1. Threading the Edge.

In our weekend update, we highlighted the importance of reclaiming the three-month range lows where Bitcoin had been consolidating. Specifically, we pointed to the area above $57k as part of the price recovery and the challenge to the Daily 200 EMA as a key element in this move to resume the long-term upward trend. However, the price has been rejected twice at exactly $58.3k and subsequently lost the range lows, with the price reacting by seeking liquidity in the wicks down to $54.5k.

The selling pressure has been relentless. Today, the German government, which has sold nearly half of its Bitcoin holdings, sold 3,000 Bitcoins in less than an hour. On the Mt. Gox front, with potential sales from repayments, we could consider that any additional selling pressure has already been accounted for.

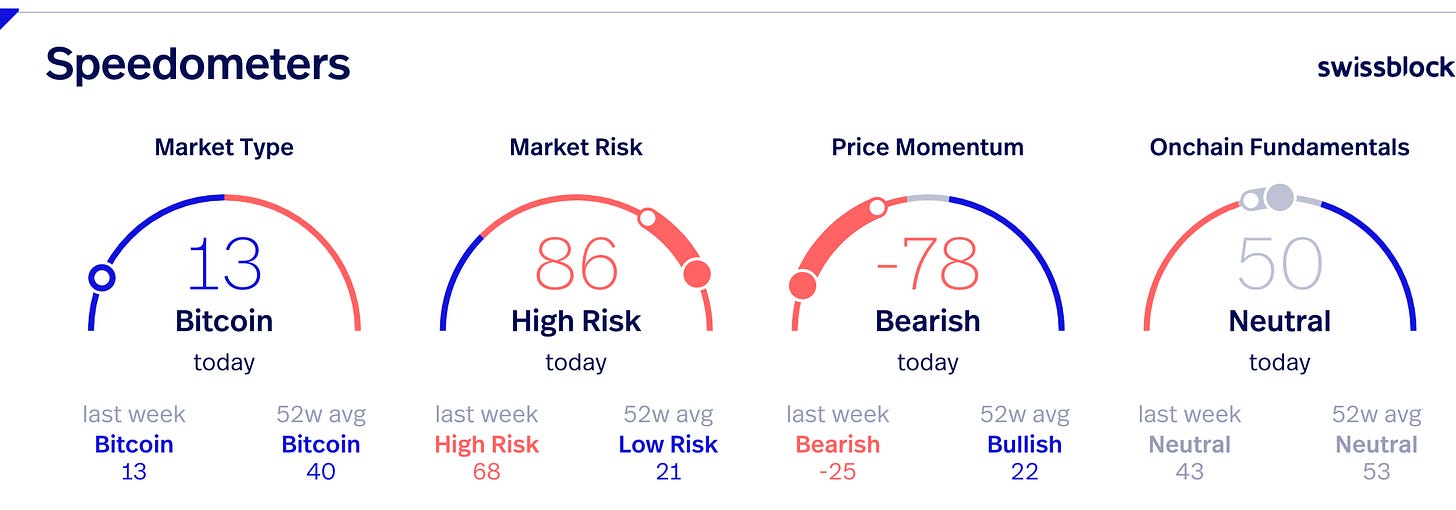

A scenario we anticipated, if Bitcoin began to range and weaken around the $57k zone, was a revisit to the $54k area. This movement ultimately occurred, leaving a trail of liquidations for both bears and bulls. We are now in the same price zone as the weekend, above $56k, while the risk signal remains elevated. The question now is, what’s next for Bitcoin's price?

2. Bitcoin’s Price in Context.

Check out today’s featured news highlight

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.