“Time is the longest distance between two places.” - Tennessee Williams

🇨🇭 Join our Swissblock Telegram Group! Get daily updates, in-house content, and technical analysis on crypto & macroeconomics. Tap into a hub of knowledge and insights. Stay ahead with Swissblock. Sign up now! 🚀

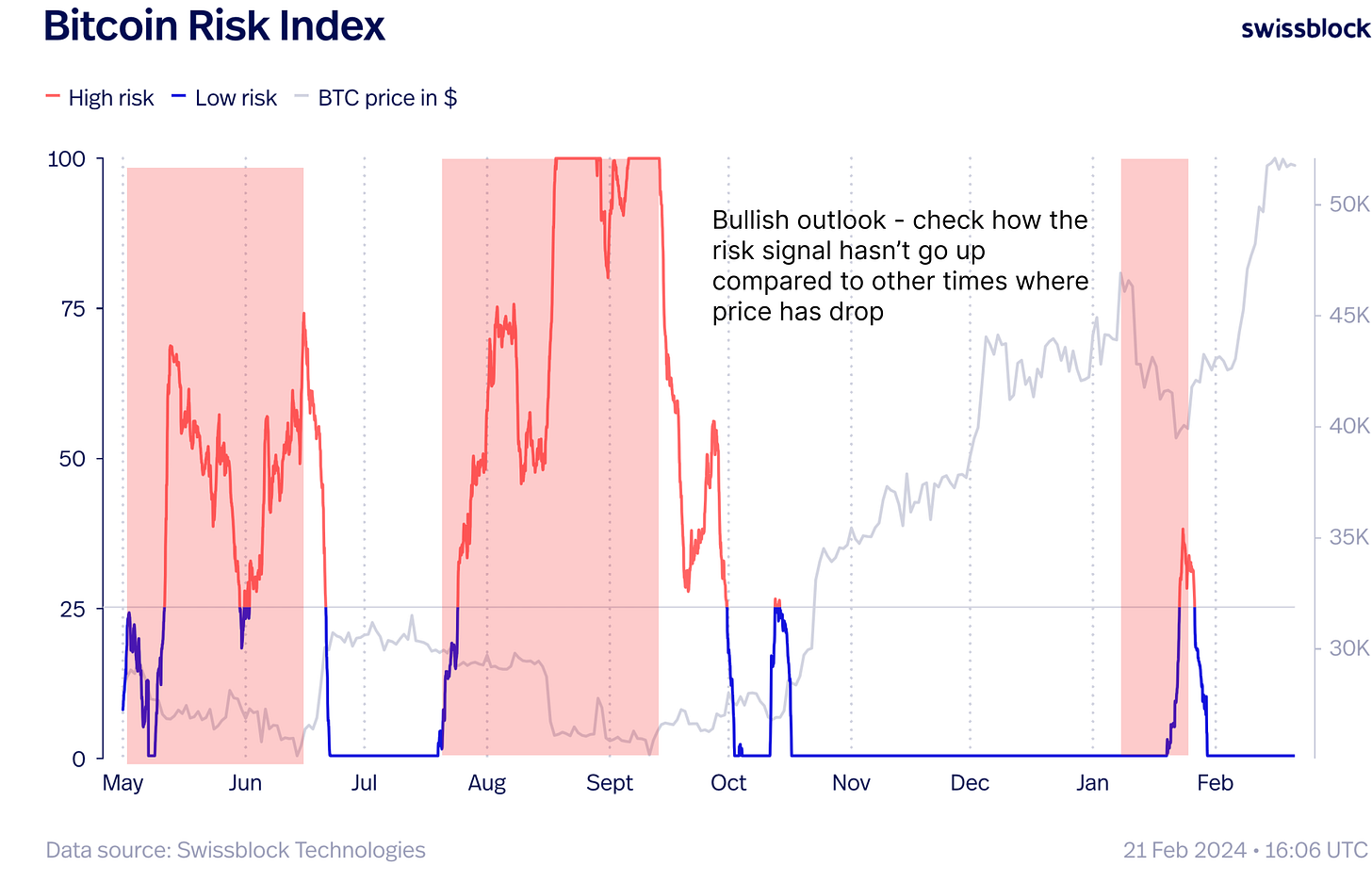

BTC has experienced a slight retracement from the $52k level, garnering significant attention due to its historical significance as a zone of both buyer and seller activity. Amidst this backdrop, market conditions remain turbulent, characterized by heightened noise and volatility.

While the prevailing sentiment suggests a potential continuation of the upward trajectory, the current scenario may necessitate a period of consolidation or even a retracement to the $47.5k support level. This adjustment would serve to alleviate excess volatility and reinforce market stability before potential further upside moves.

The short-term outlook for the Dollar Index (DXY) depends heavily on the Federal Reserve's communicated stance regarding monetary policy. A hawkish tone from the Fed, suggesting a delay in rate cuts due to elevated inflation levels, is likely to strengthen the dollar, resulting in an upward movement in the DXY.

This pivotal moment for the DXY not only revolves around the immediate reaction to the Fed's minutes but also sets the trajectory for the dollar's direction in the near future. Await for the release of minutes from the Fed’s January meeting (1:00 PM EST), which could provide fresh hints about the path ahead for interest rates.

$41.249k serves as robust support, with no closed candle opening below it and subsequently closing beneath, showcasing strong buyer activity. Notably, $43.495 marks a pivotal level, facilitating BTC's breach into the $50k range, yet encountering resistance at $48.384k, a level tested in January but not surpassed on major time frames.

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.