“Bitcoin is perhaps the first scarce thing in the world we can say we truly possess.” - Jimmy Song

🇨🇭 Join our Swissblock Telegram Group! Get daily updates, in-house content, and technical analysis on crypto & macroeconomics. Tap into a hub of knowledge and insights. Stay ahead with Swissblock. Sign up now! 🚀

BTC continues to show strength and is above 42k which is the current support. If nothing changes, expect it to grind higher with 48k as the key target. Bias is bullish and will turn bearish only if BTC falls under 40k. We are at a low risk environment with a slight bearish momentum, but on the long term indicators point to a bullish sentiment.

At the same time, the price is back in a range that started in December and is now ongoing for three months. This reads like a consolidation before the next major move. Expect BTC to get volatile as soon as it breaks away.

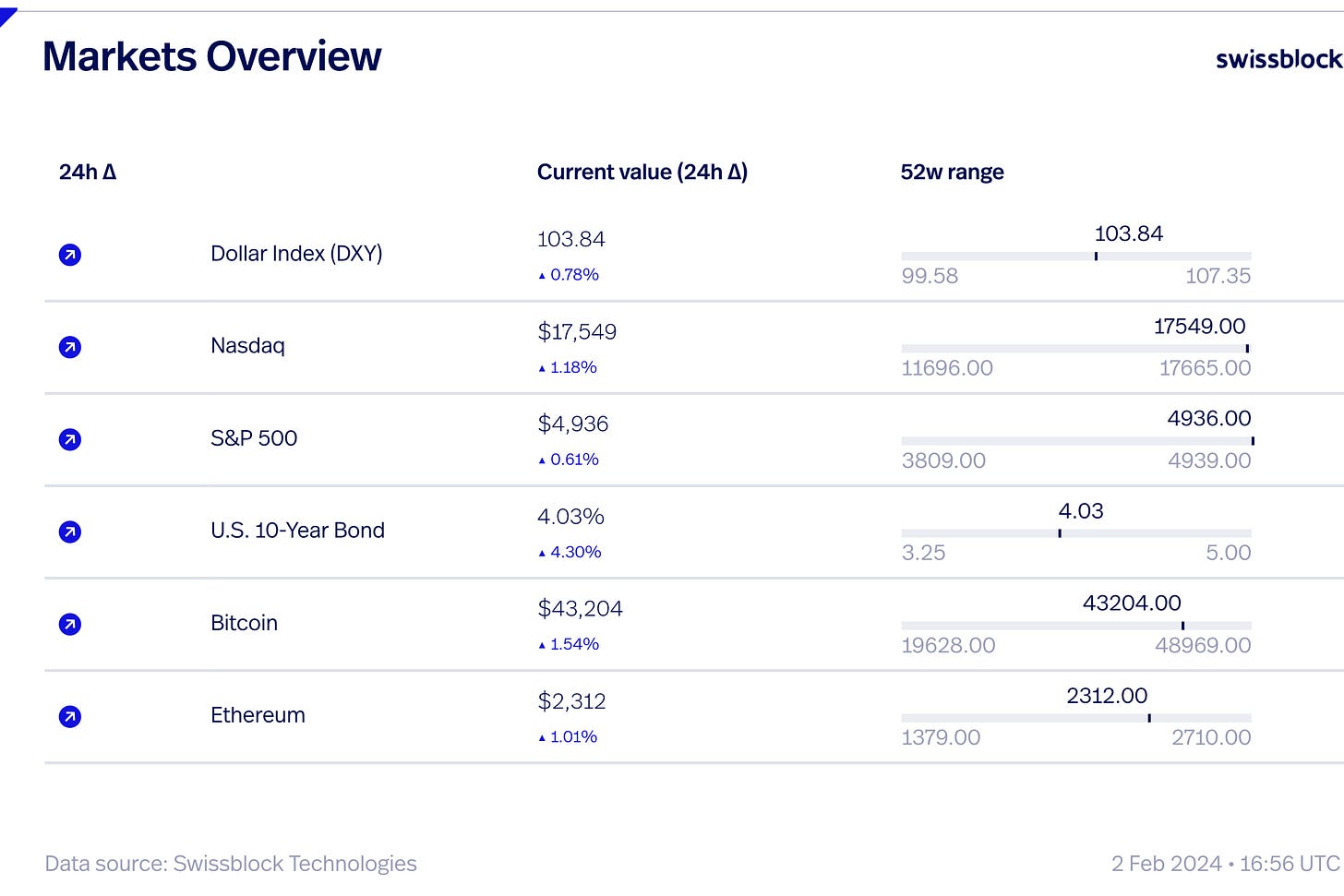

Risky assets and stocks posted a mild rebound after Federal Reserve Chair Jerome Powell signalled to markets that a rate hike is likely not coming until later this spring. Powell announced it would be holding interest rates at their current level , with only an “unexpected weakening” in the labor market and other instances that would result in a rate cut sooner than expected.

This suggests trader conviction that rates will be coming down sharply, despite what Chair Powell said. Given that Futures actually increased the odds of rate cuts this year despite Powell’s comments, and US equities sold off by over 1.5%, it seems clear that markets believe the Fed is about to make a policy mistake by keeping rates too high for too long.

BTC’s price trajectory in February 2024 is anticipated to retest the $45k area, reflecting a shift in market dynamics. The cooling of selling pressure post-ETF approval and a recent influx of $220 million into long-term savings contribute to this outlook. The next critical level for a potential retest is the Range Lows at $40.3k. If BTC manages to hold this level, there could be a scenario of forming a higher low and subsequent movement back up to the Mid-Range.

Breaking above the upper Bollinger band around $44.135k could signal a decisive breakout, paving the way for a retest of $45k. Conversely, bears might regain control if a reversal occurs below $38k, but the lower Bollinger Band suggests potential bullish support around $38.092k to prevent further losses.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.