Note: After the weekend playbook we conclude the Compass with a small poll for our paid subscribers.

The Case for $100K Bitcoin.

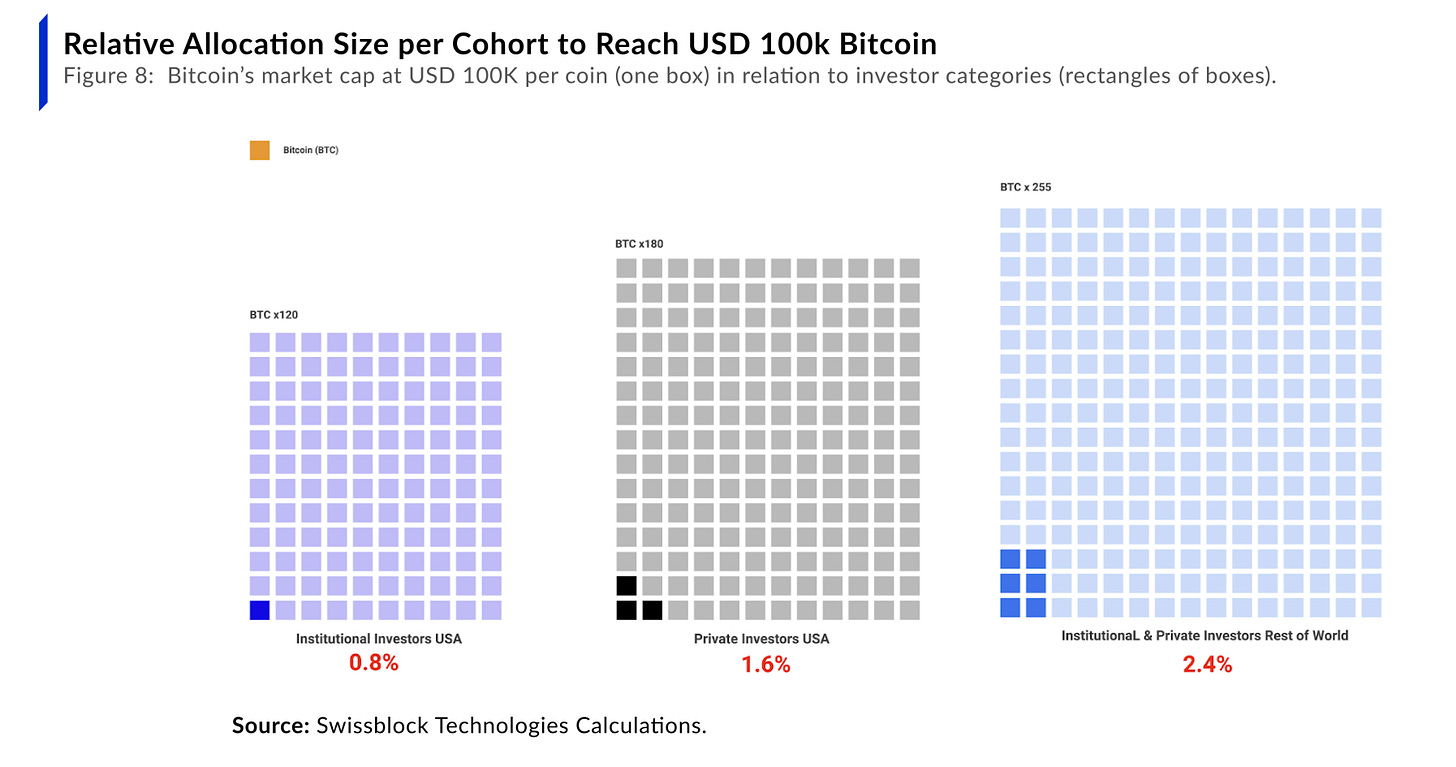

In the inaugural 2020 report by the Swissblock team, The Case for $100K Bitcoin, we outlined why, from our perspective, $100K wasn’t just a speculative target but an achievable—and to some extent, inevitable—milestone within a five-year timeframe. At that time, Bitcoin had surpassed the $10K milestone, and imagining a 10x increase seemed like madness.

We invite you to revisit this report to see how many of the arguments presented, which opened the possibility of a $100K Bitcoin, remain valid and relevant today. From August 2020, we’ve experienced the peak of a bull run that took us to an all-time high of $69K, followed by a bear market that saw the Terra/Luna collapse, the fall of Celsius, the implosion of FTX, stablecoin depegging, Operation Chokepoint, and excessive scrutiny and hostility from authorities. Yet, in the end, Bitcoin’s resurgence not only brought us to $100K but reaffirmed its status as a digital asset revolutionizing the financial landscape.

