“The most basic question is not what is best, but who shall decide what is best.” - Thomas Sowell

BTC has shown a slight rally at the start of the week, shaking out bearish sentiment from previous weeks. It has drawn significant interest due to its recent strength, fuelled by speculations that central banks may continue to cut rates, which would favor BTC. However, price faces strong resistance at the $67k level, though it maintains a strong daily chart within the $66k-$67k range, with a potential bullish retest of $64k expected.

If BTC breaks through the $67k resistance with high trading volume, the next resistance level would be $71.5k. The market’s response to central bank rate cuts will be crucial in determining BTC’s trajectory, and a successful breach of $67k could signal further bullish momentum.

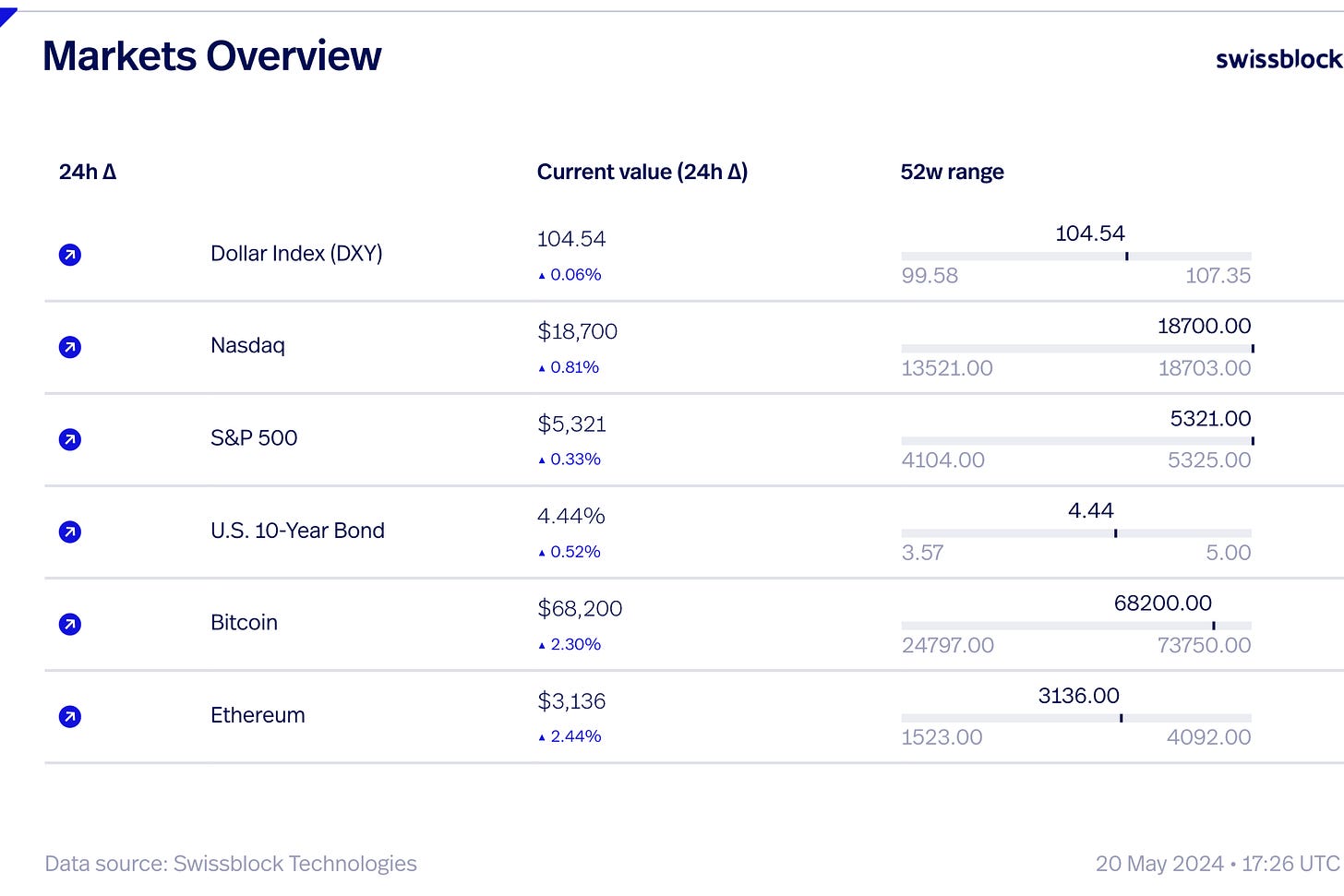

Last week, data from US PPI strengthened dollar index while more data from US CPI, retail sales, empire state manufacturing index, and unemployment claims weakened the dollar index, leading to more pump in BTC. This week, we have FOMC meeting minutes, US unemployment claims, PMIs and revised UoM consumer sentiment data to keep our eyes on.

Weaker dollar index means more pump in BTC price and vice versa. BTC prices are steady amid cautious trading and interest rate outlook as price remains between $60k-$70k since March, awaiting breakout catalysts, stabilized DXY limits BTC’s upside as Middle East tensions boost safe havens.

The 4-hour chart for BTC shows that the $60k support level has consistently prevented deeper corrections, allowing to rally. It has broken above the midline of its channel and completed a pullback, now gradually approaching the $68k resistance level. The Relative Strength Index (RSI) is above 50%, suggesting potential for a breakout above this resistance level.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.