Dear Subscribers,

Bitcoin keeps heading higher as BTC price strength flies in the face of a hawkish Fed and the bitcoin halving in the horizon.

In this Uncharted:

We dive into the latest price rally of 7% to $30k before retracing on an erroneous news headline of the SEC approving BlackRock's spot BTC ETF application.

We go over the rationale of gradually accumulate key altcoins as they are currently lagging behind BTC, with most of the top 100 altcoins expected to revert to positive trends.

We analyse how the recent robust macroeconomic data has fuelled mid-term optimism for risk assets, although it has introduced short-term uncertainty.

Let’s dive in!

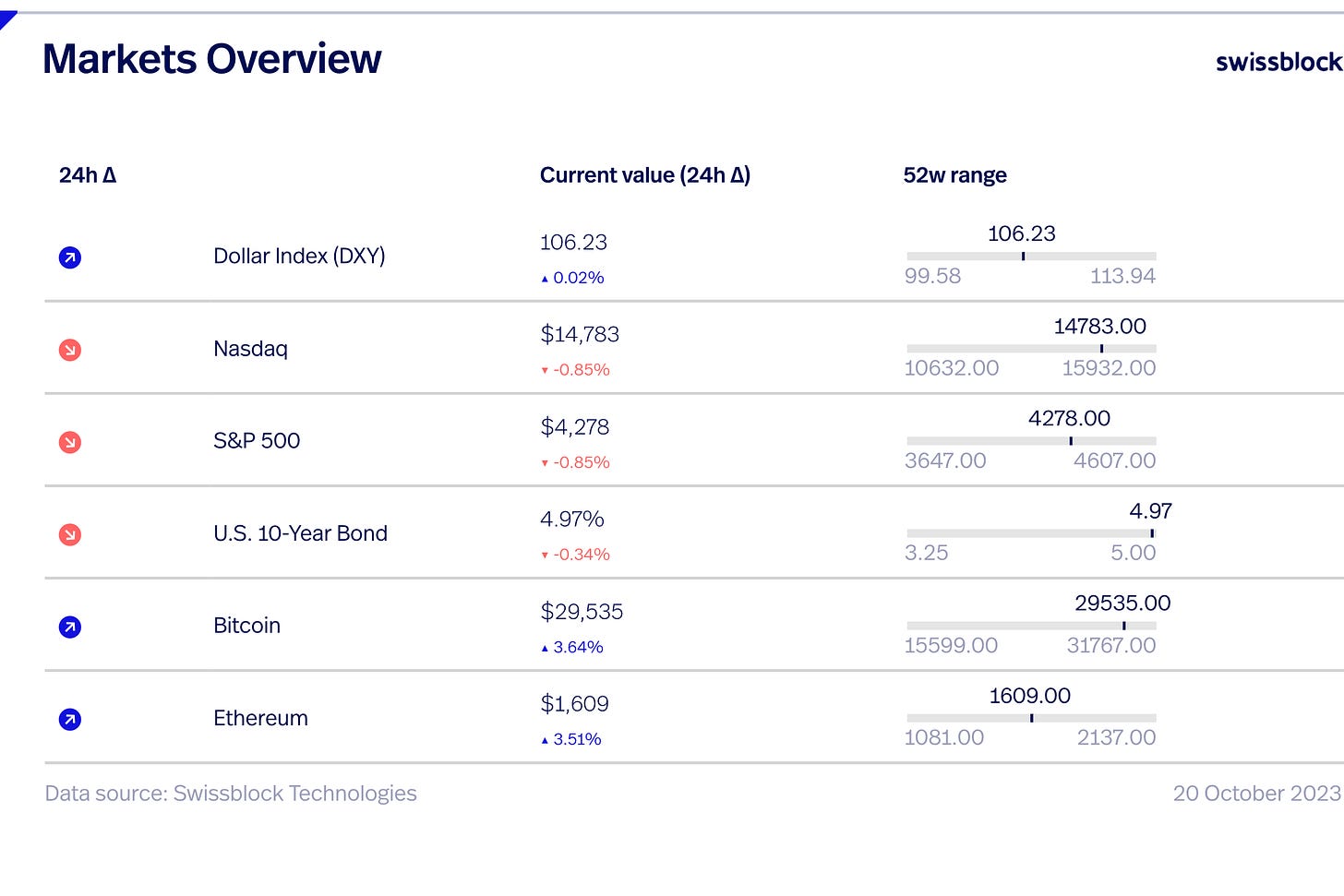

State of the System

We left the last Uncharted with bitcoin fighting to hold the $27k support level:

“Despite strong headwinds, we are back within the bullish quadrant as bitcoin holds over $27k. The risk of a pronounced drop has eased, but bitcoin's momentum is gradually losing steam. We might be at the beginning of the end of bears' control, but the environment is volatile. Holding the line ($27k) is key for further upside.” - Uncharted 49

