The Morning After.

This week, Bitcoin has broken through everything: the previous all-time high, the seven-month consolidation range, and the bears betting on short positions. We were looking for Bitcoin to break out of this consolidation with a decisive move—Bitcoin-style. We are just one more push away from reaching $90k, one of the most significant milestones we could achieve.

When Bitcoin enters uncharted territory, it can take a lot of time and distance before it looks back. What's ahead isn’t just "discovery mode" but also a game of liquidations and speculation. It’s not simply "easy mode" where everything will pump day in and day out.

This weekend’s pump has validated one of the two scenarios we anticipated, where Bitcoin could establish a range, then subsequently liquidate the shorts that started to accumulate, expecting a drop. The volume of bear liquidations over the weekend fueled Bitcoin's push beyond $80k, setting the stage for a skyrocketing surge to $87k during Monday, leaving bears stunned and without an escape.

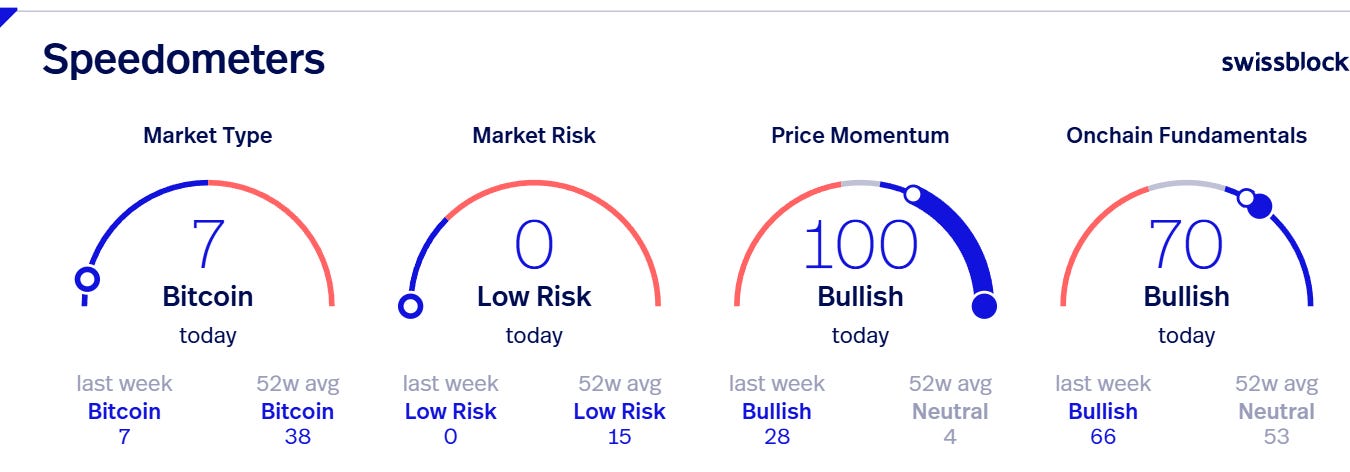

This momentum has marked the price in the most bullish zone, along with strong fundamentals, with a Bitcoin season still unfolding. Let’s see what this week brings to identify short-term opportunities.

Bullish Momentum.

