A Careful Euphoria.

Once the anticipation for the rate cut has finally passed, it’s time to start asking the right questions: Was the 50 bps cut positive for the markets? Does this make a soft landing a real possibility? Are these decisions being made on technical grounds, or are they politically driven? In short, has the storm passed, or are we in the eye of the hurricane?

To understand this, everything depends on the timeframe through which we view the events. In the short term, all markets have responded bullishly to the 50 bps cut, despite a concerning macro outlook. This aligns with our Q4 2024 vision: a break of previous highs in sync with an Altcoin Season.

In the first half of 2025, we’ll see the real effects of the rate cuts—not because of the cuts themselves, but due to the delay in their implementation.

It all depends on the viewer's perspective. Some may see that the storm has passed, while others observe another forming on the horizon, though it hasn’t happened yet. But we shouldn’t get ahead of ourselves and must learn from the past. Last October, the prevailing market narrative was that the S&P 500 would continue to collapse, with an inevitable recession. What happened next? A rally in the S&P 500 with a 40% gain from November 2023 to today.

Those who succumbed to the alarms and pessimism now regret not entering the market in time, or not doing so because they were waiting for catastrophe. This is not the moment to yield to the worst predictions. We've been waiting for the last quarter of the year after months of moving within a macro range.

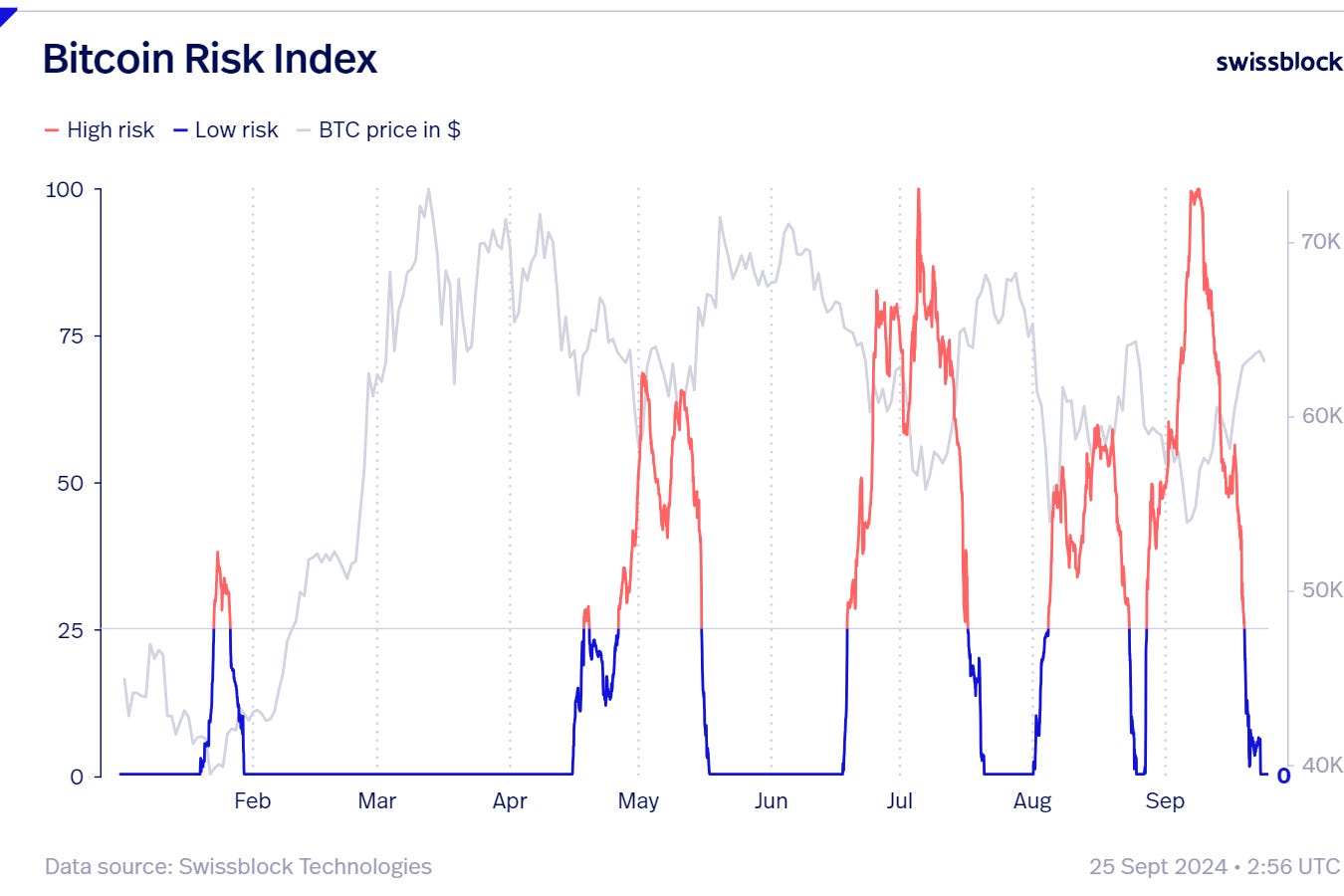

The stars are aligning on our journey: the risk index has plummeted to zero, and it's no longer Bitcoin setting the pace in the market but Altcoins. Price momentum is about to turn bullish, and the fundamentals continue to strengthen.

Everything is falling into place for Bitcoin to challenge its all-time high and for Altcoins to lift their sails. After months stuck in the same range, it seems we're finally ready to lift anchor.

Will it play out as expected, or might there still be delays along the way? Let’s take a closer look at our Swissblock indicators.

Risk at 0: Can it last?

We have hit zero on the Risk Index after a month of spikes that soared to 100 during the correction to $53k. In that price zone, Bitcoin formed a higher low, which has triggered a 20% recovery in just over two weeks. What do we expect next?

If the Risk Index stabilizes at zero, we could witness a sustained Bitcoin rally that challenges previous all-time highs. Notice how from February until mid-April, the risk remained low, aligning with the rally that took us from $42k to an all-time high at $74k. Since then, we've had brief periods where the index stayed at zero, notably during the post-halving rally from May to June and for a few days at the end of July, driven by the FOMO surrounding the Bitcoin Conference.

What’s clear is that the longer we stay in this low-risk regime, the higher the likelihood of a sustained upward movement, especially if supported by the alignment of other key indicators.

Price Momentum is about to break.

The price momentum is about to reverse into the positive quadrant, and it seems like this could happen at any moment.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.