In the last playbook, we outlined a pivotal scenario:

More than price, Bitcoin dominance deserves attention. If dominance declines, it could signal the start of an Altcoin Season, while a recovery in dominance could lead to a Bitcoin-only Christmas rally.

While the environment surrounding Bitcoin has shifted post-FOMC, the $97.2K to $98.5K range seems to be holding well (currently we are testing the lower end), and BTC dominance remains in focus. Let’s examine key drivers for Bitcoin and Altcoins over the weekend, as well as implications for the coming week.

Alea Iacta Est.

Jerome Powell declared war on Trump and has taken a bold stance, appearing unprepared in his recent remarks, signaling a turbulent road ahead. With inflation high, employment fragile, and the economy showing resilience, Powell faces an uphill battle to avoid going down in history as the Fed Chairman who missed the soft landing. The battle is a political one.

The Fed's projection of two rate cuts by 2025 didn’t sit well with markets. Red numbers dominated indices, risk assets, oil, and gold, while the DXY hit a yearly high and the VIX spiked by 75%. Yields surged again, reflecting disbelief in Powell’s quantitative easing narrative.

Despite this backdrop, markets demonstrated resilience. This Friday’s quadruple witching hour (simultaneous expiration of stock futures, index futures, index options, and stock options) passed without sparking panic.

Bitcoin experienced a flash crash, plummeting to $92K in a swift move that wiped out residual market weakness. Yet, it quickly rebounded in a V-shaped recovery back to $97K.

This sharp recovery might signal the final cleanup needed to pave the way for a year-end rally, but questions remain:

How much strength does Bitcoin have left for a sustained rally?

What maneuvering is still necessary to secure the trajectory?

Let’s break it down step by step in the coming analysis.

Bitcoin Takes a Hit, But I Hear No Bell.

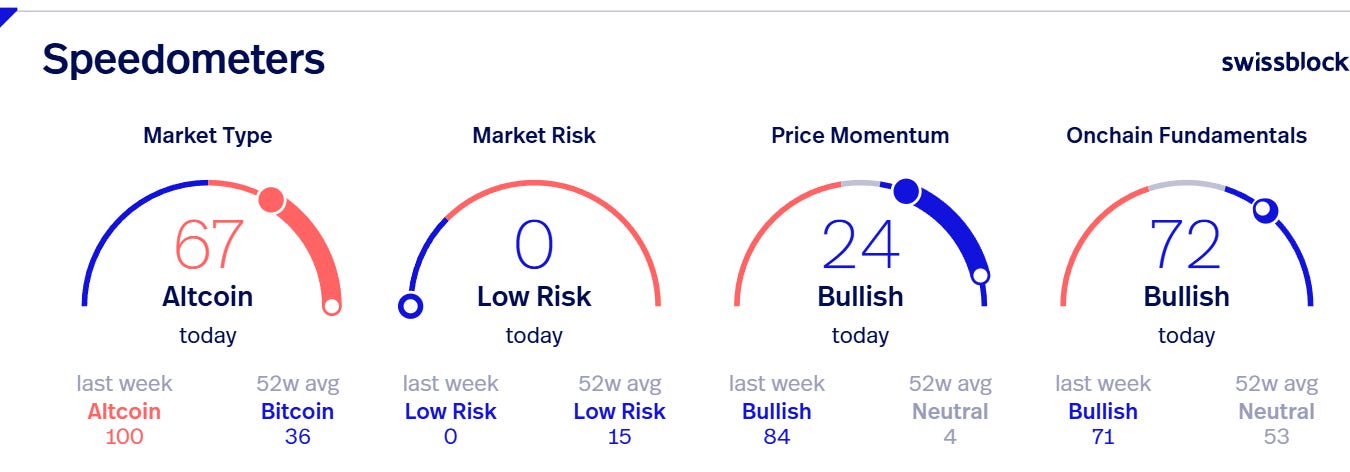

Price momentum has taken a hit after Bitcoin lost $100K, dipped to $92K, and is now fighting to reclaim the $100K level.

Bitcoin has lost steam in its attempt to re-enter the ascending channel it previously followed. Is this dip merely a deviation from the trend of the past month? Or is the price momentum signaling that the strength to reach higher targets has run out? Let’s analyze the indicators.

First, profit-taking has remained persistent, increasing over the past week but with less intensity compared to prior weeks. This activity primarily stems from long-term holders (LTHs) closing portfolio positions, as we'll see in more detail later.

The door remains open for stronger buying pressure from various market participants. However, the Cumulative Volume Delta (CVD) remains in negative territory,

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.