Is this a Good Time to be a Bear?

Over the weekend, the European Central Bank (ECB) published a paper titled "The Distributional Consequences of Bitcoin," sparking debate within the community. Increasingly, it’s becoming harder to take certain arguments seriously.

For instance, the claim that "In absolute terms, early adopters increase their real wealth and consumption at the expense of the real wealth and consumption of those who do not hold Bitcoin or who invest in it only at a later stage" is equivalent to saying you don't like private property because individuals benefit from it, or that you dislike equities because companies profit from their investors.

The point is that rationalizing these kinds of attacks on Bitcoin isn't very productive. Not long after, the Minneapolis Fed nearly echoed the ECB paper, stating that "A legal prohibition against Bitcoin can restore unique implementation of permanent primary deficits, and so can a tax on Bitcoin..." In essence, the arguments against Bitcoin are increasingly being reduced to absurdity; the point is that both governments and central banks can no longer continue to ignore Bitcoin.

Policies like the one from the Italian government, which plans to raise the capital gains tax on crypto from 26% to 42%, serve as a clear signal of the trend many governments could follow. However, this only makes us more bullish.

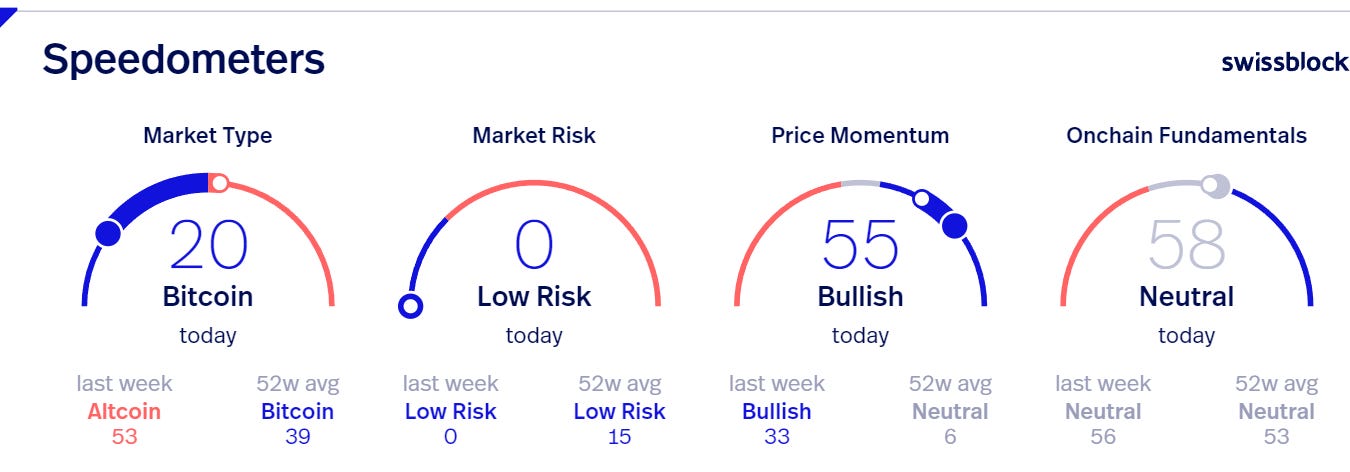

Our speedometers show that Bitcoin is dominating the market, with bullish price momentum, risk levels remaining at zero, and fundamentals that have improved since our last reading. Let’s see the details.

Price Momentum Developing.

Over the weekend, we saw a whale purchase more than 38,000 spot BTC, sending it to a wallet that has been accumulating without making a single sale. On the other hand, CME Bitcoin futures have reached a new all-time high. Interest in Bitcoin spans both the spot market and the futures market, which is something to take into account when establishing a strategy, as we've been analyzing in recent playbooks.

This week closed with Bitcoin showing a performance of 10%, and we saw how the price momentum shifted into the positive quadrant. What we're now looking for to support a continued ascent for Bitcoin and a sustainable breakout from the consolidation is for the price momentum to establish a range before the next upward move is triggered.

Bitcoin Health Status.

The Hash Rate has once again reached an all-time high, signaling that the network is robust and secure. After the cycle's low was marked in June, and a higher low was established in early September before

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.