"Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria" - Sir John Templeton

BTC is holding steady at $27K, while the broader crypto markets are barely moving, with some traders looking to today's central bank policy choices as the reason for any movement (2:00pm EST). The Fed Funds Rate is widely projected to remain steady at 5.25%-5.50%, while the Risk Signal has fallen below 30 for the first time since July.

BTC's price volatility the past week contrasts with the calm in TradiFi. The central bank's likelihood of a hawkish or dovish surprise is minimal, favouring BTC's price trend.

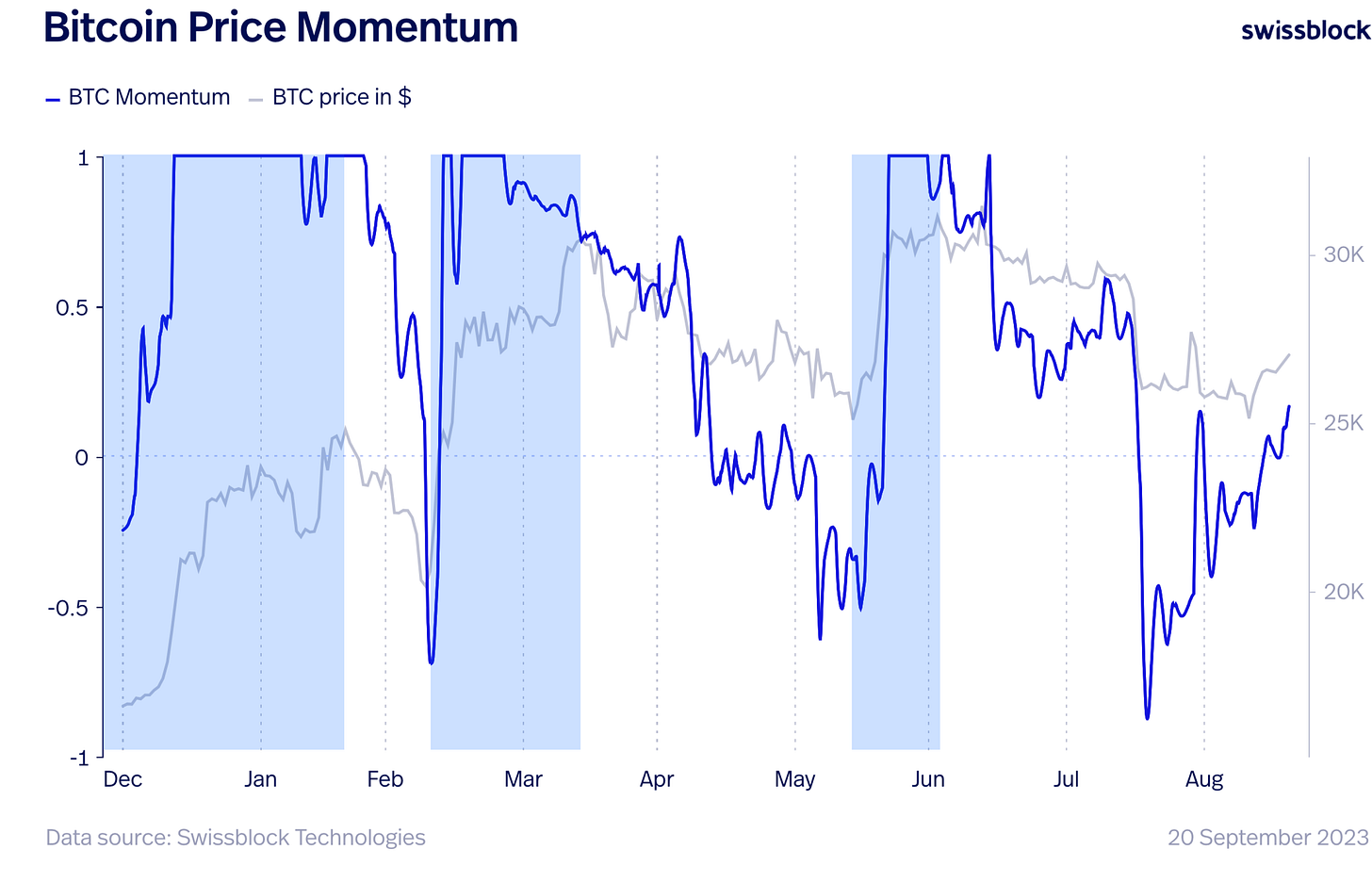

After Japan's biggest investment bank, Nomura, anounced that its crypto subsidiary was launching a new adoption fund for institutional investors, BTC gained $27.2K, and momentum is building. A valid bullish entry has happened in the price activity leading up to today's meeting.

Upside momentum might bring the price up to the $27.78K (200-day MA) resistance level. If the asset breaks through the major barrier over $27.5K, it may test $28K. Momentum is in our side, and if it continues pilling up we could see price moving up.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.