Hopefully, you set your sights on the return to $69k since our October 29th publication:

In the weekly start playbook, we stated: […] the rally has been fueled by futures since the weekend, so we may see liquidations and position closures in the short term. Given this dynamic, ideally, we should see a retest of the $68k-$70k zone, with $69k as our point of control.

Let’s explore what’s next.

The Greatest Fear is Uncertainty.

We went through a week full of fundamentals that could move abruptly Bitcoin and the markets—and that’s exactly what happened. Shifting from near-euphoria to moderate optimism, the release of macro data and earnings reports from companies impacted indices, leading them into corrective zones.

But now that this has passed, the biggest source of fear remains in the air.

The upcoming U.S. presidential election on Tuesday is the most significant short-term factor we face. The market’s fear isn't centered on which candidate wins—whether it’s Harris or Trump isn’t the main issue. Instead, the concern is whether one of the candidates will refuse to acknowledge the other’s victory, which could lead to a legitimacy and institutional crisis in the U.S., triggering a shockwave that could ripple across all markets, at least in the short term.

Once a resolution arrives, hopefully within legal and democratic bounds, this will likely bring relief and drive markets once again, influenced by their own dynamics.

November is one of the most bullish months for Bitcoin, setting the stage for a potential continuation of an "Uptober" that didn't start as many expected. This month will likely begin with a similar promise, as uncertainty—the greatest fear of all—starts to fade. Meanwhile, brace yourselves: volatility is coming.

The speedometers show that we’re in a regime entirely dominated by Bitcoin, with zero risk, bullish momentum, and strong, stable fundamentals. Let’s break down Bitcoin’s current status.

Bitcoin Shows its Dominance.

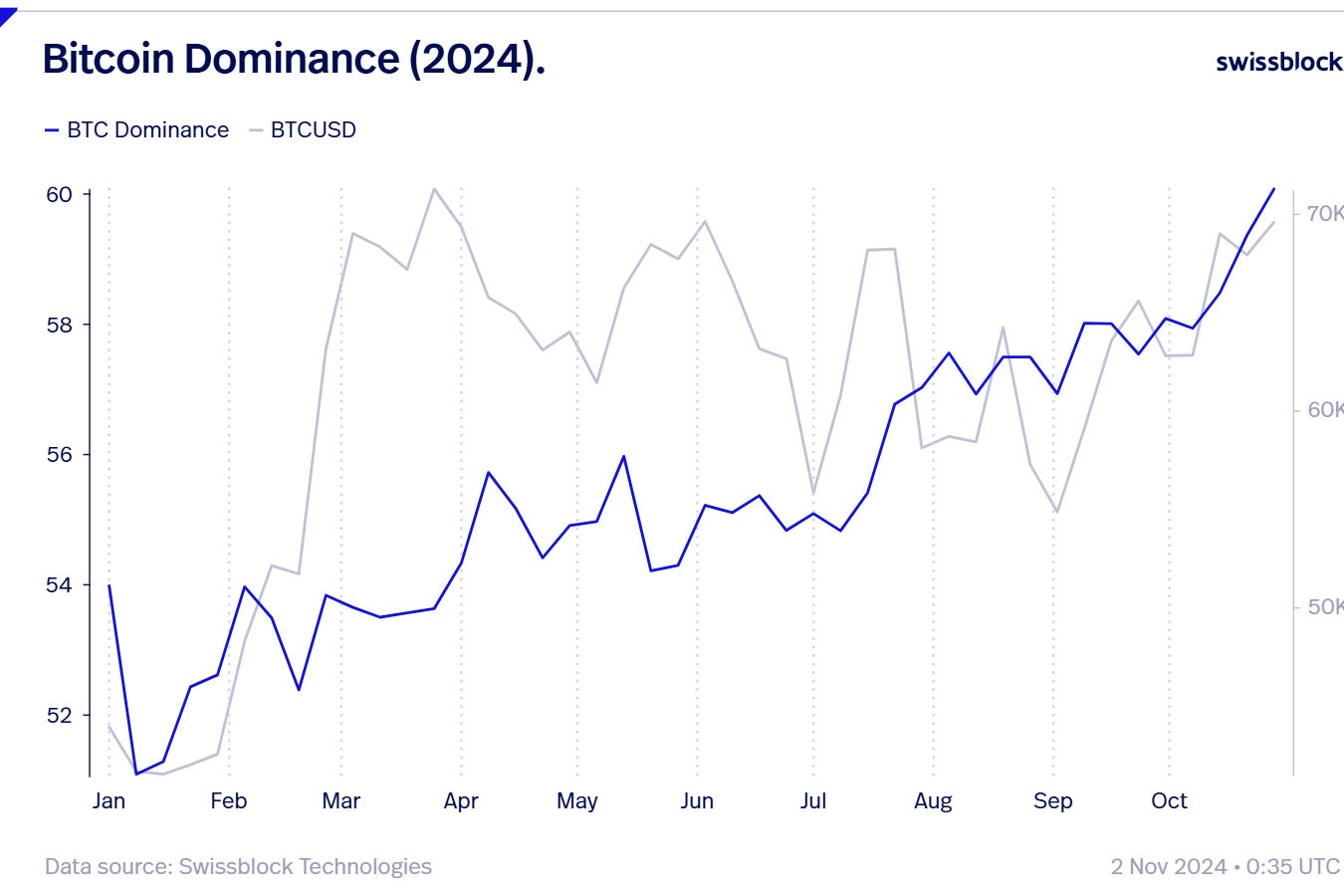

If October taught us anything, it’s that during the month’s bullish movement, Bitcoin strengthened to sustain its upward trend through its dominance. Capital flowed more significantly into Bitcoin, pushing its dominance to a new high for the current cycle.

This shift has put pressure on Altcoins, especially Ethereum, which ended the month in negative territory. Ethereum initially

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.