In the last playbook, we outlined this scenario:

Failing to break out toward the $108K–$110K zone...indicates that Bitcoin lacks the necessary strength and volume for a move upward. This makes a retest of the $101.5K–$102.5K zone imminent.

The market sell-off, triggered by the collapse of Nvidia and chip stocks, painted the Nasdaq red and pushed Bitcoin down to $97.8K. However, Bitcoin has now returned to the zone we initially anticipated: $101.5K—$102.5K, and currently, it’s even slightly above trading at $102.8K.

With ongoing pressure on tech stocks, the upcoming FOMC meeting on Wednesday, and earnings season just around the corner, the environment for Bitcoin and the broader crypto ecosystem remains highly complex.

The Black Whale

The AI race has taken a new turn with the emergence of DeepSeek, a model projected to be more efficient in cost and performance, potentially matching or even outperforming OpenAI models. This disruption has created waves in the markets, and even before the CME Futures opened and markets began trading, another "Black Monday" was anticipated.

And it lived up to the expectation: Nvidia closed the day with a blood-red 18% loss, wiping out over $590 billion in market cap. This erased all gains since October 2024 and marked the largest one-day market cap loss in history. The Nasdaq closed down 3.3%, with losses heavily concentrated in tech stocks and risk assets.

DeepSeek’s emergence is crucial because, if its costs and hardware claims are confirmed, it could have severe repercussions—not only for Nvidia and chip companies, which would face reduced demand for their products, but also for giants like Google, Amazon, and Microsoft. These companies, having invested heavily in data center infrastructure, might find that they’ve been overpaying for a potentially overvalued approach.

This initial reaction might only be the beginning. While the impact hasn’t yet spread across the entire market, it raises the possibility of a bubble deflating slowly rather than bursting suddenly—a scenario that could prove even more devastating, dragging broader markets and carrying severe economic implications.

What’s truly disruptive may not be what we’re witnessing now, but what’s yet to come. This might just be the Black Whale’s first wave forming.

Macro Complexity.

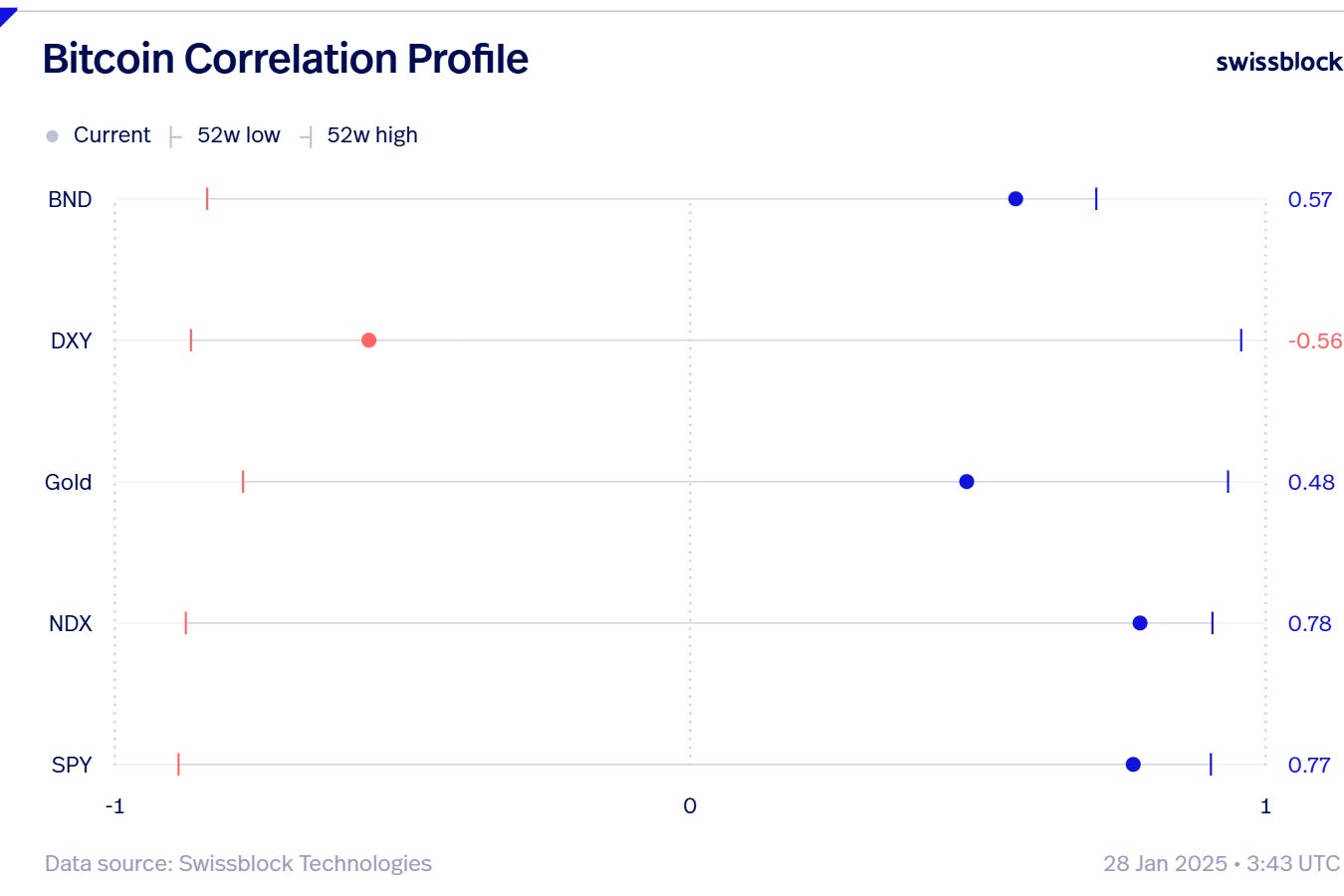

Bitcoin remains closely correlated with indices, particularly the Nasdaq. From the opening of CME Futures, a negative market session on Monday was expected.

After such a sharp Monday drop, a rebound from lows in the coming days seems likely as the market digests and assesses DeepSeek's implications. The key question is

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.