Can I Play with Madness?

If you’re a hodler, congratulations! You’ve saved yourself from a hefty dose of madness and volatility on Thursday. If you’re a trader checking the price every fifteen minutes, you’ve experienced all the emotions of a rollercoaster passenger unsure if the tracks are intact or what the next maneuver might be.

But that’s how it is—this market plays with your emotions. Just yesterday, we were above $100K, and the next target was $200K—or even, if it already hit $100K, how far could $1M really be? And then, in the next moment, we corrected more than 13%, and suddenly Peter Schiff and even Dan Peña were back, claiming this was going to zero!

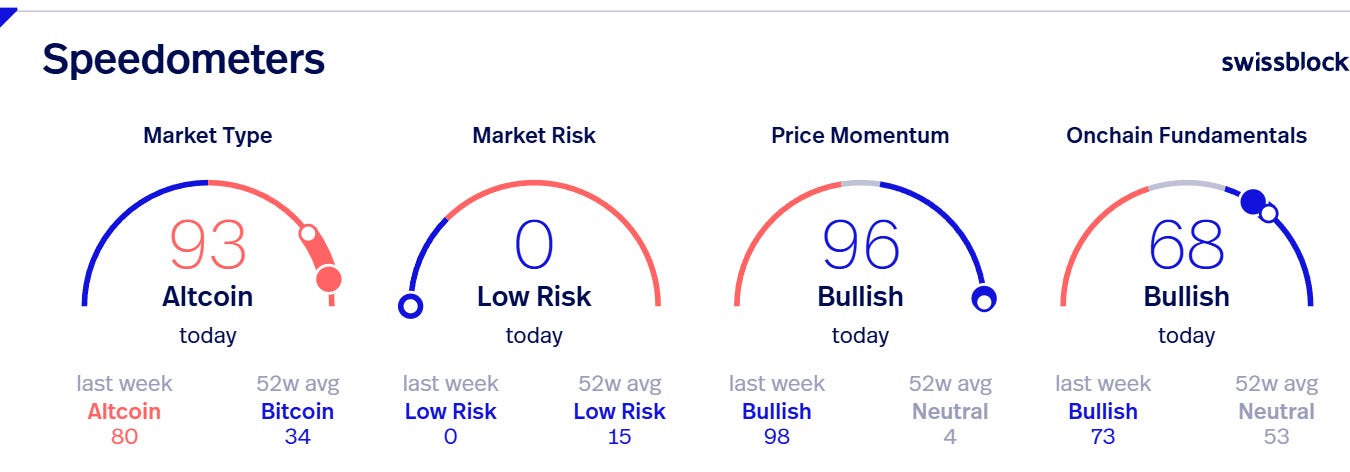

Blessed are the hodlers and the strong hands that bring stability to this market. And as the madness subsides, we see that we’re in the middle of Altcoin Season, with the Bitcoin Risk Signal at 0, strong price momentum, and solid fundamentals. But the big question remains: will we fall again, and is there more chaos ahead? Let’s see how sustainable this recovery truly is.

Bitcoin's Last 48 Hours.

Bitcoin's price action over the past 48 hours has been a wild ride, not for the faint of heart. The true virtue of hodlers? They skip all this madness—if they didn’t check the charts, they’d think nothing happened.

During this period, Bitcoin broke past $100K, climbed to $104K, then retraced to $99K. In a dramatic 5-minute candle, it plunged from $98K to $90K (an 8% dip), grabbed liquidity in that zone, and staged a V-shaped recovery, bringing us back near $100K. This whirlwind liquidated over $1 billion in positions, mostly longs.

However, despite this extreme volatility, Altcoins remained unaffected, and there was no significant rise in market risk. The rapid recovery left the market seemingly unchanged, except for one key shift: the clearing of over-leveraged positions. This allowed for participant rotation, setting the stage for a more gradual and sustained price increase.

