Ready to Engage Acceleration.

After last week's unexpected rise in geopolitical risk, which led to a correction in the markets and the temporary spread of fear and uncertainty, today we see a slight pullback on the markets, following the optimism unleashed last Friday with the positive employment data from the U.S.

We cannot overlook that we are still largely dependent on the macroeconomic environment to determine the next moves, and the increase in geopolitical risk is something we must take into account.

In the coming weeks, surely we’ll be listening to opinions affirming or negating the idea that the worst is behind us and that the Fed's maneuvers have achieved a soft landing. Will we finally see the acceleration needed to end the year on a high note, or is this merely a false move, with another market retraction on the horizon?

From our point of view, we are about to accelerate towards uncharted territory, although a few final details still need to be secured. Although there's no specific date for the full reimbursement, the news that FTX's plan to settle with its creditors has been approved, along with the liquidity this entails, provides additional momentum for this acceleration.

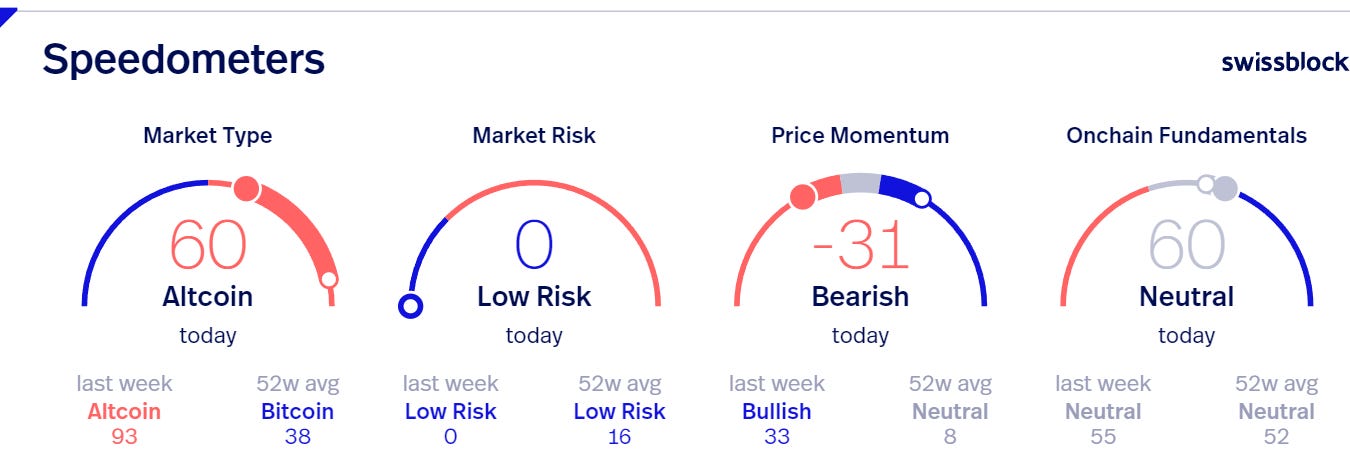

The setup of the speedometers reaffirms what we have been anticipating: the risk remains at zero, with continuous improvement in fundamentals and an uptick in price momentum. This setup allows us to consider the continuation of a bullish movement in Bitcoin. Let's examine what favors us in this scenario.

The Bait.

Bitcoin is many things, and the most interesting aspect is that it can be studied from multiple angles—programming, mathematics, economics, and philosophy. Simultaneously, Bitcoin is a 24/7 trading school. On the one hand, the market never rests, and on the other, we see all kinds of tactics and patterns in which only the best survive. At some point, with a cooler head, we will be able to analyze how Bitcoin didn't take the bait last week, specifically between Monday, September 30, and Wednesday, October 2, when geopolitical risk soared, along with fear and uncertainty.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.