Wave Goodbye, Operation Chokepoint 2.0 (for now)

If someone had told us a year ago that, during the most important Bitcoin Conference of the year, a high-profile politician would make an announcement that could forever change the crypto ecosystem, we wouldn't have believed it. And we're not referring to the participation of Donald Trump, the former president and US presidential candidate. We're talking about the announcement made by US Senator Cynthia Lummis at the Bitcoin Conference 2024, where she introduced a bill to create a Bitcoin reserve aimed at reducing the national debt. This reserve would include the 213,000 BTC currently held by US authorities, according to Arkham Intelligence, and would aim to accumulate at least one million BTC over five years.

This represents a monumental shift, regardless of whether the bill is ultimately approved. The mere fact that high-profile political figures publicly characterize Bitcoin as an asset capable of counteracting the effects of extensive debt issuance—and recognize this as a fundamental problem—marks a victory for Bitcoin. Once the problem and solution are acknowledged, they cannot be ignored or overlooked.

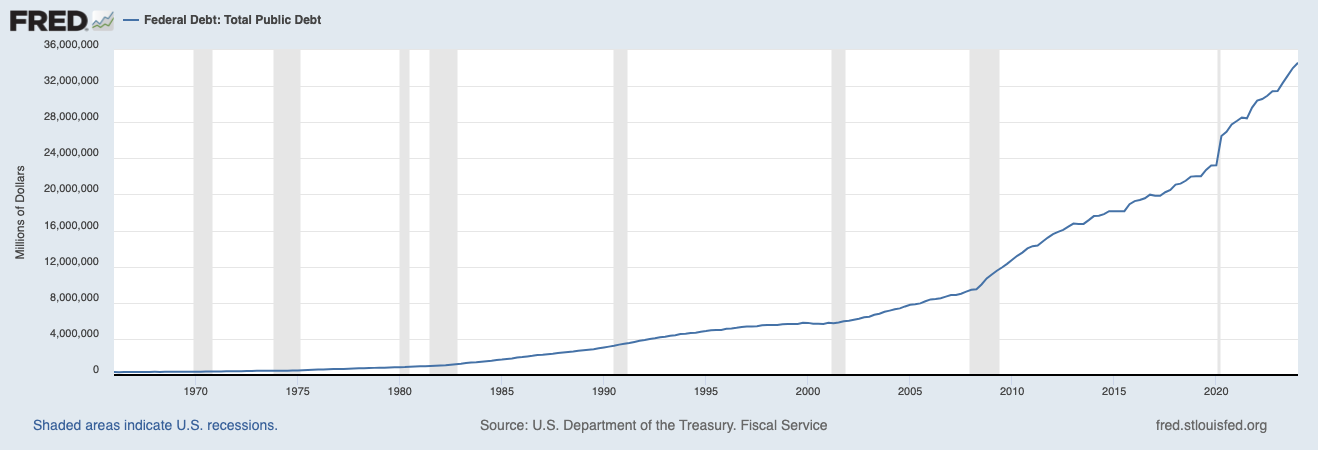

Source: St Louis Fed The U.S. federal debt has surged significantly, especially since 2020, due to the effects of the COVID-19 pandemic, expanding from $23 trillion to $34 trillion in just four years. At the Bitcoin Conference 2024, Michael Saylor's remarks centered on how Bitcoin could be transformed into a treasury reserve asset to reduce national debt and preserve capital.

And finally, Donald Trump's speech at the conference provided several standout moments that made headlines. He promised to replace Gary Gensler as head of the SEC, signaling an end to Operation Chokepoint 2.0—a series of punitive actions against crypto. Alongside Cynthia Lummis, Trump pledged to maintain the U.S. government's Bitcoin holdings and to create a Bitcoin stockpile as a reserve for the dollar. He also vowed that the U.S. government would never create a CBDC (Central Bank Digital Currency) and promised to pardon Ross Ulbricht, who is serving a life sentence for his involvement in Silk Road. True to his style, Trump, an unlikely champion of Bitcoin, set a high bar that his Democratic counterpart, Kamala Harris, will have to meet or exceed. This is precisely what makes Trump's speech significant: it has established Bitcoin as a topic of public and political relevance for the current US election.

A Lesson on Volatility and Manipulation.

