“The reality is that financial markets are self-destabilizing; occasionally they tend toward disequilibrium, not equilibrium.” - George Soros

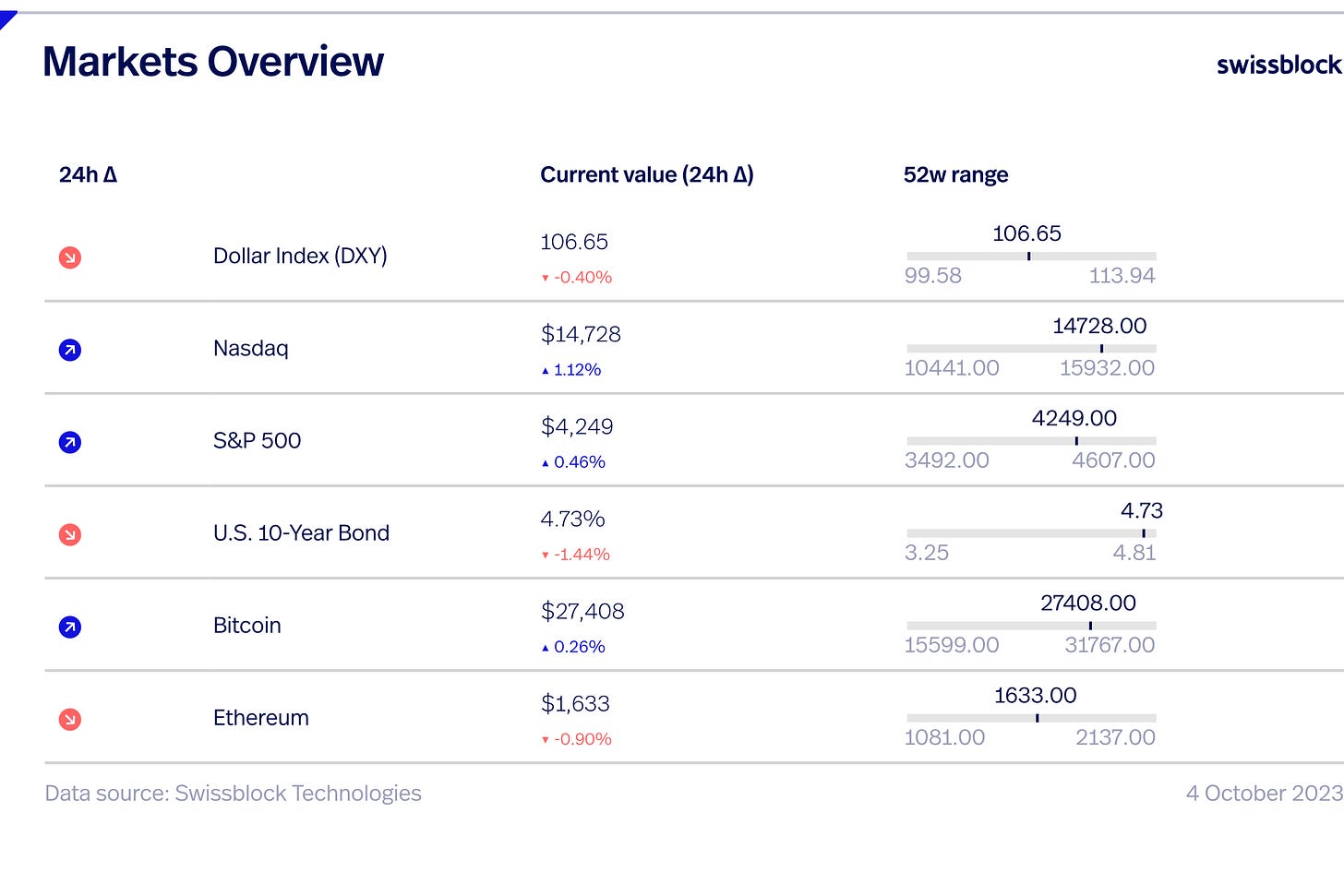

BTC rose 6% on Sunday; however, after failing to break through the $28.5K obstacle, the price fell 4.5% the following day. However, the Risk Signal fell precipitously and below the high-risk threshold, implying that a significant decline is unlikely at this level.

This drop occurred due to the poor performance of the ETH ($1.635k) futures exchange-traded funds (ETFs) introduced on October 2nd and concerns about an impending economic slump.

The U.S. dollar index is basking in a fresh glow, reaching its highest level since last November at 107.217. This surge comes as the market eagerly anticipates key U.S. labor data, which could further elevate the greenback if job openings and non-farm payrolls outperform. As has become common in recent months, BTCUSD has continued to shake off sharp DXY swings.

BTC is outperforming stock markets, especially as the DXY and bond yields continue to rise. We are currently in a "dead zone" and may test this mid-range resistance for some time. A break of $29k would be optimistic.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.