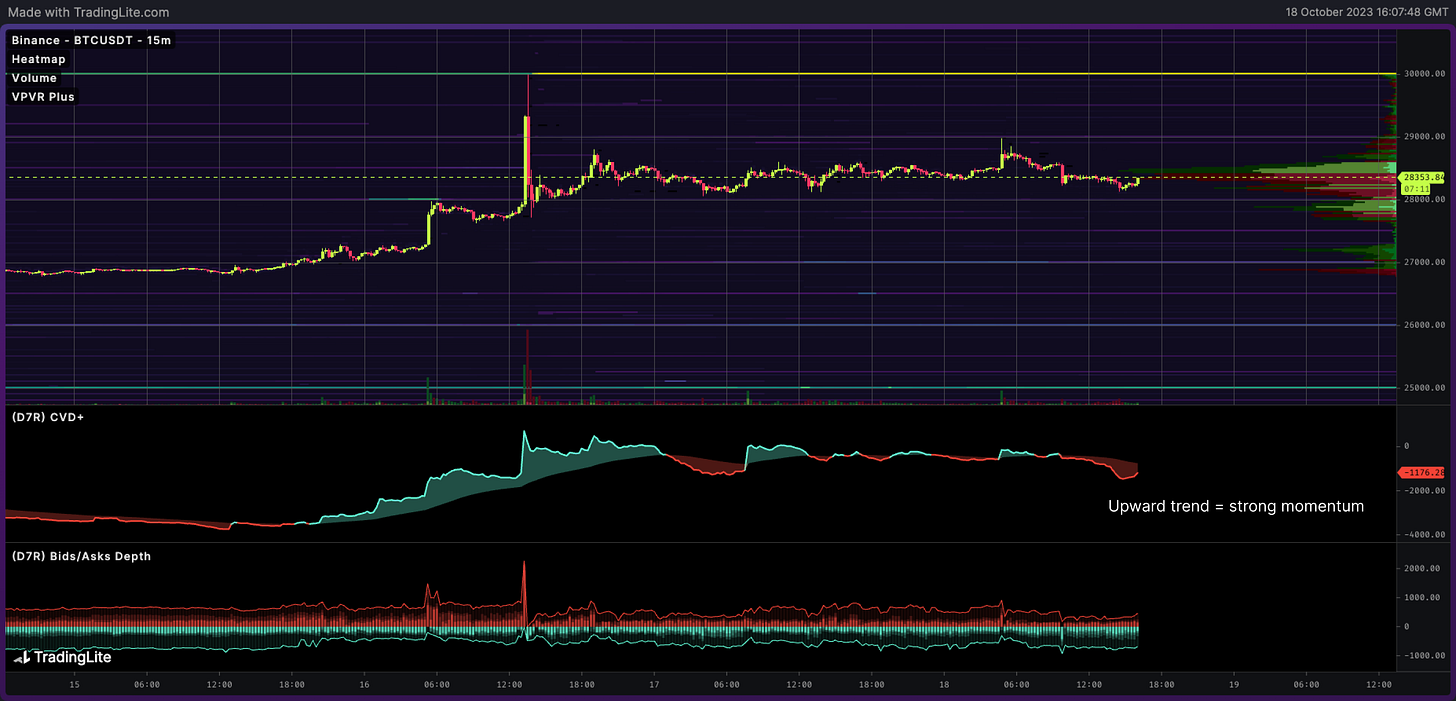

Bitcoin is going full steam, breaking over to the long-awaited $28k range, where it's holding firm. Momentum has turned bullish, and the risk of a pronounced drop is relatively low. It seems we can face some resistance in the short term, but the mid-term is stronger than ever. Is this the beginning of another strong move up?

When looking at the regime shift, we can observe that the environment has turned bullish. Interest and demand have increased, and we finally broke out of the bearish trend starting on August 17. The timing of the move is still unclear as we wait for further confirmation, but it should play out going into November.

Given the uncertainty around the timing, it's best to focus on specific levels crucial for propagating the upcoming strong move higher. The ultimate goal is breaking over $30k and holding, but we need to accomplish a few milestones beforehand.

The price needs to hold over $27.7k and break the short-term resistance at $28.5k. This scenario would confirm the newly triggered mid-term bullish trend. We can build the base to break the second milestone: $29.5k and hold. Creating a solid base is crucial because we need strong momentum to break over $30k, considering that we set a solid liquid (currently resistance) level before the August 17th correction.

The figure below shows the magnitude of the $30k resistance level - there are over 700BTC in limit sell orders waiting to fight demand. The greatest risk we face at the moment is the lack of significant buy walls below the price to resist selling pressure. Notice how the closest buy wall is at $27k and is fairly weak compared to the $30k resistance level. Therefore, spot demand (spot CVD) needs to continue trending up (green in the figure below). This will suggest strong momentum as participants market buy, pushing the price higher.

The mid-term outlook is looking very optimistic, but that does not mean that a retest of lower levels is out of the picture. Yes, the Risk Signal is at 0 - low-risk environment - and a break below $27k seems unlikely without a major catalyst, but we're up for a short-term consolidation between $27.6 - and $28.5k. Bear in mind that a move to $27.3k with current volatility levels is within expectations. Especially when considering the macro outlook.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.