Bitcoin reached $69.4k, following an upward pattern that we interpreted as a pre-conference pump, reflecting overly positive market sentiment. What followed was a typical price manipulation structure often seen during events with strong sentiment, whether bullish or bearish. In this case, as positive news (such as Trump's intervention to deepen his Bitcoin policy) was anticipated, the price saw an initial surge, followed by a “sell the news” type pullback (similar to reactions to macroeconomic data). This move liquidated those late to go long on the price. Subsequently, the price was pushed up again to liquidate short positions. Once this maneuver was completed, the underlying direction of the price movements became clear.

Rate cuts: A political decision?

It was a tough week for risk assets and technology stocks, experiencing losses not seen since October 2022. The stocks representing the "Magnificent Seven" (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla) suffered nearly $1.75 billion in market cap losses, with the worst session recorded on Wednesday. Bitcoin saw its worst decline of the week on Wednesday, highlighting its renewed correlation with risk assets. This decline was followed by a rebound that, on the one hand, drove Bitcoin up to $68k and, on the other, helped the S&P 500 and Nasdaq recover their lost levels.

Source: TradingView Stock Heatmap Does this mean that Bitcoin and crypto assets are aligning with traditional indices again? Not necessarily, but we should keep in mind that both markets are susceptible to macroeconomic data. Friday's Personal Consumption Expenditures (PCE) data yielded mixed results, with June PCE inflation above expectations and Core PCE inflation decreasing to 2.5%, meeting expectations. We understand that the Fed will only partially reveal its intentions and react release by release, step by step.

We are in a seasonally bearish period for traditional markets, so we can also interpret the selloff in the indices as a way for the market to prepare for a possible rate cut in September, in which probabilities are still high at 88%. This sets the stage for the scenario that, regardless of whether the Fed achieves its goal of lowering inflation to 2%, a rate cut could positively influence market sentiment in the lead-up to the U.S. elections.

What is next?

On Thursday, Bitcoin reacted to the escalade of liquidations by forming support at the Daily 50 EMA, just below the $64k zone, and reclaimed the $65.5k support. This propelled it back to the $67.5k resistance, briefly surpassing it and reaching above $68k, an area we identified as a short-term profit-taking zone. However, more profit-taking was needed to drive the price down significantly. We interpret Friday's daily close above $67.5k as a positive signal, reinforcing our current reference point for targeting the upper part of the range.

To continue our playbook, a weekly close above $67.5k will leave an absorption wick down to $64k, indicating the continuation of the bullish price trend. Step by step and level by level, Bitcoin's price has consolidated in the range above $65.5k and $67.5k, which we interpret as an accumulation pattern. In summary, a weekly close above $67.5k, a price level that has proven tough to break, will provide positive signals for the next leg up.

Swissblock’s key metrics also see continued improvements, while we remain deep in Bitcoin season. It may be the moment to focus on the biggest crypto and rotate back into Altcoins when the next all-time high is reached.

Key Takeaways.

US Senator Cynthia Lummis announced a bill at the Bitcoin Conference 2024 to create a Bitcoin reserve to reduce the national debt. The proposal aims to accumulate at least one million BTC over five years, including the 210,000 BTC currently held by US authorities.

The proposal, regardless of its approval, signifies a major shift in how Bitcoin is perceived by high-profile political figures. Michael Saylor’s approach and Donald Trump’s speech reinforce Bitcoin's potential as a hedge against extensive debt issuance and underscore its increasing political relevance.

Bitcoin's price reached $69.4k pre-conference, reflecting overly positive sentiment, followed by a typical manipulation pattern, with initial surges, pullbacks, and eventual stabilization. The price later consolidated around $67.5k, indicating accumulation and setting the stage for potential bullish continuation.

The tech sector and risk assets, including Bitcoin, saw significant losses, reminiscent of October 2022. Bitcoin's decline aligned with a broader market selloff, marking a partial correlation with traditional markets.

Mixed PCE inflation data was interpreted positively by markets, suggesting possible Fed rate cuts, which could influence market sentiment positively, a factor that seems particularly salient with the upcoming US elections.

A weekly close above $67.5k, supported by the Weekly 20 SMA at $65.5k, is crucial for continuing the bullish trend. It seems like a strong setup for the coming week.