“If you don’t know who you are, this is an expensive place to find out.” - Adam Smith

🇨🇭 Join our Swissblock Telegram Group! Get daily updates, in-house content, and technical analysis on crypto & macroeconomics. Tap into a hub of knowledge and insights. Stay ahead with Swissblock. Sign up now! 🚀

BTC has surged to the $47.5k level, a point of significant resistance seen previously in the market. Despite the rapid bullish movement in recent days, there are doubts about whether there's enough momentum to break through this resistance. The rise has coincided with the widening of the Bollinger Bands, which we have hinting a couple weeks back.

A pullback is anticipated, potentially reaching as low as the $40k level, without significantly altering the overall bullish trend. Both the 20-day and 50-day EMAs lie between the current price and the $40k level, suggesting potential support. If a rally ensues, the next resistance levels to watch are $49.15k and $52k.

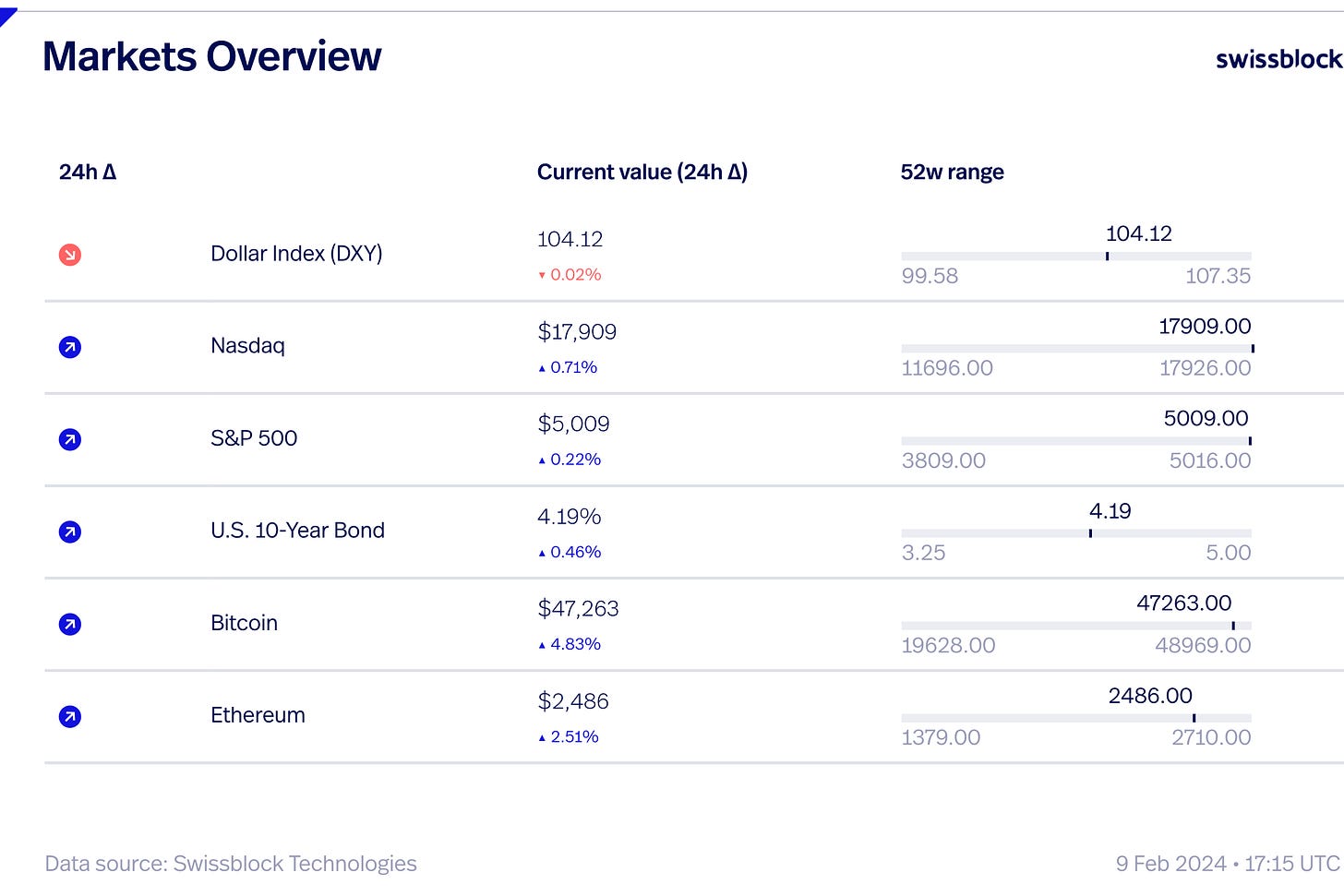

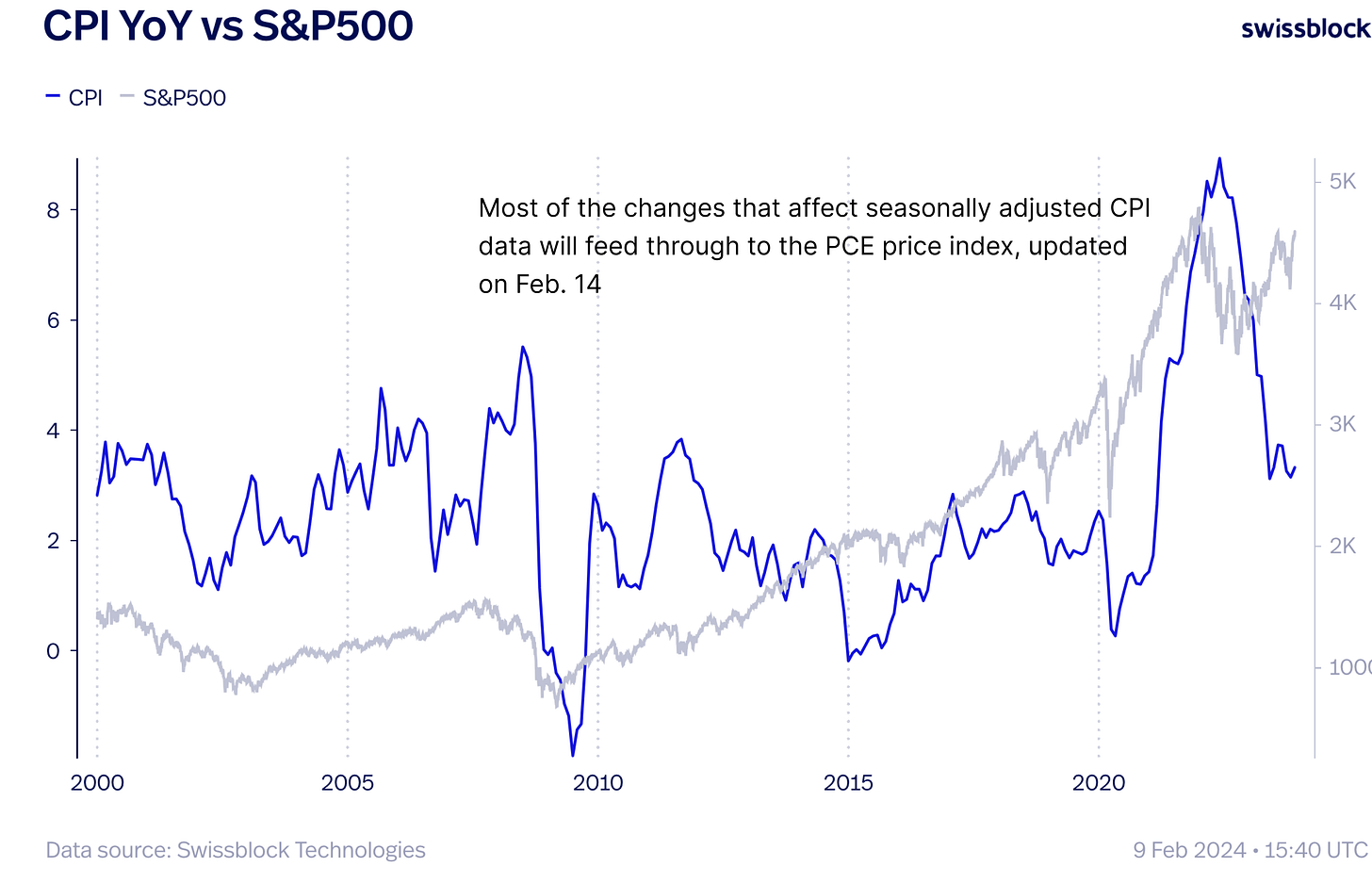

Labor market statistics and statements from Fed officials are shaping expectations for interest rate movements, impacting the market’s performance. The latest weekly jobless claims report revealed figures slightly below economists' forecasts, indicating the resilience of the U.S. labor market and a strong economic backdrop.

Strong employment numbers generally support a firmer stance by the Federal Reserve on interest rates, potentially delaying any rate cuts. Recent comments from Fed officials, such as Minneapolis Fed President Neel Kashkari, suggest a cautious approach, with expectations of only two or three rate cuts in 2024. This cautious outlook dampens hopes for aggressive rate cuts in the near term, typically benefiting the U.S. dollar.

The change in open interest is crucial, especially if the price reaches recent highs, warranting close monitoring. While large accounts continued to buy, the retail side started to close long positions and open short transactions. Spot order distribution is shifting towards the positive zone, while whale deltas remain positive.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.