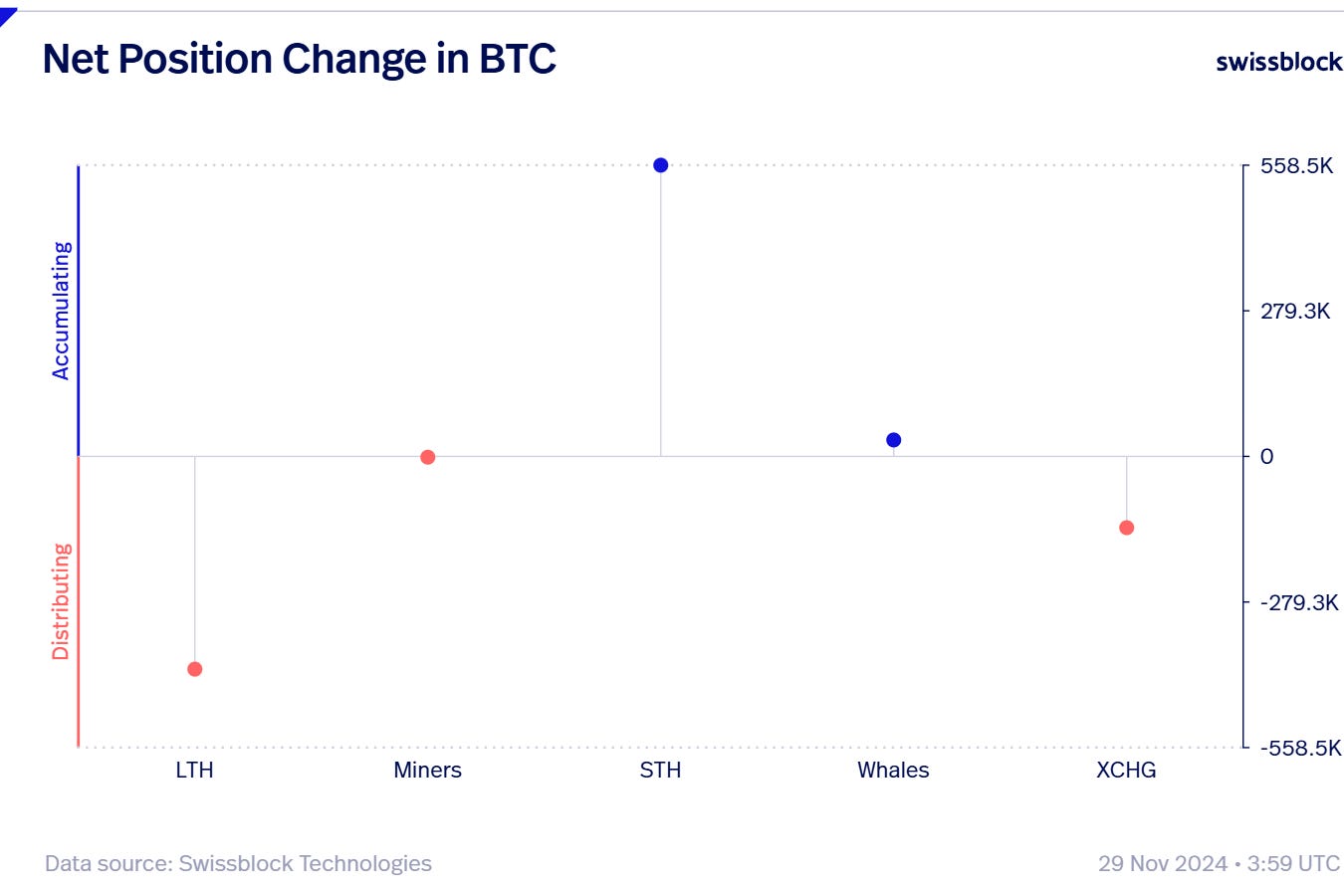

This week, we are observing slight changes in the dynamics of market participants compared to last week. Long-term holders have continued selling, but whales are entering the market.

Whales had begun a very subtle period of distribution before the U.S. elections and continued to exit their positions lightly during the rally to the $100K zone. However, during this correction, they have started accumulating, absorbing the BTC sold by other participants.

On the other hand, long-term holders have continued exiting their positions and have been the most aggressive profit-takers. (Net Realized Profit peaked when Bitcoin approached $100K).

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.