In the weekend playbook, we anticipated this scenario:

Currently, Bitcoin has formed a range between $92K and $100K. Breaking the edges of the range could lead to false breakouts that trap traders (both bulls and bears), with the market later moving in the opposite direction. On the downside, we could temporarily break the range and create a deviation into the $90K-$86.5K zone.

We have briefly visited this deviation area, but the price hasn't rebounded yet, as BTC trades at $93.8K. Are we close to forming a bottom, or is there more downward pressure ahead?

A Year to Remember.

It has been a remarkable year for Bitcoin and the crypto ecosystem. BTC/USD is about to close an annual candle with a 120% gain and has surged 475% since bottoming out after the FTX implosion.

Nevertheless, the most significant developments have been on the fundamental side. This year marked the beginning of institutional adoption. This is no small feat for an asset that has been dismissed as a Ponzi scheme, magical internet money, and other derogatory terms.

Although still viewed with suspicion and skepticism, the fact that there is talk of a strategic Bitcoin reserve and its value as a store of value being debated is a symbolic and moral victory for those who have believed in Bitcoin from the start. It represents an escape from the fiat system and kicks off a path to freedom from centralized power.

To you, who have been with us this year, we thank you for your trust.

BFI is Weakening, but there is a Silver Lining.

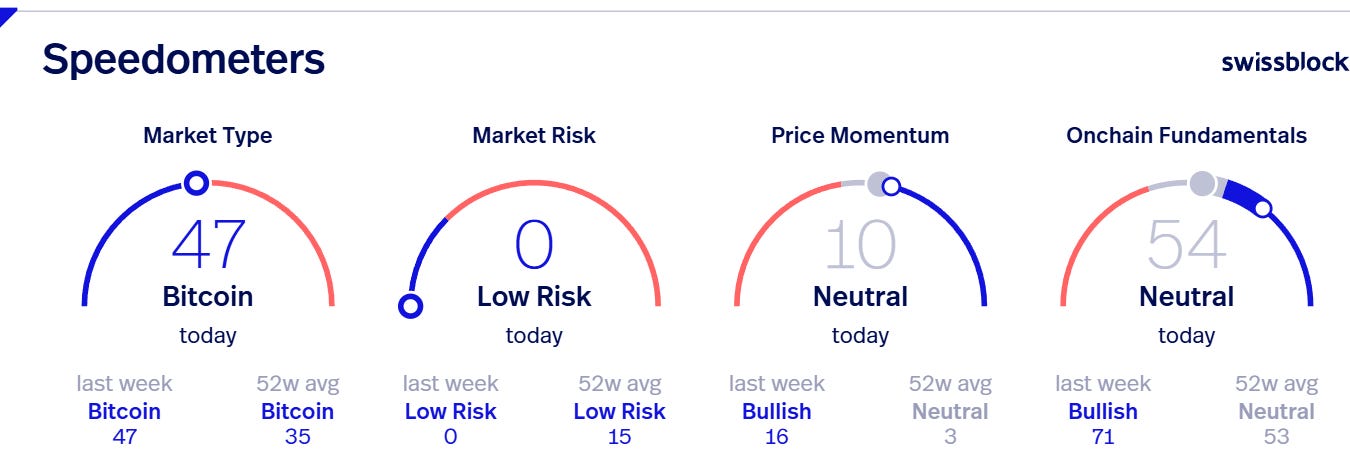

The BFI has returned to neutral territory after spending nearly two months in the bullish quadrant. The system shows signs of weakening, anticipating deeper corrections. However, not everything is a negative reading in this context.

As we can see, among the components of the BFI, liquidity gives us a reading of 34, but network growth registers at 75. This highlights that only one of the elements is showing weakness, while the other remains in its bullish trend and in positive territory.

There are specific factors that have influenced the weakening of liquidity, largely due to seasonal factors. A recovery could be seen at the beginning of the year.

The number of accumulation addresses has been on a short-term bearish trend since October. This movement coincides with the exit of long-term holders and a distribution phase among whales.

We observe a similar trend with the number of addresses holding more than $100k, which is currently pausing its upward trend. Despite this, it remains in an accumulation phase.

Where the liquidity outflow is most evident is in the number of active addresses. In December, it broke its upward trend, falling below both short- and long-term trends.

We note that this decline in liquidity is due to seasonal factors. As the year ends, there is profit-taking and liquidity withdrawals from the system to reposition and reconfigure portfolios for the beginning of the next year.

How quickly liquidity can return to the system depends on how the year shapes up for investors. We have indications that this could happen by comparing the current moment with the previous Bitcoin bull market phase.

Let’s examine the period from December 2020 to February 2021, which corresponds to a similar market cycle phase and comparable price action.

At that time, liquidity outflows coincided with a price correction, but network growth persisted. Similarly, when the price stabilized and new liquidity began to flow into the market, the price rebounded strongly. This suggests we could potentially see a price pump once liquidity returns to the market.

USDT or not USDT? That is the question.

The delisting of USDT from Coinbase following the December 30 implementation of the MiCA regulation in the European Union has stirred some level of concern. However, this FUD hasn't been as intense due to low market activity during the year's final stretch.

The viability of stablecoins in Europe is being reshaped by MiCA. Tether, unable or unwilling to comply with the new requirements, decided to pull its stablecoin from the European market. Is this because Tether lacks transparency or refuses to undergo audits by European authorities?

This stems from MiCA's requirement that a significant portion of stablecoin liquidity be deposited in European banks, contrasting with Tether's typical operations. Tether claims its assets are backed 1:1, with underlying collateral being liquid.

However, Tether's business model involves backing liquidity with short-term bonds, which serve as the underlying collateral for USDT issuance. Tether "mints" new USDT tokens equivalent to the fiat amount deposited or the bond's value. These stablecoins are issued across various blockchain networks, including Ethereum, Tron, Solana, and Bitcoin (via Omni Layer).

How much of USDT’s market cap will shift to USDC, backed by Coinbase and Circle, and fully compliant with MiCA? More critically, does this withdrawal risk a USDT depeg or market destabilization?

In our view,

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.