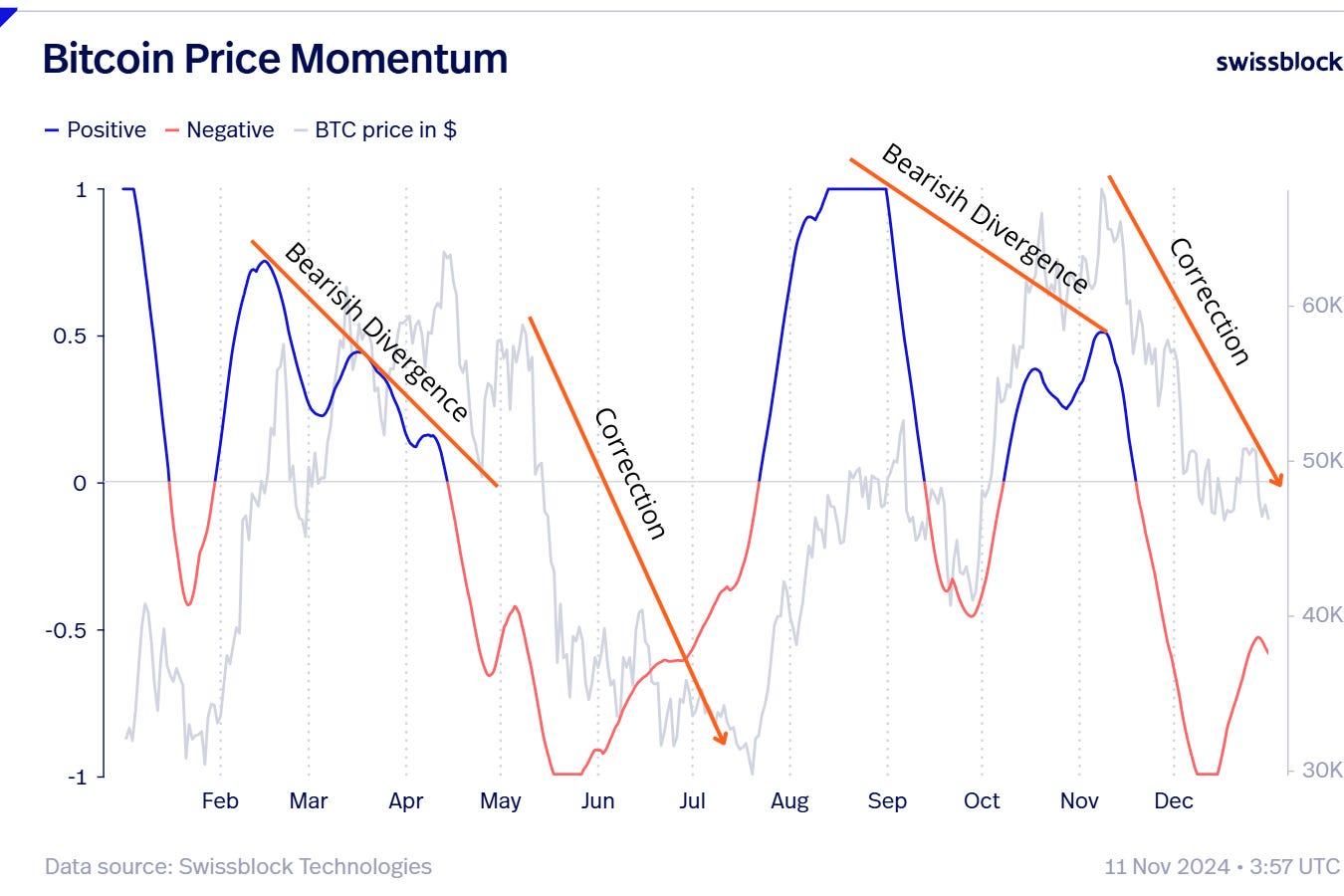

Price momentum has reached new highs, and it's no wonder. Look at the chart: throughout this year, there have been specific moments where this has occurred—during the pump to match the previous all-time high of $69K and when the new ATH was set at $74K.

This doesn’t mean that after reaching these high zones, price momentum necessarily has to deteriorate to bring deep correction levels, but caution is essential once the price reaches this momentum.

Notice how, in 2021, with the end of the bullish cycle, price momentum tended to signal both bullish peaks and bearish entry zones. Particularly, observe the period from February to mid-April, where a bearish divergence formed between price momentum and price, which was confirmed in May with a major correction.

This price correction was significant, and although it wasn’t a shift from bullish to bearish market, it was indeed a correction. Notice how the rebound in price momentum indicated a price recovery, leading to Bitcoin’s second surge from mid-July to November, when the $69k all-time high was established. Also, observe how a second bearish divergence formed in price momentum, leading to a larger correction that eventually marked a trend reversal.

We need to monitor this closely to identify phases of the market where corrections can offer entry opportunities and avoid getting caught in deeper corrective moves.

Bullish Fundamentals.

Bitcoin's fundamentals are currently very strong, and network growth has reached a new high for the year. However, to grasp the importance of this trend, we must view it in the context of past performance. For instance, even though Bitcoin’s fundamentals are in an optimal state, there is still room for further upward movement.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.