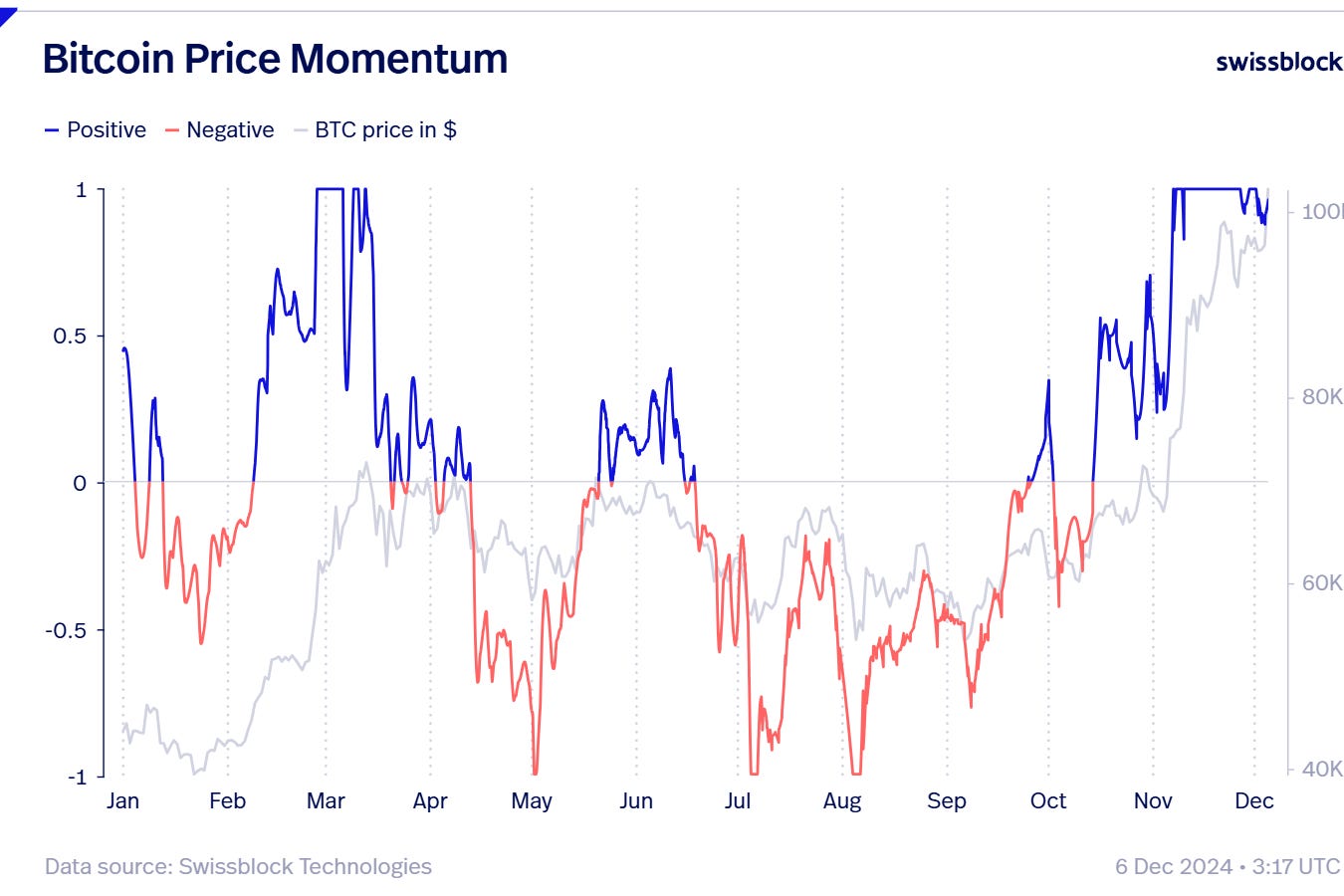

The price momentum remains strong and bullish. The range constructed around the $90K base shows no signs of momentum weakening, signaling a sustainable and extended bullish movement.

As we’ve seen, this indicator provides early warnings when bullish momentum is fading, often signaling an impending correction. For example, during Q1, Bitcoin's momentum began to deteriorate as it peaked in March.

Since no similar deterioration is evident now, we can confidently assert that bullish momentum and price action will likely persist in the short term.

To strengthen this outlook, we must also monitor other indicators. Together, they provide a more comprehensive picture, enhancing the ability to forecast Bitcoin's next moves. The bullish path remains intact, but vigilance is key.

It’s About the Fundamentals.

In the Bitcoin Fundamental Index, we have been observing a downward reading over the last week, with a slight rebound following Bitcoin's V-shape recovery. The relevance of this indicator lies in measuring the health and strength of Bitcoin's fundamental components, making its reading useful as an early warning for both corrections and recoveries.

Breaking down its components, we see that network growth has remained stable, indicating that the growth in active addresses has stayed functional. However, we note that liquidity has

Keep reading with a 7-day free trial

Subscribe to Swissblock Insights to keep reading this post and get 7 days of free access to the full post archives.